1. ?The industry experienced its first year-over-year decline in 2001, when revenue and volume dropped 5% and 4%, respectively. This validates fundamental changes in industry structure and market dynamics brought on by geographical and regional realignment in manufacturing, and overcapacity of adhesive production.

2. ?Following the recession, margin pressures were caused by rapid escalation of raw-material and energy costs due to rising oil and natural gas prices, and shortages of key raw materials.

The Next Five Years

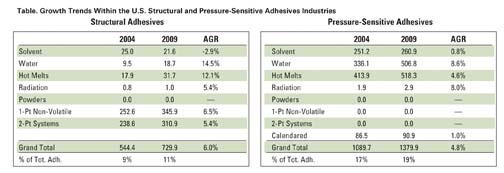

The U.S. adhesives industry ($11 billion and 6.5 billion dry lbs) is considered fundamentally mature due to the fact that 74% of the industry is performing at or below GDP growth. However, the remaining 26% will be the engine for future growth, with pressure-sensitive adhesives (PSA) accounting for 17% of adhesive demand based on volume, and structural adhesives (defined as load-bearing bonds in excess of 1000 psi) accounting for 9% of demand (see Table).Six major trends are affecting the future use of PSA and structural adhesives, particularly against their prime competition-mechanical fasteners.

End users prefer PSAs because their key value proposition is to deliver an adhesive to a bond joint in a user-friendly, clean and efficient manner.

While the general adhesives industry will continue to grow at a 3% annual clip, these categories will gain share against their conventional counterparts. It is anticipated that PSA and structural adhesives will eventually make up 30% of the total adhesives market. More importantly, these categories also represent a more profitable mix of products to adhesive manufacturers.

For more information, phone (513) 469-7555 or visit www.chemquest.com.