Boeing 787 Dreamliner

Photo courtesy of Boeing

Photo courtesy of Boeing

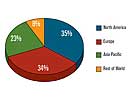

Figure 1. Geographic Distribution

Figure 2. End Markets

Construction grew globally at 4.7%, fueled by major global construction projects. None was more evident than in China’s unquenchable infrastructure expansion and preparation for the upcoming world games and 2008 Olympics.

India is also making its mark. India’s government is investing heavily in infrastructure projects to attract foreign investment. While still in the shadows of China, India will not remain there long, recording a solid 9.2% GDP growth - one of the fastest in the region and the world.

Pressure-sensitive tapes grew at 5.1% globally. Replacement of mechanical fasteners and liquid adhesives are major drivers, fueling PSA growth as user-friendly application alternatives. Energy prices are putting a lot of pressure on fuel efficiency and financial performance within sectors such as transportation. This is driving design changes to incorporate lighter-weight alloys and composites, making it attractive to use adhesives - and specifically PSAs - to fasten dissimilar materials. Medical and electronic applications, while relatively smaller, contributed significantly to PSA tape growth as well.

Three resin families, comprised of acrylic, polyurethane and silicones/hybrids, were the greatest benefactors, reflecting growth greater than 5% per annum. Not surprisingly, these resins families, supplied both in liquid and PSA tape forms, benefited primarily from expansion in construction spending, transportation, and medical applications.

Perhaps the greatest growth has been in moisture-cure hot melts, which are used for assembly applications including engineered lumber, furniture assembly and automotive and manufactured housing.

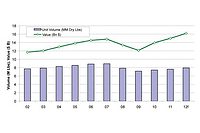

Figure 3.

While still negligible, the industry advanced the use of synthetic polymers from renewable bio-based materials. Faced with record energy prices, end users were eager to evaluate new technology to mitigate their dwindling margins.

The industry is bullish on 2007, even with a slowdown in construction spending due to higher interest rates in North America and Europe. First-quarter performance showed moderate revenue growth but significant improvement in margins as a result of slightly lower raw-material prices relative to first quarter 2006.

In closing, few industries are as stalwart and vibrant as the global adhesives and sealants industry. It will continue to be a good portfolio investment for the foreseeable future.

For more information, phone (513) 469-7555 or visit www.chemquest.com.