Despite the prospects, China never has been - and has not yet become - an easy place in which to operate. China's business and legal environments can be exasperating and unpredictable. Although to the outside world it puts on a face of capitalism, China's political system is still deeply rooted in communism and thus can be at times oppressive and inconsistent. Moreover, its vast interior, home to nearly two thirds of the population, is rural and undeveloped with respect to the infrastructure and distribution channels required to bring products to market. While urban migration is ongoing (in 2002, 39% of the population dwelled in urban households) and the population is climbing in social status (a staggering 200 million Chinese transcend the poverty level), its managerial prospects and skilled labor force are modest by western standards.

While the challenges of conducting business in China can be overwhelming, following are a few pointers to consider.

- Finding the right partner - avoid the errors of foreign firms who, in a rush to make a profit, were forced into unattractive joint ventures with government enterprises or bureaus.

- Keep it simple and start slow - it probably is not the best strategy to take your top technology to China. Remember, you have an unskilled labor force that may not be prepared to operate and manage expensive, highly automated equipment.

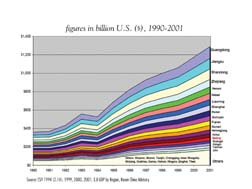

- Think locally - it is important to recognize that China does not operate as a single unified economy. Rather, it consists of many regional economies (see Figure) where trade barriers are sometimes even higher than barriers to international trade. Regional trade in certain commodities is often banned by local governments to protect local industries. While WTO entry is slowly removing these regional trade barriers, it will be some time yet before trade can be conducted across China as a single unified economy.

- Operate within the culture - the Chinese culture is highly hierarchical. It is rooted in values where trust is developed through long-term friendships and demonstrable actions. Avoid rotating expatriate managers every two years. Rather, commit to a team that will work to develop trust with local management and authorities over an extended time period.

- Develop local management - it is easy to find laborers in China, but the pool of experienced managers is shallow. Work through networks of your customers and suppliers and develop relationships with local universities to find a few good managers.

- Plan for turnover - the demand for experienced management and laborers is an issue for all companies. Expect a turnover of 30-35% per annum as new foreign investment competes for the people you've developed in your organization.

- Protect intellectual property - theft of intellectual property is well documented. Intellectual properties related to technology, equipment and processes are at risk, therefore it is prudent to go slow and avoid taking top of the line technology to China.

- Plan your logistics carefully - examine your sources of supply and channels of distribution well before deciding on location or breadth of product offering. China's most developed infrastructure is in the coastal regions. Logistics can be a nightmare beyond that. This is another reason to think locally.

The case for China is strong even with the challenges of establishing sustainable operations. Growth in China is so strong that China has joined the United States as a locomotive for global growth. China has grown to become one of the world's largest consumers of many commodities. China is contributing nearly 5% to global industrial production, but consuming over 20% of world materials for infrastructure expenditure and manufacturing growth. Motor vehicle sales are soaring, and China has become the third largest auto market in the world, behind the United States and Japan - a phenomenal statistic considering that vehicle ownership is only 3.3 million units and the average per capita income is $1,000. Rapid growth in China is also a major factor behind the current high level of world oil prices. Crude oil imports hit record levels in 04, at greater than ten metric tons per month. Oil net imports are now up forty one percent year to date vs. 2003. In terms of consumption, China surpassed Japan as the second largest consumer of oil (7.1% share of global consumption) just behind the U.S.

Relative to formulated products, we note the minor degree of complex reactive systems that find use in sophisticated structural end uses such as auto, electronic, medical devices and various product assembly applications. The majority of consumption is in waterborne formulative technologies utilized in packaging and construction markets.

Phenomenal growth does not come without its own set of challenges, however. Credit Suisse First Boston predicts that half of China's 31 provinces will face electricity shortages in coming months. Likewise, transportation bottlenecks threaten to limit export growth. Higher costs for energy and other commodities mean that energy- and material-intensive Chinese manufacturers must either raise prices or suffer a profit squeeze that could force some of them into bankruptcy.

When it comes to China, it is imperative to participate; the journey is long and navigating the waters can be frustrating. Rest assured, however, that the view is worth the climb.

For more information, contact The ChemQuest Group Inc., 8150 Corporate Park Drive, Suite 250, Cincinnati, OH 45242; phone (513) 469-7555; fax (513) 469-7779; or visit http://www.chemquest.com .