Adhesives have historically played a significant role in laminating, bonding and assembling components of automotive interiors for both aesthetic and performance reasons. In 2001, approximately 96 mil. dry pounds of adhesive were consumed in automotive interior applications in North America, ranging from laminated constructions and trim attachment to structural bonds. Despite aggressive competition from other forms of laminating and fastening, such as flame lamination, various forms of welding, mechanical fasteners and molded-in clips, the use of adhesives has continued to grow.

As automotive exterior designs become more similar from model to model, the interior of the car becomes increasingly important in differentiating each from the next. The quality, or perceived quality, of the automobile's interior - especially the acoustic characteristics - are major differentiators. This means that the components of the interior must be functional, meeting performance specifications while also providing the aesthetics dictated by the designer and the expected acoustics.

Pressures on costs and vehicle weight (meeting Corporate Average Fuel Economy, or CAFE, regulations), while meeting safety goals, further accentuate the challenge, driving the industry toward new, less costly materials and processes. The trend toward recycling the entire vehicle, already relatively strong in Europe, has recently begun to affect material and fastening choices in auto interiors in North America. Thus, new materials and processes are continually under development. Many of these require changes in fastening or in companion construction materials, such as adhesives.

Some of the advantages of using adhesives include the following:

- Invisible bonding

- Even distribution of bond stress

- Ability to join dissimilar substrates and surfaces

- Ability to fill gaps

- Elimination of vibration failure

- Corrosion protection

- Reduced manufacturing/assembly costs

- Bond strength

- Potential for dual functionality

- Ability to fit into tight spaces

- Continuous and significant price pressure

- Need for improved performance and aesthetics

- Environmentally friendly and recyclable materials

- Globalization

Price Pressure

Driven by price pressures, less expensive low-surface-energy polymers, such as polyolefins, are gaining ground at the expense of ABS, PC/ABS and polyvinyl chloride. Increased use of polyolefin resins provides both a challenge and an opportunity for adhesives. Due to differences in surface tension, many commonly used high-performance adhesive technologies will not adhere to polyolefins without some form of pretreatment, such as a primer application or corona treatment. This added step increases the cost of the process to the point that the savings from lower substrate costs are lost to the added processing step. Adhesive suppliers have met this challenge through the introduction of new technologies that exhibit adhesion to untreated surfaces. Though they are more expensive on a unit basis than existing adhesives, the elimination of the pretreatment step results in a final component cost that is below current levels.Another way in which adhesive manufacturers are attacking the cost pressure is to apply adhesives to substrates further back in the value chain, prior to lamination. The coated flat stock is rolled up for storage prior to shipment to the Tier 1 manufacturer. There it is bonded to the part by heat and light pressure, thus eliminating steps, floor space, labor and cleanup in the mold and cover process. Typically, non-pressure-sensitive polyurethanes, polyamides, acrylics, polyolefins and polyesters are used in pre-applications. Application methods vary from the standard roll coat process to even faster spray application for improved productivity.

Pressure-sensitive double-coated and transfer tapes have been applied to trim parts at Tier 2 and 3 levels for several years. At assembly, the release liner is easily removed and the part secured into place with minimal pressure, providing fast, neat, and economical assembly. Technologies for activation and cure have evolved significantly, and some thermoset adhesives are now available for pre-application. One supplier has recently developed a novel polyurethane adhesive that combines the advantages of normal hot-melt adhesives with those of reactive (thermoset) polyurethanes. The adhesive contains an encapsulated isocyanate, and crosslinking is activated by high-temperature heat pulsing at the time of lamination.

Improved Performance and Aesthetics

As specifications for bond performance at extreme temperatures have increased to as high as 125°C (260°F) and dropped as low as -40°C (-40°F) in some applications, adhesive suppliers have met the challenge with new technologies. Reactive hot-melt adhesives have gained particular popularity due to their ultimate temperature resistance and strength, as well as fast robotic application and fast green-strength development. These adhesives, applied at a relatively low temperature, reduce the threat of substrate distortion, but will ultimately cure to provide the desired properties.Particular applications include bonding attachment clips for interior panels, reinforcement of the door on the passenger-side air bag, lamp assembly and spare-tire cover lamination. Two-part epoxy adhesives and silicone adhesives are also used to meet these requirements; the choice depends on the substrate and the specifications. Solventless acrylic adhesives that will meet these rigid specifications and adhere to low-energy surfaces are currently under development.

The trend toward better safety performance also provides an opportunity for adhesive growth. With the advent of side air bags for side-impact protection and side curtains for rollover protection in minivans and sport-utility vehicles, high-performance substrates consisting of film-to-fabric adhesive laminations are becoming more popular. These applications are experiencing double-digit growth, even in less developed economies.

The use of adhesive tapes applied in joint areas to prevent squeaks and rattles is also growing. Squeaking has become a particularly common problem since the growth in plastic-on-plastic substrates within the interior. Tape is often the most cost-effective solution to this problem.

The introduction of new fabrics, such as woven microfibers and microfiber suede, as replacements for current upholstery and leather will also provide new challenges and opportunities for adhesives. As more electrical and electronic systems are crammed into cockpits, the complexity of the design and the material choices have increased as well. For example, Tier 1 suppliers are planning to replace some of the in-dash vents with strategically placed ducts or breathable panels that provide indirect airflow. This will open up more space for electronics and more potential uses for adhesives.

Environmentally Friendly Processes and Recyclable Interiors

As in other manufacturing operations, the trend in adhesives is to eliminate solvents where possible. Liquid adhesives are moving away from solvents and toward water and 100% solids. Hot-melt adhesives and powder adhesives have also grown significantly as a result of this trend. Hot-melt technology offers improved performance and tidier application over waterborne products, in many instances eliminating VOCs. Hot melts are growing much faster than waterborne adhesives as a result.The automobile recycling trend has driven a move to simplified constructions of similar substrates and adhesives. A construction of related technology does not have to be separated in the recycling process. Components built from polypropylene substrates and thermoplastic olefin skins bonded with polyolefin adhesives - as well as polyethylene terephthalate substrates and skins bonded with polyester-based adhesives - are currently the most popular, and thermoplastic polyurethane systems are in development. An added benefit is a weight reduction of 10% or more with the new polyolefin constructions.

Natural-fiber composites have gained popularity in Europe and are receiving increased attention in North America. Acrylic and polypropylene resins manufactured from plant matter are even lighter in weight, less costly, and potentially more elastic than conventional materials. These materials provide still more opportunities for new adhesives, as they will potentially bond differently than conventional materials.

Globalization

Although material selections for automotive interiors are made on a regional level, many material and process trends that have started in Europe have migrated to North America and the rest of the world. Two examples are natural-fiber composites and in-mold laminating. Adhesive suppliers are aware of the trends and are preparing to again meet the challenge through new technology.Summary

Auto interiors have become a hotbed of change and innovation over the last several years, fostered by the consumer perception of vehicle quality that comes from a well-designed and appointed interior. Adhesives play a major role in construction of the interior, providing quality bonding along with aesthetic appeal.Increasing and significant price pressures have strained the adhesives industry, but suppliers continue to invest in research to meet the requirements with lower cost materials that perform. The trends to less expensive low-energy substrates, higher performance and recycling have provided an added challenge, but adhesive suppliers are up to the task. With each challenge comes opportunity.

Susan Anderson is director, Global Business Development, of The ChemQuest Group Inc. (http://www.chemquest.com ), an international strategic management consulting firm specializing in the adhesives, sealants and coatings industries, headquartered in Cincinnati. Call them at 513-469-7555.Links

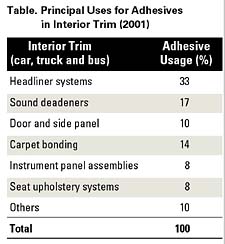

Adhesives can be found in most major components of automobile interiors, including headliners, door panels, interior pillars, instrument panels, seating and package trays. They are especially adept at laminating and assembling dissimilar substrates. A common example is the lamination of vinyl cover skin-to-polyurethane foam and attachment to an anti-lock braking system (ABS) or polycarbonate (PC)/ABS instrument panel. Adhesives are also used to bond ductwork, assemble components, fasten graphics and attach carpet. Adhesives reinforce mechanical fasteners and seal the bond point against corrosion. Tapes bond trim to the interior surfaces, fasten graphics, attach carpet, seal joints against penetration by the elements, and reduce noise, to name a few common uses. Adhesive resin technology varies from ethylene vinyl acetate hot melts on the low end to silicone, cyanoacrylate, epoxy and polyurethane for higher performance applications. The table provides a breakdown of the principle uses for adhesives in interior trim.

Adhesives are versatile. They are supplied in several forms and various polymer technologies to provide the materials engineer with multiple choices for component construction. This is particularly important in today's challenging business environment.

The original equipment manufacturer trend toward integration of suppliers and outsourcing has shifted the responsibility for entire interiors from design-to-supplier integration to major Tier 1 suppliers. This has also consolidated the adhesive customer base, increasing the power of buyers and the demands on adhesive suppliers for performance and significant price improvements. Customers are expecting more innovation and service but are not willing to pay higher prices for them, which is a difficult situation. However, when current technologies cannot meet the requirements, adhesive suppliers are meeting the challenges with increased research and development efforts directed toward lowering costs for equal or better performance. This price reduction may not always be directly related to the adhesive price, but instead may come through increased productivity in both the formulator and customer processes.

Four major trends are having a primary effect on the materials chosen for automotive interiors, including adhesives. Each by itself is a strong driver for material change, but together the challenge becomes even greater.