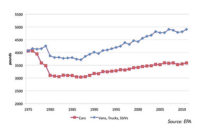

Construction-related end uses are among the largest categories of adhesive applications, making up approximately $4 billion of the $16 billion adhesive market in the U.S. The U.S. construction market has seen a 9% increase in spending for the first six months of 2012, compared to the first six months of 2011. This follows four consecutive year-over-year declines (see Figure 1). Despite the turnaround, private residential construction spending is only about 45% of its peak level, while private non-residential construction spending is faring slightly better, at about 65% of its 2006 peak.

CONSTRUCTION CHANGES

Unlike coatings, where a major driver of demand is the turnover of existing homes, adhesive use in residential construction occurs primarily in new construction. Even there, however, the linkage is not what it used to be. Many market transactions have been made by institutions with a large portfolio of properties to resell, rather than by individual sellers. Often, properties that would normally have been repainted are not. The same sellers are having an impact on new residential construction as builders compete with existing, distressed home inventories, lowering the demand for new homes.

PERMITS, STARTS AND SALES

Figure 2 demonstrates how new residential construction has fallen in recent years. Sales of single-family new homes dropped from 1.4 million units in 2005 to around 0.3 million units in 2011—a decline of close to 80%. Despite a slight improvement in new home sales in 2012, no one expects that sales will return to the peak anytime soon.

One favorable factor going forward is the number of new household formations, which is greater than the number of new homes being created. Between that and the need to replace homes that are removed through demolition or disaster each year, ChemQuest estimates that new home sales should rise 0.7 million as the market gets back to equilibrium over the next 24 months.

One area of construction that has, until recently, fared better is infrastructure spending (see Figure 3). In fact, public construction spending grew until 2010, even while private spending was undergoing large contractions. This growth primarily resulted from the large stimulus measures undertaken in the wake of the financial crisis of 2007-08. However, government spending on construction projects is now under pressure as state and local governments cut back in order to balance their budgets.

In conclusion, after many years of a trough in the U.S. housing and construction markets, there appears to be some upward momentum. Assuming that the trends from the first half of the year continue, ChemQuest has raised its annual adhesive demand projection in the U.S. for construction end uses to be closer to 5%, up from the previous 2%.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.