Emulsion polymers are widely used as the polymeric base for a variety of general-purpose adhesives. The largest volume market for these materials is packaging adhesives used for paper and paperboard packaging, including boxes, folded cartons and paper bags. Emulsions also serve as binders for pressure-sensitive adhesives used for tapes and labels; in the production of nonwovens such as diapers and feminine hygiene products; and in consumer products such as household glue and carpenter's wood glue.

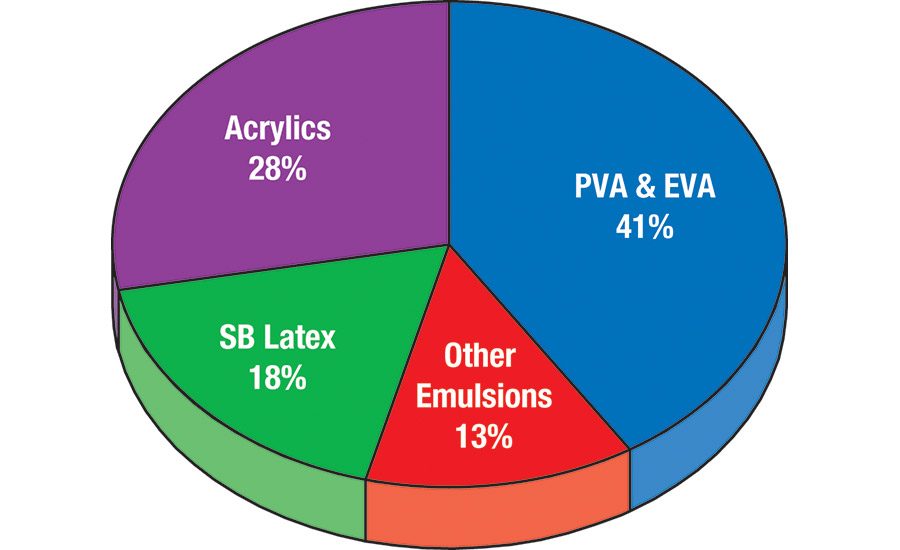

Adhesive Emulsions by Type

PVA and EVA predominate, but acrylics are steadily expanding their market share. General-purpose adhesives may be based on any one of a range of emulsions, including vinyl acetate polymers (encompassing polyvinyl acetate [PVA] and ethylene vinyl acetate [EVA]), acrylics and styrene-butadiene (SB) latex. Smaller volume types include emulsions based on polyvinyl chloride, latex nitrile and acrylonitrile copolymers. PVAs are among the least expensive materials available, while acrylics generally are the most costly, with SB latex typically falling in between.

Vinyl acetate polymers will remain the largest segment of the market, where polyvinyl acetate, ethylene vinyl acetate and other polymers serve as moderately priced, nontoxic glues. Most prominently, PVA is used as the base for both white glue and carpenter's wood glue, two versatile, general-purpose products with broad use in the consumer segment. Vinyl acetate polymer adhesives are amenable to high-speed production processes and function best in the bonding of paper and wood. In particular, PVA and EVA adhesives are widely used in paperboard packaging, particularly the side seaming of lightweight board used for small cartons or boxes. These adhesives also find use in bookbinding, on-site construction, textiles, envelopes, bags and sacks, and labels. Furniture uses include wood veneer, edge gluing and general assembly. Global demand for vinyl acetate polymer emulsions in adhesives is forecast to approach one million metric tons by 2005.

Acrylics (encompassing pure acrylics as well as styrene acrylics and vinyl acrylics) are gaining market share in adhesives, particularly in pressure-sensitive tapes and labels, such as envelopes, decal and label applications, as well as medical tapes. In these applications, acrylics function well in both removable and permanent pressure sensitive adhesives. In permanent pressure sensitive applications, acrylics offer good mechanical stability and provide the necessary high tack and peel strength. For removable applications, acrylics offer good mechanical stability and good cohesive strength. Acrylic emulsions can also be used to join a variety of substrates including metals, plastics, ceramics, wood, leather and textiles. Global demand for acrylic emulsions in adhesives markets is forecast to exceed 600,000 metric tons by 2005.

SB latex is used as the polymeric base for pressure sensitive adhesives, where SB latex tackifiers compete primarily with higher performance acrylics and specialized butyl rubber compounds. In adhesives, SB emulsions provide good resistance to water and solvents, good low-temperature properties, high tensile strength and good adhesion to a variety of substrates. Global demand for SB latex used in adhesives is forecast to exceed 400,000 metric tons by 2005.

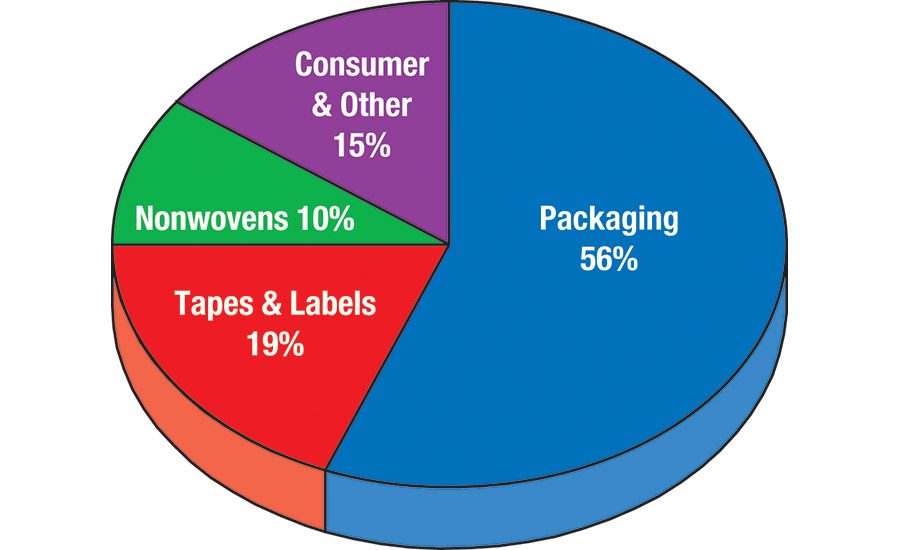

Adhesive Emulsions by Market

Paper and paperboard packaging markets stable, slower growing; strongest gains forecast for tapes and labels. Emulsion-based adhesives are used primarily in packaging applications, particularly paperboard products such as boxes (corrugated, solid, folding and set-up), sanitary food containers, tubes, cans and drums. Paper packaging includes shipping sacks, along with paper bags and sacks, envelopes and associated materials. Other packaging markets include laminations such as paper/foil, foil/film and film/film. The most rapid annual gains in this segment are forecast for pressure sensitive adhesives used in the production of tapes and labels, where demand for emulsion polymers is forecast to exceed 400,000 metric tons in 2006.

One major factor behind gains in demand for tapes and labels will be the improved cost and performance characteristics of pressure sensitive tapes, which are allowing these materials to replace and/or supplement cold-set glues and, in certain circumstances, mechanical fasteners in the manufacture and assembly of durable goods. Intense functional competition for emulsions will continue to arise from various elastomer-based hot melt adhesives, particularly hot melts based on thermoplastic elastomers (TPEs) (such as Kraton styrenic block copolymers), which have carved out a strong position in tapes and labels over the last decade in United States and West European markets. The nonwovens market encompasses emulsions used in the production of various disposables, which includes diapers, feminine-hygiene products and adult-incontinence products, along with medical products. Major applications include binding together the absorbent fibers, as well as bonding the absorbent portion to the outer layer. In these uses, emulsion polymers act as binders and provide solvent resistance, wet and dry strength, and a soft-hand feel in disposable products such as towels, wipes, diaper-cover stock, feminine-hygiene products and surgical packs.

Adhesives Emulsion Suppliers

At the end of 2000, the global market for emulsion polymers (encompassing all markets, not just adhesives) totaled $14.9 billion. The three leading suppliers are Rohm and Haas, Dow Chemical and BASF, which support annual sales of emulsion polymers in 2000 ranging from just under $1 billion for BASF to well over $1 billion for Dow and Rohm and Haas.

There is also a formidable second tier of suppliers with annual sales of emulsion polymers in the $300-million to $600-million range in 2000. This group encompasses Air Products Polymers, Clariant, Reichhold, Eni, National Starch and Chemical, OMNOVA Solutions, PolymerLatex and Rhodia.

In January 2002, Dow Chemical and Reichhold launched a new 50/50 joint venture called Dow Reichhold Specialty Latex, which combined Dow's Specialty Latex business with Reichhold's Emulsions business. Considering that both Dow and Reichhold are major adhesives suppliers in their own rights, the new venture has a major presence as a supplier of emulsions to the adhesives industry, particularly in construction-related applications such as mortars, repair compounds and tile adhesives, as well as packaging adhesives, masking tape and wood adhesives. The venture is the world's leading producer of SB latex and holds significant positions in acrylics and vinyl acetate polymers.

Rohm and Haas also is a leading, vertically integrated player in the adhesives segment, producing acrylic acid feedstocks as well as acrylic emulsions and a wide range of acrylic packaging and pressure sensitive adhesives. Rohm and Haas is the world's largest supplier of emulsions, and its adhesives business ranks as the fifth largest in the world.

Among other emulsion suppliers, National Starch is among the world's leading suppliers of adhesive emulsions, particularly as a captive supplier for its own adhesives business, where National Starch ranks second in the world behind Henkel/Loctite. In addition to its captive business, National Starch is a major merchant supplier of emulsions through its Vinamul Polymers unit, which has merchant sales of about $300 million concentrated in vinyl acetate polymers (about 80% of merchant sales), as well as acrylics.

Other leading emulsion polymer suppliers that support a significant focus on adhesives applications include Air Products Polymers (a joint venture between Air Products and Wacker), BASF, Clariant and Eni. Air Products Polymers focuses on vinyl acetate polymers, which are offered under the Airflex tradename for adhesives and other applications. Wacker and Air Products also participate in another joint venture, Wacker Polymer Systems, which manufactures redispersible powders. Clariant also produces primarily vinyl acetate polymers, which are marketed under the MOWILITH tradename for adhesives and other markets.

BASF produces SB latex as well as acrylic and styrene-acrylic dispersions under the Acronal tradename for pressure-sensitive and industrial adhesives, among other applications. Eni produces SB latex through Polimeri Europa. Other major suppliers of emulsion polymers include Avecia, JSR and Noveon.

More information on emulsion polymers used in the adhesives industry is given in Study #1457 World Emulsion Polymers available from The Freedonia Group, Inc., 767 Beta Drive, Cleveland, OH 44143-2326; call Connie Gangloff at 440-684-9600; fax 440-646-0484; e-mail cgangloff@freedoniagroup.com; or visit www.freedoniagroup.com.