"We’re a manufacturer, not an engineering firm. I’m not sure we really do R&D.” “We’re not a Fortune 500 company; I’m not sure we have enough R&D to file for a credit.” These comments are common from mid-sized manufacturers. When it comes to the Credit for Increasing Research Activities (I.R.C. §41, “the R&D credit”), a common misconception is that a company won’t qualify for the R&D credit if it doesn’t have a laboratory, a dedicated R&D division or an engineer on staff. While those things can certainly be evidence of R&D, they are far from being the only factors.

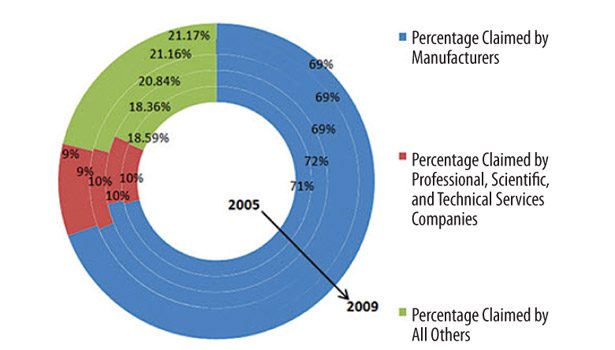

In reality, manufacturing companies actually benefit from the R&D credit more than any other group. Since 2005, manufacturers have consistently claimed approximately 70% of the total amount of R&D credits given out by the federal government.1 The term “R&D” conjures the idea of laboratories, engineering firms, and other organizations that focus solely on scientific research. However, as Figure 1 shows, “professional, scientific and technical services” companies make up a very small percentage of the credit when compared with manufacturers.2 Manufacturers have consistently claimed around 70% of the R&D tax credits since 2005.

This is due, in part, to the fact that manufacturing companies frequently engage in numerous types of activities that may not seem like traditional R&D but actually do meet the requirements of §41 for purposes of finding qualified research expenses for the R&D credit. As a result, manufacturers frequently have more R&D expenses than they think and are ideal candidates for filing the R&D tax credit.

R&D QUALIFICATIONS

Part of the misconception regarding who can take the R&D tax credit stems from the definition of R&D. Put simply, §41 includes a four-part test for qualified expenses:

• The activity must be for the design and/or development of a new or improved business component.

• Technical uncertainty must be inherent in the developmental process.

• A process of experimentation must be undertaken in order to eliminate the technical uncertainties encountered during design and development.

• The process of experimentation must rely on one or more of the hard sciences, such as engineering, physics or chemistry.

The many rules and exceptions that make up the R&D tax credit can make companies—especially manufacturers—think that they have no qualified research activities when they actually do. Although traversing these complexities can be difficult, with the help of tax professionals, many manufacturers have found that they do have activities that qualify them for significant R&D tax credits.

SIZE DOESN’T MATTER

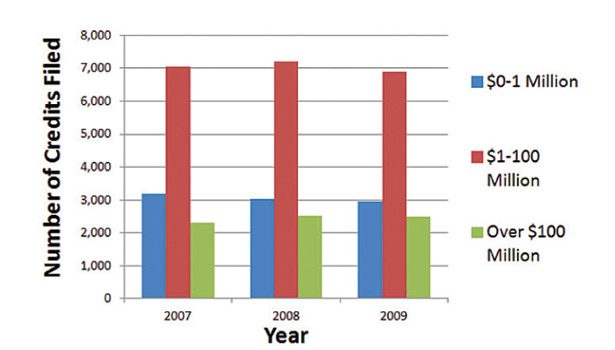

An equally common misconception is that only large Fortune 500 companies can benefit from the R&D credit. In actuality, midsized companies claim the credit far more frequently among manufacturers. This is partly due to the fact that midsized manufacturers frequently spend time performing small, customized and one-off projects, as well as prototyping, whereas larger manufacturers often have a greater focus on non-qualified production. Figure 2 shows that midsized manufacturers (those with receipts between $1 million and $100 million) make up the vast majority of manufacturers filing for the credit.

Midsized manufacturers generally claim approximately 70% of the total credits claimed by manufacturers.3 In addition, those midsized companies are not just the manufacturers with receipts in the $50 million to $100 million range. In most years, manufacturers claiming credits come equally (if not more frequently) from the $1 million to $10 million range than the $10 million to $100 million level.4 From 2007-2009, manufacturers with $1 million to $10 million in gross receipts claimed an average of 37% of the total credits, while manufacturers with $10 million to $100 million in gross receipts claimed an average of 33% of the credits claimed by manufacturers. Across the spectrum of midsized manufacturers, companies are finding R&D tax benefits related to their own market niche.

DISCOVERING OPPORTUNITIES

Midsized manufacturers are the big winners when it comes to benefitting from the Credit for Increasing Research Activities. While navigating the twists and turns of the R&D tax credit can seem daunting, many companies are finding it can be a very rewarding endeavor. Just because a company is on the smaller side or does not have an R&D department does not mean it will not find benefit from the R&D credit. On the contrary, it is midsized manufacturers that have the most to gain.

For more information, contact the lead author at (281) 558-7100 or sdhanani@paradigmlp.com, or visit www.ParadigmLP.com.

REFERENCES

1. Number calculated from statistics on total credit amounts claimed and amount of credit claimed by manufacturers in each year from 2005-2009, www.irs.gov/taxstats/article/0,,id=164402,00.html.

2. Percentages based on statistics on total credit amounts vs. amounts claimed by manufacturers and professions, scientific and technical services companies in each year, www.irs.gov/taxstats/article/0,,id=164402,00.html.

3. Percentages based on IRS statistics on Corporations Claiming a Credit, by Manufacturing Subsector, www.irs.gov/taxstats/article/0,,id=164402,00.html.

4. Id.