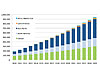

Table 1. Global Cumulative GW Installed by Region (2010-2025). Used with permission from IHS Emerging Energy Research.

Over the next several years, the industry will see a substantial investment in blades, nacelles and spinner hubs (see Figure 1). It is anticipated that by 2025, the cumulative installed capacity will reach over 940 GW (see Table 1). Predictions are that the wind blade market will be worth over $5 billion in 2012, approaching $9 billion by 2025.1

The worldwide demand for renewable energy has pushed manufacturers to develop larger and lighter blades at lower costs relative to their size. In the past 10 years, the average wind turbine has nearly doubled its output to 1.75 MW. This trend is due to the lower cost of energy (COE) for one 2.5 MW turbine than for five 500 kW machines. Whereas the smaller 500 kW machine blade length averages 22 m, the more efficient 2.5 MW machine averages around 50 m-over twice as long.

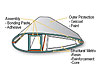

Materials that go into today’s blade composites have to meet growing challenges. A wind blade’s performance is a combination of design, fabrication quality and materials. Historically, the development of composite materials has been challenged by the fact that one material supplier typically makes the reinforcement, a second the resin, potentially a third the adhesive, and maybe yet another the coating (see Figure 2). Each material-as well as the composite structure-must meet processing, static and dynamic property requirements.

Before blade designers or manufacturers will even look at a product’s tech data sheet, they will likely want to know whether it has Germanischer Lloyds (GL) or Det Norske Veritas (DNV) certification. Designers need to be assured that materials are durable enough to meet the 20-year lifespan requirement for blades. Involving blade material suppliers early in the design process provides an opportunity to improve the manufacturing cycle time, durability and overall performance of blades.

Figure 1. Composite Structures in a Wind Turbine

Leveraging Raw Material Suppliers

It is critical that material suppliers see how they fit in the overall wind turbine supply chain and how they can bring new value (see Figure 3). The value that material suppliers offer is often not immediately understood by players further down the chain. To realize paths for blade improvement, material suppliers need to be brought into the new blade design process early.In addition to helping control quality, a material supplier can also improve productivity through solutions that reduce blade production cycle time and minimize cost, thereby providing a competitive advantage to the fabricator and ultimately advancing the entire industry. Material suppliers are able to do this by observing their customers’ manufacturing processes and optimizing key product characteristics related to a materials processability and performance. The customer can then pass that savings to the turbine manufacturer or end user.

The ultimate goal is to reduce the cost of energy produced by wind turbines compared to alternatives. Through developing better partnerships with all players along the supply chain, the material supplier has real power to add value.

Figure 2. Wind Blade Cross-Section

Keys to Good Partnerships

Development partnerships occur not only between material suppliers and customers, but also between different raw material suppliers to validate that their products perform well together. Four key factors govern both of these partnerships: design, standardization, global supply chain and environmental considerations.Design

The integration of the supplier into the customer’s design and production process is critical to ensuring that the voice of the customer is captured and actual needs are addressed. For new product development, a system is required to manage communication, capture the critical aspects for success of the product, and track progress to achieving milestones. Common tools include product blueprinting for voice of customer (VOC), design for six sigma (DfSS) to manage the overall development process, and lean six sigma (LSS) for quality assurance.

Standardization

The communication of specifications alone does not guarantee delivery of what the customer needs. Several ISO or ASTM methods are used to measure critical aspects of wind materials. Within these standards, variations of methods of analysis exist and may lead to poor correlation between the supplier and customer.

All testing parameters need to be agreed upon, and measurement system calibration must also be addressed. Gauge R&Rs and round-robin studies are required at the start of new partnerships so time is not lost during the product development stage and quality is ensured through scale-up and the life of the product. Great expense is attributed to the rejection of a good product or the acceptance of a poor one.

Global Supply Chain

Wind is a global industry. Many players, such as GE, Vestas, Gamesa and LM, maintain production facilities in all the key regions; these companies are looking to material suppliers to provide a consistent product to all manufacturing sites. When selecting partners, OEMs and fabricators often look for differentiation in the form of global reach and just-in-time product availability.

Environmental Considerations

Material suppliers must guide the use of their products. They must ensure that best practices and proper environmental health and safety procedures are followed to protect workers and the environment. By participating in initiatives such as the chemical industry’s Responsible Care® program, material suppliers lead by example and show their commitment to continuously improve health, safety and environmental performance.

Figure 3. Wind Blade Value Chain

The Future

Since it is renewable, wind energy is seen as green, but much of the technology used in wind is actually petroleum based. Material suppliers are in a unique position to help drive wind turbine production to be greener. Today, the composites and adhesives industries have achieved success in the advancement of technologies that incorporate precursors derived from soy, corn, biomass, and recycled content in new products. Historically, the main issue with these products has been that they typically have higher cost or do not perform as well as traditional products. As the wind industry matures, so will these technologies. It is only a matter of time before they become more competitive with traditional materials.Good relationships are essential to creating a win-win environment for all participants. Building excellent development partnerships is about capturing opportunities to optimize performance and productivity, and passing value on through the supply chain. How a raw material for blades performs or processes is directly related to its chemistry. To improve productivity, adhesives, coatings and resins need to cure faster and at ambient conditions.

To help reduce the cost of energy from a turbine, it is the responsibility of all players to derive more value from the wind supply chain to advance the industry. We are at a stage in blade manufacturing where it is time to take advantage of real opportunities to effectively balance all the risks to improve cost, productivity, and performance to ensure that wind continues to win.

About Ashland

Founded in 1924, Ashland Inc. began as an oil refining company. Today, Ashland Inc. is a global specialty chemicals manufacturer with four commercial units: Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets (Valvoline). In 2010, Ashland posted $9 billion in sales and employed more than 14,000 individuals worldwide.Ashland’s goal in wind power is to help drive down the cost per kilowatt by supplying cost-effective, high-productivity products for production of blades, nacelles and hub covers. All around the world, Ashland works with its partners to smooth the global wind energy value chain for delivery of next generation wind turbines. Visit www.ashland.com for more information.