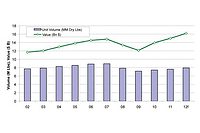

Figure 1. Adhesives and Sealants Growth Trends 1996-2008

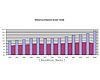

As shown in Figures 1-2, the industry is forecast to achieve $15.9 billion in revenue and 8.0 million dry lbs in 2008. The economy is sluggish, with consumer spending down, the housing sector retreating and U.S. automakers’ woes worsening - dipping below 50% market share. As a result, we are forecasting sharp volume declines of 10.4%, while revenue growth due to price actions passing through raw material hikes is increasing at a rate of 12.7%.

Figure 2. Year-Over-Year Growth Trends

Manufacturers have cited the following as their challenges for 2008 and through the remainder of the decade, ranked in order:

- Rising raw-material costs driven by oil and natural gas prices.

- Compressed margins and their ability to continue to raise prices in the face of stagflation.

- The condition of the U.S. economy.

- The availability of key raw materials and the rate at which emerging economies, such as China, continue to gobble global demand. (China is absorbing 25% of global commodities output.)

- Manuvering changes in competitive landscape due to continued consolidation.

- Innovation of “green” products and design to meet higher-than-anticipated demand.

- Dealing with offshoring markets; e.g., deciding whether to partner with foreign suppliers and manufacturers and/or follow customers to emerging markets.

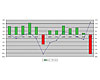

Manufacturers have a significant challenge in maintaining margins. In fact, they are currently experiencing a compression of margins due to a heavy dose of raw material cost increases that have gone into effect over the last two months (some key raw materials increased 25-40%).

Manufacturers have done a good job of recouping lost margins, but on average still lag 3-6 months behind and need to recoup an addional 8 points of margin. In a soft economy led by housing declines and lower automotive sales, this is very difficult and may, in fact, obstruct needed pricing actions.

Table.

Conclusion

Volume within the North American adhesive and sealant industry will retract for the second time this decade, and much more severely than in 2001. However, the industry’s balance sheet is significantly improved, leading to much better prospects for weathering the storm.Adhesive and sealant manufacturers will continue to meet these challenges by improving internal efficiencies and innovation. The key facet to their success is pass-through of raw materials in the face of slowing global demand.

For more information, phone (513) 469-7555 or visit www.chemquest.com.