Construction, automotive and pressure-sensitive products were the largest outlets for adhesives and sealants in Japan, combining for 57% of sales.

The region is comprised of the mature economies of Japan, South Korea, Taiwan and Australia, as well as emerging markets, led by China and India. The mature economies represent about 40% of the regional adhesives and sealants sales; volume in these countries is forecast to grow at a 1% annual rate through 2013. Sales in these countries will be down significantly in 2009. In contrast, the emerging economies represent 60% of regional demand and are forecast to expand at a 9% annual rate through 2013. Growth in the emerging economies for 2009 is placed at 5%, although some of the smaller economies will experience declines. Adhesives and sealants consumption ranges from less than $1 per capita in India to over $15 per capita in Japan and Taiwan.

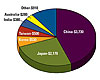

Figure 1. Adhesives & Sealants by Country (Total $8,500 MM)

Country Overviews

China has moved to the top position in regional sales, overtaking Japan, which led at the start of the decade. Figure 1 shows that China consumed $3,730 MM of adhesives and sealants in 2008, 44% of the total. China’s 3.7 billion lbs. of adhesives and sealants was one-half of the regional volume. Volume growth is forecast at 9% per year through 2013, off a few points from the rapid rise of the last several years. Only modest growth of 6-7% is projected for 2009. China is the region’s largest consumer of adhesives for pressure-sensitive products, footwear, woodworking, packaging, disposable products and textiles, and is second to Japan in sealants for construction and automotive applications. China produced just over 11 billion square meters of pressure-sensitive tape and label and graphic products in 2008, about half of the regional total. China made 70% of the world’s 15 billion pairs of shoes. The country manufactured about 35% of the 28 million motor vehicles assembled in the region, and will shortly overtake Japan to become the largest motor-vehicle producer. Currently, the bulk of vehicle production goes toward domestic sales. China is the second-largest consumer of electronic adhesives in the world, and is forecast to be the largest in the next few years.Japan is the second-largest adhesives and sealants consumer in the Asia-Pacific region, with just over one-quarter of the sales and about one-fifth of the volume. The worldwide financial crisis and the appreciation of the yen caused the economy to falter in the second half of 2008. Little growth is forecast for adhesives and sealants through 2013; volumes will be down significantly in 2009. In 2008, Japan was the area’s largest consumer of construction and automotive adhesives and sealants. Japan is currently just ahead of China in electronic and consumer adhesives, and is second to China in all other end uses. Japan was the largest automotive producer in Asia in 2008, and nearly 60% of its vehicle output was exported. Adhesives and sealants usage in automotive applications plunged in late 2008 and continue to decline in 2009. Construction, automotive and pressure-sensitive products were the largest outlets for adhesives and sealants in Japan, combining for 57% of sales.

South Korea and Taiwan are third and fourth in the region for adhesives and sealants, each with about 6% of the total dollars. Both are mature economies, and adhesives and sealants growth is forecast at 1-2% per year through 2013; 2009 will be a down year. Korea is the third-largest user of construction and automotive adhesives and sealants. It is also a significant consumer of electronic adhesives, just behind Japan and China. Taiwan is the third-largest in pressure-sensitive product adhesives and a strong fourth in electronic adhesives. Pressure-sensitive product and electronic applications accounted for nearly 65% of Taiwan’s sales in 2008.

India is the fifth-largest consumer of adhesives and sealants in Asia-Pacific, but the country edges out China to garner the second-fastest growth rate. Growth through 2013 is placed at 11% per year; however, in 2009, growth will be about one-half the long-term forecast. Adhesives and sealants consumption in India is low, considering that it has the world’s second-largest population. Disposable products are an area of projected rapid growth for India; production of these products is currently minimal in the country, but is expected to rise substantially. Packaging, pressure-sensitive products and woodworking are the leading end uses in India, and represented about 60% of sales in 2008.

Australia (including New Zealand) edged out Indonesia to capture the sixth position in sales in 2008. Other counties, ranked by dollars, include Malaysia, Thailand, Philippines, Vietnam and Singapore. Vietnam has the top growth rate in the region. Footwear and woodworking are the largest end uses in Vietnam, accounting for two-thirds of its dollars.

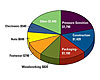

Figure 2. Adhesives & Sealants by End Use (Total $8,500 MM)

End-Use Review

As shown in Figure 2, pressure-sensitive products are the largest outlet for adhesives and sealants in the Asia-Pacific region. Included are tapes, labels and graphics, and other smaller-volume products. The Asia-Pacific region produced about 18 billion square meters of tapes and over 5 billion square meters of label and graphic stock in 2008. Adhesive consumption was 2.4 billion lbs. - nearly 1.2 billion lbs. on a dry basis (excluding water and solvent). Water-based acrylics are the largest volume adhesive, with nearly 65% of the dry lbs., and are the leading adhesive for packaging tapes and label stock. Solvent-based rubber adhesives were nearly one-fifth of the dry lbs.; applications include masking, electrical and packaging tapes. Solvent-based acrylics, used in higher-performance applications, captured 10% of the dry lbs. but 22% of the value. Hot-melt adhesives used in tapes, labels and other products made up about 5% of the dry lbs. China, Japan, and Taiwan consumed over 80% of the pressure-sensitive adhesive dollars in 2008.Construction adhesives and sealant consumption represented 17% of the volume and was split about 70:30 between sealants and adhesives, respectively. China and Japan took over 85% of the construction sealant dollars in the region. Applications include window glazing, structural glazing, insulating glass and DIY. China is by far the region’s larger consumer of insulating glass sealants, and silicones accounted for some 70% of the construction sealant sales. Polyurethanes made up about 15% of the construction sealant; polysulfide, acrylic, and butyl are other larger-volume types. Larger construction adhesive applications in Asia Pacific include flooring, pipe cements and sandwich panels.

Packaging adhesive consumption was $1.1 billion in 2008 - 13% of the Asia-Pacific total. Flexible packaging accounted for 30% of the dollars and is the fastest growing packaging application. Solvent-based polyurethanes are the leading flexible-packaging adhesives, but 100% solid and water-based technology is growing faster. China, Japan, and India consumed over 80% of the flexible packaging adhesive dollars. Woodworking adhesives accounted for 10% of the adhesives and sealants sales in the region, with water-based types representing 80%. China is the world’s largest producer of wood furniture, and consumed nearly 45% of the woodworking adhesive dollars in Asia-Pacific.

Footwear adhesives accounted for 9% of adhesives sales; over 80% is consumed in China. Vietnam and India are small but faster-growing outlets. Solvent-based polychloroprene and polyurethane adhesives remain the leading types, but water-based versions are gaining. Automotive adhesives and sealants made up 7% of sales, with sealants sealants accounting for 70%. Most of the volume is used for vehicle production; however, there is also a significant aftermarket, as there are 200 MM cars and trucks on the roadways in the region. Windshield glazing and plastisols for body sealing are larger sealant applications. Japan is the largest consumer of automotive adhesives and sealants, taking 47% of sales. China and South Korea follow.

Electronic adhesives represented a minute percentage of the volume, but 6% of sales. Electronic adhesive consumption has been hurt by the global slowdown in the electronics industry. These adhesives are used during the packaging of semiconductor devices and in printed circuit board assembly applications. They are the highest priced adhesives. Japan, China, Korea and Taiwan consumed over two-thirds of the electronic adhesives. Other adhesives and sealants end uses in Asia-Pacific ranked by dollars include product assembly, consumer, disposables, bookbinding, and textiles.

Bookbinding is one end use for adhesives in Asia-Pacific.

Competitive Outlook

Suppliers of adhesives and sealants in Asia-Pacific vary from the multi-national players to small regional competitors. Some companies compete across the board in countries, end use markets and technologies. Other firms are focused on particular markets and/or technologies. Only one company captured over 10% of adhesives and sealants sales in the region; no other company had over 5%. The top 12 suppliers hold one-third of sales. Thus, the opportunities for adhesives and sealants companies and raw material suppliers remain attractive.The above information is based uponAsian Adhesives & Sealants, a new study by Steven Nerlfi, Minesh Kusumgar and Michael Growney. For more information, phone (973) 439-0030, e-mail nerlfikng@cs.com or visit www.kusumgar-nerlfi-growney.com.