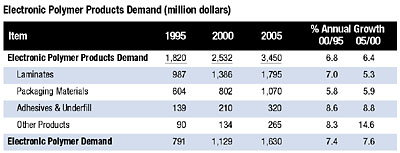

Growth in electronic polymer products has lagged gains in electronic components over the last decade due to intense pricing pressure and the tendency of chip manufacturers to outsource their chip-packaging and assembly activities to lower-cost companies in Asia. U.S. firms have responded to this ongoing threat by investing heavily in research and development programs regarding new packaging technologies and higher-value processes and products.

The shift to new packaging technologies, particularly direct chip attachment, is intensifying the need for close collaboration between chipmakers and back-end operations, which should favor domestic firms over offshore concerns. These and other trends are presented in Electronic Polymers, a study from The Freedonia Group, Inc., a Cleveland-based firm that does industrial market research.

The industry' s most rapid annual gains are forecast for low-k dielectric polymers, with demand reaching $75 million in 2005 from negligible levels in 2000. Low-k dielectric polymers (or polymers exhibiting a low dielectric constant) are challenging traditional silicon dioxide in crucial ILD (interlayer dielectric) applications in semiconductor fabrication. The primary functional competition for low-k polymers, which are applied via a spin-on process, is arising from CVD (chemical vapor deposition) processes utilizing carbon-doped glass.

Epoxies Still the Workhorses

Epoxy resins will remain the workhorses of the electronic-component industry, despite persistent challenges from various higher-priced specialty resins. Epoxies are highly versatile and find significant applications in all major product segments.

Polyimide resins will offer the market's most rapid gains, reflecting greater demand for these high-performance polymers as laminating resins for PCBs, chip encapsulants and interlayer dielectrics.

Niche Materials Become Major Segments

For electronic polymers, the primary competitive factor will be the emergence of flip-chip and other types of chip-scale packaging as a significant challenger to traditional wire-bonded packages. Standard packages will still predominate, but the move to area-array packaging will cause significant shifts in material requirements as formerly niche materials become major segments of the industry.Conductive adhesives will see strong gains as these materials replace lead solders, while demand for molding compounds and die-attach adhesives, both used in traditional wire-bonded packaging, will post below-average gains.

Electronic Polymers (published 01/2002, 220 pages) is available for $3,600 from The Freedonia Group, Inc., 767 Beta Drive, Cleveland, OH 44143-2326. For further details, please contact Corinne Gangloff; phone 440-684-9600; fax 440-646-0484; e-mail pr@freedoniagroup.com; or visit the Web site www.freedoniagroup.com. Or Circle No. 71.