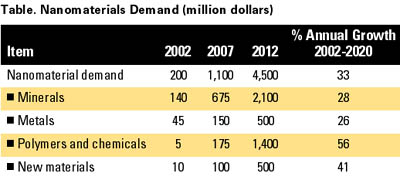

After a decade-long buildup, nanotechnology is beginning to see its first commercial successes, although basic materials are grabbing the spotlight from more sensational early projections of cancer-killing nanobots and self-assembling automobiles. The development of nanoscale materials (e.g., substances with particle size between 1 and 100 nanometers) is a key step in the eventual production of more sophisticated nanomachines, nanoelectronics and nanomedical devices. In fact, the move toward nanotechnology is a continuation of ongoing miniaturization efforts in many industrial sectors. Research has flowed in two directions: reducing the size of existing manufacturing materials such as metal oxides through the use of new production technologies, and developing entirely new materials such as nanotubes and buckyballs that are intrinsically nanosized.

These and other trends are presented in Nanomaterials, a new study from The Freedonia Group Inc., a Cleveland-based industrial market research firm.

Conventional products - essentially smaller versions of extant products, such as silicon dioxide, titanium dioxide and clay - are expected to register robust growth both through the forecast period and beyond. Already, these materials have established a market presence in such applications as sunscreens and chemical mechanical polishing (CMP) slurries. Conventional nanomaterials will account for the large majority of overall demand for the foreseeable future. However, new nanomaterials - many of which are yet to be commercialized - are expected to register even better growth, from a negligible base in 2002. Carbon nanotubes, the likely anchor product of the new materials category, are finding use now in specialty composites and in fluoropolymers.

Nanomaterials (published 07/2003, 379 pages) is available for $3,800 from The Freedonia Group Inc., 767 Beta Drive, Cleveland, OH 44143-2326. For more information, contact Corinne Gangloff, phone 440-684-9600; fax 440-646-0484; e-mail pr@freedoniagroup.com ; or visit www.freedoniagroup.com.