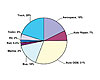

In North America, structural adhesives used in transportation are a $1.2 billion industry that is projected to grow about 3-4% annually through 2013. As shown in Figure 1, auto OEM is by far the leading transportation end-use market (31%). Other leading markets include truck (20%) and bus (16%).

Automotive

A multitude of applications in today’s cars, trucks and buses generate the huge volumes of structural adhesives used in these industries: hem flanges for doors and enclosures, window/glass attachment, weld bonding, attachment of reinforcements and anti-flutters, brake and friction pads, SMC body panels, etc. These applications increasingly involve the assembly of dissimilar substrates (e.g., steel-to-plastics, steel-to-magnesium, etc.) in major exterior and framing components. Structural adhesives are a well-established, accepted and preferred fastening method for bonding diverse substrates.The fact that the composition of today’s cars has changed, and will continue to dramatically do so, bodes well for the continued use of structural adhesives:

• Mild steel is forecast to decline from today’s 55% of an average vehicle’s weight to about 29% by 2015, while high-strength, low-alloy steels are projected to grow from 11.9% to 68% in 2015.

• By 2010, vehicles will average 318 lbs of aluminum vs. the current level of 274 lbs.

• Plastic content in vehicles grew from 11% in 1990 to 14% in 2000, and is forecast to grow to 17% by 2011 (or about 5.63 billion lbs). The biggest growth will be in body applications, which will grow from 1.2 billion lbs in 2001 to 1.6 billion lbs in 2011.

• The average vehicle contained 6.5 lbs of magnesium in 2000 and 8.8 lbs in 2003; this will increase to more than 12.0 lbs in 2010.

The displacement of mechanical fasteners is becoming more prevalent, as they are labor intensive and both process and unit costs typically exceed that of adhesives. It is estimated that 68 lbs of adhesive have replaced 201 lbs of mechanical fasteners on the average vehicle in recent years, for a variety of good reasons. Adhesives:

• Spread a load across the entire bond-line vs. singular points of contact for mechanical fasteners.

• Mitigate the adverse effect that welding has on today’s thin-gage, high-strength steels.

• Mitigate differences in coefficients of thermal expansion between dissimilar substrates.

• Increase styling latitude for design engineers and have more components assembled off-line with modular assembly and construction methods to reduce costs and improve quality.

• Fill gaps and seal the bond-line from moisture entry, as well as impart noise and vibration dampening properties.

Aerospace

In aerospace, which constitutes 18% of the market, weight vs. performance is even more vital than it is for the automotive industry. The aerospace industry must work to meet the new Corporate Average Fuel Economy (CAFE) standards, so anything that can be done to decrease weight and improve fuel economy is highly valued and rewarded.As a result, composites have become the predominate material of construction for today’s aircraft, with titanium also seeing increased use. For example, an Airbus A300 introduced in 1972 used about 1% composites and about 5% titanium in its construction, while the new Boeing 787 uses about 50% composites and 15% titanium. These factors all definitely favor the increased use of structural adhesives.

Growth Opportunities

While structural adhesives are well-accepted in many applications, they only capture about 10-12% of the overall industrial fastening market. So how does the industry grow? Here are some key points that need to be addressed:• Welding technology has been practiced for a long time and has an established track record for reliability and predictability. Adhesive bonding has a much shorter history, so more data (long-term durability and fatigue) needs to be developed to support the use of adhesives for such key structural applications as frame rails, floor pans, roofs, front modules (radiator and IP supports), etc.

• Because of this long history, workers are routinely trained and certified in proper welding techniques. The adhesive industry needs to focus more attention on seeing that the workforce gets proper instruction and certification on such crucial issues as proper surface prep, accurate bond-line placement, correct manual or automated application, the use of the appropriate adhesive for an application, etc. Without such attention, even the best structural adhesive will likely under-perform.

• The industry needs to develop new and improved structural adhesives that are more robust, cure faster and/or require less energy, are lower density, disbond “on command,” adhere through oily surfaces, bond non-polar substrates, use less material, etc.

As future end-use applications for structural adhesives become even more demanding and critical, the industry will need to rise up to meet these new challenges, just like it has done to advance structural adhesives to where they are today.

Richard B. Jones is vice president of The ChemQuest Group Inc., an international strategic management consulting firm specializing in the adhesives, sealants, and coatings industries, headquartered in Cincinnati.

For more information, phone (513) 469-7555 or visit www.chemquest.com.