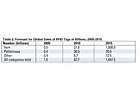

Since 2005, 1.8 billion RFID tags have been sold. Key volume applications for RFID technology have been in markets such as access cards for the financial, security and safety markets, or for the automotive and passenger transport sector. Smaller markets include leisure, libraries, laundry and healthcare. A breakdown of RFID sales by sector to the end of 2004 can be seen in Table 1.

Most of these tags had a silicon chip in them, making them clever but delicate and - in most cases - expensive. Sales of chipless tags, however, have been relatively small when compared to sales of chip tags.

FUTURE VERY DIFFERENT FROM THE PAST

New research by IDTechEx reveals rapid growth in RFID. The following table shows the IDTechEx projection for RFID tag growth to 2015.After addressing technical problems with UHF, 3.1 billion tags will be used for pallets and cases this year. Item-level tagging (especially by pharmaceuticals) and tagging of baggage, animals, books, tickets, and other non-retail markets are strongly growing in value. In 2008, 6.8 billion tags will be sold for such applications and 15.3 billion tags will be sold for pallets/cases, but the former tag value will be higher than that for pallets/cases.

The market for RFID interrogators will reach $1.14 billion in 2008 for EPC interrogators and $0.75 billion for other interrogators, such as near-field communication interrogators. Forecasts by territorial region show that, by 2010, 48% of RFID tags by numbers will be sold in East Asia, followed by 32% to North America.

Deliveries and orders in 2004 were a good deal higher than the year before. Even if one mistakenly considers the RFID tag to be nothing more than a barcode replacement, such figures are not necessarily unrealistic because there are somewhere between five and 10 trillion barcodes printed in the world every year. However, these tags will not reach the 10-trillion level before 2020 at the soonest, where they will need to cost less than one U.S. cent and be entirely printed, like a barcode is today.

DISRUPTIONS, NOT TRENDS

The curves do not extrapolate up and up. The research showed that the highest-volume applications of RFID will mimic barcodes, where a market for barcode labels grew then declined as barcodes were printed directly onto products and packaging. The value of that label market peaked before the annual numbers sold; that was because of strong price erosion. We see the same occurring with RFID, but on long timescales and with one difference: in contrast to today's directly printed barcodes, the printed radio barcodes will not use the same ink as the graphic printing. There will be a growing and lucrative market for electronic inks used to print RFID tags onto labels and directly onto products and packaging. We estimated these timescales and volumes.ONE-CENT TAG CONTROVERSY

We doubt that the necessary one-cent tags needed for tagging everything in the supermarket - the largest volume potential for RFID - will be profitably achieved with silicon chips within 10 years, if ever. It is believed that giants like IBM, Xerox, Dai Nippon Printing and Samsung that are developing ‘chipless' alternatives, such as polymer transistor circuits and Surface Acoustic Wave (SAW) devices, may be on a better tack for the long term.FIVE-CENT CHIP TAGS SEEN AS A CERTAINTY

Chip tags are certain to get down to five cents as orders approaching 10 billion tags are placed. Chip tags can also address enormous secondary markets, even if consumer packaged goods (potential trillions yearly), postal packages (potential 650 billion yearly) and manufactured books (50 billion yearly) mainly take one-cent and sub-one-cent chipless tags in due course.Several chip manufacturers have approached us saying that they have no interest in producing the required sub-one-cent chips for five-cent RFID tags, but they do seek less price-sensitive, more-sophisticated large niche markets in RFID. The new report gives great detail on these.

BILLION DOLLAR, BILLION TAG NICHES

Such opportunities run into at least tens of billions of tags yearly and disproportionately large sums on infrastructure and services. The large niches are often new RFID markets coming out of nowhere, not extrapolations of past trends. They include the following.- The South Korean Ubiquitous Sensor Networks (USN) projects backed by the South Korean government for monitoring natural disasters and many other uses

- The tagging of all patients, staff and assets in healthcare facilities worldwide for error prevention and other reasons

- Anti-terrorism measures in global logistics

- Meat and livestock tagging in the face of new legislation against disease

- Tagging of high-value banknotes and drugs for anticounterfeiting

Timelines are provided for all of these. In addition, many examples of legal encouragement are examined, such as the probable tagging of one billion tires yearly with embedded RFID devices that can also sense pressure. Responding to client needs, IDTechEx looks in some detail at potential under-and-over supply in all parts of the RFID value chain. Industry is not responding to the challenges in a way that evenly addresses all needs.

ITEM-LEVEL COMING SOONER THAN REALIZED

We believe that item-level tagging, particularly of drugs, will rival the output of pallet and case tagging, despite the hype about the latter programs. With companies such as Hewlett Packard, IBM and Samsung working on the UHF problems, they will be solved. Any forecaster must however consider the fact that Gillette and others see the logistics of UHF as being so tough that they must redesign the geometry and materials of a significant percentage of their cases and contents to make them ‘UHF friendly' while the systems are being optimized. Such options are neither cheap nor rapid.By contrast, Pfizer, GlaxoSmithKline and other major pharmaceutical companies started tagging certain products on a permanent basis in 2005. They are not all hooked on UHF, and some favor the more proven 13.56MHz waveband used with almost all item-level tagging and contactless smart cards to date - about one billion items are out there and working well. The range of UHF is rarely needed at item level. Indeed, DHL has ordered its first million tags for postal packages, and they work at 13.56 MHz.

In such a frenzy of success and failure, forecasting is a risky business. Who predicted that only modest quantities of pallets and cases would be tagged in 2004, but orders for over 150 million RFID air baggage tags would be placed? Who in the West noticed that 50 million RFID tickets were delivered against just one order in Japan? We will be producing more forecasts in this notoriously changeable field.

For more information, contact Raghu Das, +44 (0) 1223 813703, e-mail r.das@idtechex.com .

SIDEBAR: European Commission to launch public inquiry into RFID

By Peter Sayer, IDG News Service, Paris BureauNew legislation may be required to regulate the widespread use of RFID (radio frequency identification) tags, the European Commission said March 9, announcing the beginning of a public inquiry to identify citizens' concerns about the technology.

RFID tags are increasingly being used to track inventory in supermarkets or to authenticate and encode information in national identity documents. Each tag contains a unique serial number that can be read by an electronic device at distances ranging from a few millimeters up to several meters. By associating the serial number with information contained in databases, the tags can be used to provide personal information on the bearer of an identity document or the full manufacturing and shipping history of a consumer product, perhaps even including who bought it and when.

The Commission is concerned about the personal privacy and security issues raised by such applications, and intends to hold a series of workshops in Brussels through June to canvas public opinion on the subject. The results of the workshops will be incorporated into a consultation document due to be published in September.

Protection of personal information in electronic form is already the subject of a European law, the e-Privacy Directive. If the Commission identifies new threats to European Union citizens' privacy from RFID and determines that new legislation is required to protect them, then it will consider revising that directive, it said.

RFID is also a European issue for other reasons. Laws allowing for the free movement of goods around the E.U. would be worthless if tags on packaged foods from Poland, say, were unreadable by scanners in Portugal, as supermarkets would not be able to track their inventory. The Commission is also considering legislation on technology standards and radio spectrum allocation to ensure the harmonization of tag technology across the E.U.