Photo: Scapa Automotive

Table

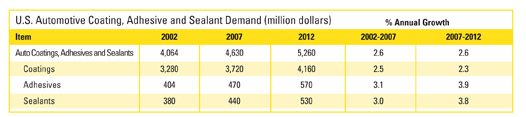

The original equipment manufacturer (OEM) market for coatings, adhesives and sealants is heavily dependent on motor-vehicle production patterns. Through 2012, motor-vehicle production is expected to rebound from the poor performance seen in the 2002-2007 period, spurring demand in the OEM market.

Aftermarket demand will benefit from continued growth in the existing number of motor vehicles, as well as the popularity of light trucks, vans and sport-utility vehicles over the past decade. Despite below-average gains in the production of these larger light vehicles due to high fuel prices and market saturation, these vehicles - which consume higher volumes of coatings, adhesives, and sealants in their repair than smaller light vehicles - will maintain a significant share of total existing motor vehicles. Providing further aftermarket support will be above-average increases in the number of medium- and heavy vehicles in use.

Demand for coatings will be somewhat limited, as competing alternatives such as paint film and in-molded color (which are used with plastic substrates) can offer cost advantages, reduce production time, and improve wear resistance. Adhesives, on the other hand, will benefit from the shift toward plastics, as they are lower in cost and better suited for use with plastics than mechanical fasteners.

For more information, contact Corinne Gangloff, The Freedonia Group Inc., 767 Beta Drive, Cleveland, OH 44143-2326; phone (440) 684-9600; fax (440) 646-0484; e-mail pr@freedoniagroup.com; or visit www.freedoniagroup.com.