It's no secret that adhesive pricing has been historically undervalued when compared to the importance derived from the function it performs. Companies habitually charge less than they could, particularly for new products, which unfortunately leads to underestimating a product's value. This is a costly mistake, since the introductory price often fixes its worth in the buyer's mind.

However, the story does not stop there. Our analysis of businesses within the adhesives industry suggests that pricing leaks continue after the initial price has been established, hence additional value leaks.

Pricing for value requires an understanding of the total economic value realized from an offering. For a new product, such value resides in one of two categories.

1. Extracted value - liberating inefficiencies from the supply chain and/ or the customer's application process, e.g., reducing film thickness resulting in greater mileage; and

2. Created value - new value enabled by the product resulting in new revenue stream for your customer, e.g., expanding the pie through replacement of mechanical fasteners.

Likewise, value leaks occur when:

- Companies grant pricing discounts. While many such discounts are legitimate due to competitive pressures, a significant amount are unwarranted and result in significant margin erosion that may be difficult to recapture.

- Companies incorporate "customer service" offerings into the price charged and offer such services equally to all customers. The biggest and best customers often receive the highest levels of service. Fundamentally, however, the company fails to assess whether these services are capturing and retaining value for the customer, or, more importantly, whether such customers generate acceptable profitability.

Understanding the Total Economic Value

In his bookDelivering Profitable Value, Michael Lanning describes a value proposition as "a clear, simple statement of the benefits, both tangible and intangible, that the company will provide, along with the approximate price it will charge each customer segment for those benefits." Our experience in the adhesives industry suggests that our clients typically express value through cost-plus product pricing and often ignore to value the intangible benefits.A good value proposition for an adhesive should address at least one or more of the following factors.

- Usage rate

- Productivity (labor, downtime, scrap, maintenance, yield, dry time)

- Asset usage (capital costs, floor space)

- Performance (service life, aesthetics)

- Environmental (waste elimination, air quality, energy consumption, etc.)

- Extracted value. End users may be willing to share liberated value for capital avoidance, recurring energy savings, waste elimination and usage rate. But they may not pay for labor, downtime or air quality because such intangibles are difficult for them to realize. Our analysis suggests that companies may retain 10-15% of each dollar of value liberated.

- Created value. Since this results in revenue expansion for the end user, they are typically willing to share more of the value. Generally, the end user retains one third of the value and uses one third to motivate downstream participants to make the switch, thus leaving one third for the enabling company. This is hardly fair, but it is a reality.

Value Leaks

The opportunity for profit improvement lies in three areas:1. Managing discounts and services consistently

2. Improving mix of business

3. Delivering higher margins on new products

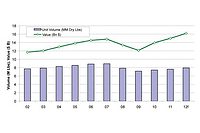

The proverbial 80:20 rule plays out in spades in adhesives. Our findings reveal ratios reflecting a make up of:

- "A" accounts - top 5% representing typically 80% of margins

- "B" accounts - next 10% representing typically 15% of margins

- "C" accounts - balance of 85% representing typically 5% of margins

Product and SKU purchases reflect similar ratios, hence an extremely long "tail" of customers and products that make up over 80% of the cost activity, yet return less than 20% of the profit.

Similarly, customer service tasks such as product sampling, technical service assistance, inventory and distribution costs reflect heavier usage by "C" accounts than by those that deliver the vast majority of margins. This comes as not much of a surprise since "C" accounts by definition are small and lack internal resources.

Companies need to align their pricing strategy and services with a consistent account-management plan. Consider creating a low-cost offering for accounts by de-bundling services. Manage technical service resources consistently within the context of A, B and C accounts. Develop a better understanding of, and communicating value for, your new offerings. Exercise discipline in providing rebates and easier terms, and avoid waiving charges such as freight allowances.

Plugging your margin and value leaks will require significant analysis of customers, products, services, and activity costs. Additionally, it will require paying attention to the details of developing plans for account management, pricing and the understanding of value.