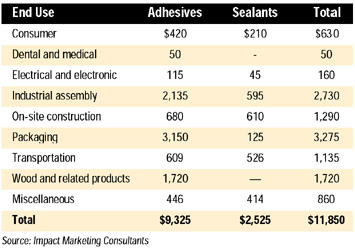

Only modest growth of 2.7% annually is forecast to 2003 when sales will reach $13.5 billion. Growth will vary within the various segments. By end use, electrical/electronic and medical/dental applications will lead the growth, but packaging will remain the leading market. By product type, sharp growth is forecast for medical and dental adhesives, and radiation-cured adhesives, although they are growing from a small base. By chemical type, most rapid growth is forecast for radiation-cured products, anaerobics, as well as polyethylene, polyvinyl acetals, silicones, epoxies and other synthetics.

According to the Guide, the industry supports over 780 suppliers. Despite major acquisitions in recent years, the business is not very concentrated. Some 19 companies have U.S. sales at $100 million or more, yet represent only 43% of the domestic total. National Starch ranks as the leading supplier with 6.5%, followed closely by H.B. Fuller with 6.1%. 3M, Henkel, Illinois Tool Works, Sovereign Specialty Chemicals, Morton, DAP (now owned by RPM), Reichhold and Borden round out the top 10.

Captive consumption also plays an important role in the industry. Major captive end uses are wood processing, such as manufacturing of particleboard, pressure sensitive tape production and rubber-to-metal bonding. Captive manufacturing accounts for about 25% of production, the report states.

The market is extremely complex and difficult to quantify. The Rauch Guide is known worldwide as a comprehensive analysis of the entire industry, covering products and end uses often excluded from government and other reports. For example, the Guide covers unformulated adhesives, captive consumption, and such end uses as bottle-cap adhesives, binders and tie-layer adhesives.

The new Guide contains six chapters with 302 pages, including industry economics, raw materials, types of adhesives and sealants, end-use markets, and a unique directory of 681 adhesives and sealants manufacturers. It is available for $445 plus shipping and handling, with discounts for multiple-copy orders.