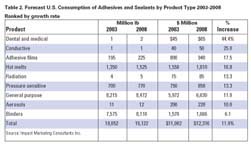

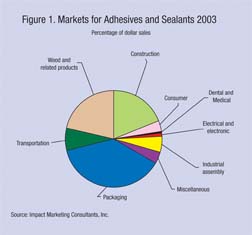

Fastest growth, when measured by end use, is forecast for dental and medical adhesives, although they are growing from a small base. Among the larger categories, electrical/electronics and industrial assembly will increase substantially. Packaging, the largest end use, will grow 12.6% by 2008 (see Table 1).

Captive consumption also plays an important role in the industry. Major captive end uses are wood processing, such as manufacturing of particleboard, pressure-sensitive tape production and rubber-to-metal

bonding. Captive manufacturing accounts for about 25%

of production.

The new guide contains six chapters, including industry economics, raw materials, types of adhesives and sealants, end-use markets, and a unique directory of 705 manufacturers of adhesives and sealants.

For more information, contact Impact Marketing Consultants Inc., P.O. Box 1226, Manchester Center, VT 05255; phone (802) 362-2325; fax (802) 609-1041; e-mail

comments@impactmarket.com; or visit www.impactmarket.com