Distribution planning (sometimes called "channel management") is probably the least exciting element of most producers' marketing plans for the specialty chemicals industry, but it should be viewed as a great opportunity. Often the "channels to market" (e.g., direct sales, independent distributor, manufacturing representatives, etc.) are allowed to evolve over time without proactive refinement to address changes in market conditions and dynamics. However, there is a great deal of power in a successful distribution strategy, as alternative methods may offer a more efficient delivery of the fundamental features of selling and delivering products and services to the universe of potential end users. The "ideal" distribution strategy offers the ability to maximize the use of all the functions of the marketing process at the lowest possible cost, while delivering the greatest possible value to the end user.

Ideally, the channels to market should be continuously optimized to best serve the producer's target markets and customers. This optimization should take into consideration the following checklist.

Channel Management Checklist:

1. Customer Buying Habits and Preferences- How do target customers buy today, and how would they prefer to buy in the future?

- Do the customers use customized make-to-order products, or standardized make-to-stock products?

- Do the customers prefer a "single-source" that can supply more than just the producer's products?

- What is the credit risk of the customers?

2. Selling Process(es)

- Who makes the final decision for buying the product? Are there specification/approval decision makers in addition to sourcing or purchasing decision makers?

3. Customer "Ownership"

- Which customer relationships do you strategically want to "own"?

- Which customer relationships are you willing to delegate to downstream distributors and agents?

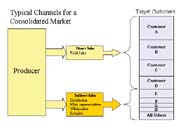

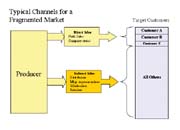

4. Market Fragmentation

- How fragmented is the market? (How many target customers hold the top 80% of the industry demand?)

- How geographically dispersed are the ship-to locations?

5. Service Requirements

- What services are required to make the offering competitive in the market (e.g., technical service, customer training, debulking, mixing, etc.)?

- Credit and billing requirements, risks, infrastructure needs?

- What cost synergies are associated with centralized customer service (order entry, order tracking, etc.) vs. outsourced or indirect customer service?

6. Overall Supply-Chain Cycle Time Requirements

- What are the customer cycle time requirements for the product offering (order-to-delivery)? What are the trends?

- What are the cycle time requirements for the services (request-to-delivery)? What are the trends?

7. Promotional Requirements

- What trade promotions are required to make the offering competitive at the regional and local level?

- How important is the local business culture to the sale?

- What is the positioning and branding strategy? Which channel(s) best help(s) to achieve these positioning and branding goals?

Most industries have evolved multiple channels to market using some combination of direct sales and indirect/independent distribution. In addition, some industries have evolved with the channel to market representing an arena of competitive dynamics and a source of competitive advantage. An example of such channel "strategy" can be seen in the industrial maintenance, repair and overhaul (MRO) adhesives and sealants market, where several distinct channels are apparent.

- Direct Sales - Suppliers can succeed by developing direct sales programs with large, often multi-location, industrial end users.

- Local Distributors - Often local businesses that provide a full line of industrial maintenance products, and sometimes services providing prompt personalized service to local users.

- National Distributors - Often multi-branch distribution centers offering full-line products and services. Some such distributors offer catalog and "mail-order" options to their customers, and develop national accounts to ease the service of localized customers.

Each channel represents a distinctly different approach and cost structure. In each case, the channel strategy serves an important role in that adhesive manufacturers' business plan by driving a low-total-cost-to-serve position, supporting product branding or underscoring target customer initiatives.

This article would not be complete without some reference to the emergence of "e-commerce." Fully addressing e-commerce as part of a distribution plan is beyond the scope of this answer, but one point is worth making. While many marketers of the 1990s believed that the Internet enabled a completely new channel to market, most marketers have recently come to realize the Internet is not a new channel, but rather a new medium. Within specialty chemicals there is a blurring of these two viewpoints. There is still a need to "physically" distribute product through traditional channels, but it appears this "physical" channel can be "debundled" from all the services and information that normally move through the physical channel with use of the Internet "channel." The implications of this debundling are far reaching and yet to be fully understood. With time, we will certainly see the Internet alter the cost structure and motivators of those participants within the channels to market.

Michael D. Brown is vice president and Robert W. Smith is director of New Business Development for The ChemQuest Group Inc., an international strategic management consulting firm specializing in the adhesives, sealants and coatings industries, with headquarters in Cincinnati.

For more information, contact The ChemQuest Group Inc., 8150 Corporate Park Drive, Suite 250, Cincinnati, OH 45242; phone (513) 469-7555; fax (513) 469-7779; or visit http://www.chemquest.com .