In August 2012, the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) issued a joint final rule for Corporate Average Fuel Economy (CAFE) standards for 2017-2025. The rule covering passenger vehicles and light trucks dramatically increases the required average fuel economy to 49.6 mpg and an average emissions level of 163 grams of CO2 per mile in 2025. This represents a 5% year-over-year increase in fuel efficiency beginning in 2017.

At first glance, this substantial increase in fuel economy standards would appear to be an enormous driver for auto and truck manufacturers to comprehensively reexamine how they are producing vehicles. Undoubtedly, one aspect of that would include shedding weight through an increased usage of lightweight materials. This change has already begun in the airline industry as airplanes are being redesigned and manufactured with composite materials replacing aluminum in major structural components for the first time. A similar change to the auto and light truck market could represent a huge opportunity for structural adhesive producers.

However, a closer look at the details of the regulation and what it means to auto and light truck manufacturers shows that such a correlation isn’t as easy to draw as it first appears. The new CAFE standards are based on a number of assumptions, including technological improvements of drivetrain components (primarily engine- and transmission-based efficiencies), a move toward electric and hybrid drivetrains, as well as mass (weight) reduction. But none of these assumptions are intended to require massive reengineering of how vehicles are produced, nor do they require rapid adoption of new technologies.

VEHICLE WEIGHT CHANGES

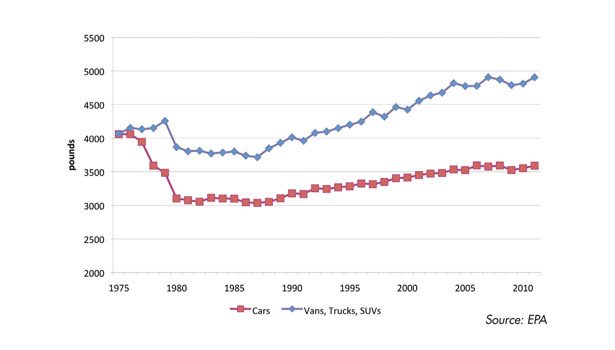

Since the early 1980s, cars and light trucks have steadily increased in weight (see Figure 1). This is due to a number of factors, including consumer preference for larger vehicles—as seen in the emergence of new classes of vehicles like SUVs and minivans—as well as an increase in both safety and amenity items, including air bags, anti-lock brakes, power windows and locks, and additional noise insulation (NVH).

While weight has been steadily increasing in recent years, auto and truck manufactures have been able to simultaneously increase fuel economy and performance. In fact, manufacturers have tended to use efficiency gains to improve performance rather than increase MPG, driven primarily by consumer preference. Figure 2 shows how much acceleration has increased on average while MPG has increased to a lesser extent.

Of all the assumptions that were used in writing the CAFE rule, mass reduction is the one most directly affecting adhesive use. Vehicle mass reduction can be accomplished two ways: by using less material or by substituting lighter weight materials for heavier ones. In a typical vehicle, the amount of weight is distributed equally among the body, the drivetrain, the chassis, and the rest (interior components, fenders, glass, etc.).

FUTURE IMPLICATIONS

While substitution has taken place on a limited basis, such as the migration to plastics for side mirrors, bumpers and some hoods, material reduction has been the primary means to reduce mass. However, much of these gains have already been achieved as there is a practical limit to how much can be reduced while maintaining safety, body rigidity and NVH. Substitution has also generally been limited to non-structural components. By far the largest opportunity for structural adhesives would be if carbon-fiber-reinforced plastics began to replace steel in automotive body-in-whites. Unfortunately, the CAFE rule doesn’t make that any more likely than before its existence due to the cost differential between the two.

In conclusion, what at first appears to be a huge driver for structural adhesive demand may turn out to be less than meets the eye. Instead, the rate of penetration for adhesives into the auto industry may not be as important as the demand for the number of units produced over the next decade. Fortunately, demand for new autos and light trucks looks to have turned a corner and is now greater than 15 million units annually. With the average age of cars and trucks in the U.S. expanding to a record 11 years, demand looks to be robust as older cars and trucks get replaced.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.