In terms of job growth—or more accurately, the lack of job growth—the Great Recession was a brutal period for the adhesives and sealants industry. According to

|

Jump to:

Overall Employment Data |

the U.S. Bureau of Labor Statistics’ (BLS) Annual Survey of Manufacturers, U.S. adhesives manufacturers shed nearly 4,400 jobs between 2009 and the end of 2011, representing a reduction of almost 20% of the workforce. Job growth has since turned around, but due to globalization and ongoing industry consolidation, it is unlikely that all of these lost domestic jobs will be regained—at least in the near term.

Taking a longer view, however, there is reason to be more optimistic, both because growth has resumed in key markets for adhesives and more generally because of a broader revival in U.S. manufacturing. The monthly BLS data from 2003-2012 provides some insights on trends in the adhesives and sealants industry that relate to employment and the productivity of labor over the past decade, and may be predictive of what we should expect going forward.

OVERALL EMPLOYMENT DATA

Each month, the BLS tracks “Paint, Coatings and Adhesives” as a distinct category of industrial activity. For the purposes of tracking broad industry trends, the distinction between the coatings industry and the adhesives and sealants industry often can be ignored, as the two industries do overlap significantly in terms of raw materials (e.g., acrylic and epoxy resins) and end markets (e.g., construction and transportation). In addition, functional distinctions between the two industries are sometimes blurred, as when an epoxy coating simultaneously serves as a sealant. Therefore, the combined data is used here as a proxy for the narrower adhesives and sealants industry.

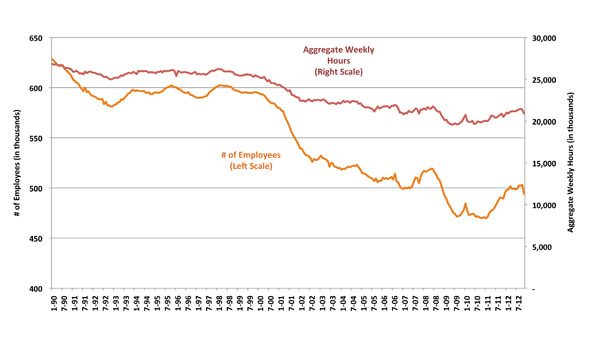

While employment in the chemicals industry has been declining for more than 20 years, the trend has recently reversed (see Figure 1). Although historically a number of short-term upticks have occurred amid the long-term downtrend, the current uptrend appears to be more sustainable. This is primarily due to the revival in U.S. petrochemical production associated with low-cost feedstocks generated by the shale gas boom. As evidence of this, several major petrochemical manufacturers have announced the build-out of new ethylene cracker capacity that is scheduled to come online by 2016.

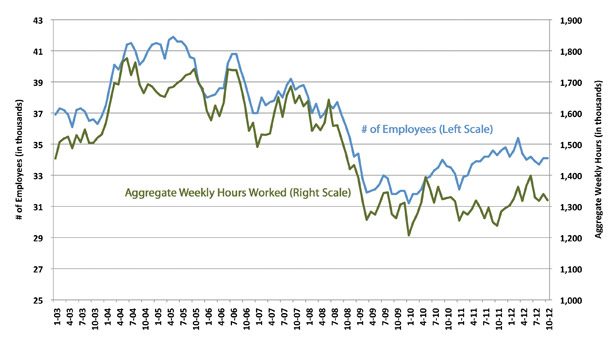

Looking at the data since 2003 for paints, coatings and adhesives, a similar trend can be observed (see Figure 2). In the third quarter of 2008 (coinciding with the onset of the financial crisis), a declining trend in both the number of production employees and aggregate hours worked accelerated. Employment stabilized by the beginning of 2010 and subsequently began to rise.

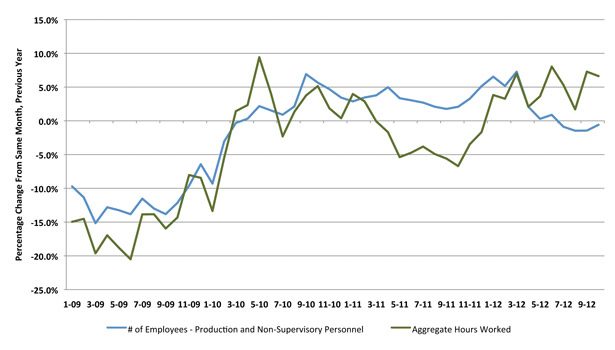

Aggregate weekly hours worked by production and non-supervisory personnel have exhibited a more modest recovery, and a comparison of year-over-year changes in Figure 3’s two data series makes this clear. Although employment has grown more or less steadily in the low single digits since the spring of 2010, the trend in aggregate hours worked has been more sporadic. In fact, aggregate hours worked in 2011 declined each month from year-earlier levels, except for January and February. In other words, even though production employees were being hired every month, the average length of the workweek for the average employee was getting shorter.

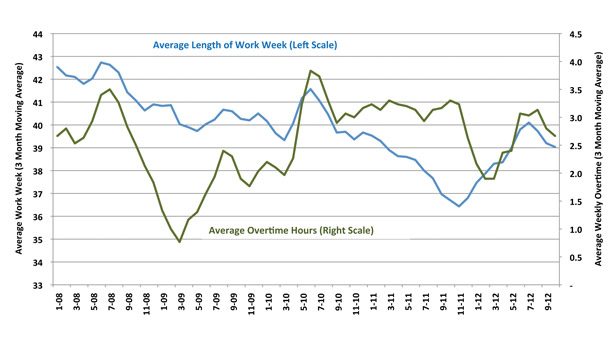

Digging deeper into the data may illuminate the cause of the discrepancy. Figure 4 shows the average length of the workweek and overtime for production personnel from 2008-2012, a period that includes the Great Recession (December 2007-June 2009). Note that the average workweek declined from the beginning of 2008 until November 2011, when the trend reversed and turned upward. Overtime hours also trended down but bottomed in March 2009, and then began to move up even as the average workweek continued to decline for another two-and-a-half years.

The fact that these changes in employment patterns occurred in the period that encompasses the Great Recession and the early stages of recovery is telling. The data underlying Figures 1 and 2 indicate that the steepest cuts in the number of employees occurred in the second half of 2008 and the first quarter of 2009, a period that was bookended by the bankruptcy of Bear Stearns in March 2008 and the stock market bottom in March 2009. Between June 2008 and March 2009, the coatings and adhesives industries together cut nearly 5,600 jobs, almost 9% of the total workforce.

Considering how plant managers typically cut back employment during recessions explains how, since the recovery began in June 2009, the number of employees increased while aggregate hours worked stagnated. Typically, managers will first lay off the least productive, less senior personnel while retaining more senior, more productive personnel. As a recovery begins, managers may be reluctant to hire new workers until it is clear that the economy has turned; in the meantime, the more experienced, retained workers may begin to accumulate more overtime. Eventually, as new workers are hired, overtime should decline and the average workweek should increase—which is exactly the pattern the data shows. This process has been drawn out because of the ongoing weakness of the recovery.

PRODUCTIVITY EXPECTATIONS

Product shipments and productivity are expected to parallel the same trends seen in employment. Productivity is defined here as the value of shipments, as measured by the BLS, divided by the aggregate hours worked; in effect, this information provides a measure of dollar output per hour worked. To be accurate, it is necessary to adjust for inflation by deflating the BLS’s data by the producer price index for paints, coatings, and adhesives in order to derive the “real” value of shipments in inflation-adjusted dollars (see Figure 5). Doing so, it can be seen that, in addition to expected seasonal variations, product shipments fell steeply during the latter part of 2008 as the financial crisis deepened, and are yet to return to previous levels, even as other sectors of the economy have recovered. The financial crisis and recession seem to have accelerated a process of decline that was already under way, as adhesives and coatings firms, like many other suppliers, followed their customers overseas and shifted production to take advantage of cheaper labor and opportunities in faster-growing economies.

As expected, productivity also declined during the recession, as shipments fell faster than aggregate hours worked. Since then, productivity has recovered to a more normalized level, with seasonal lows of about $1,200 of product per hour and seasonal highs reaching just over $1,600 of product per hour, a range that is consistent with pre-recession levels (see Figure 6). Barring any significant improvements in process technology (not to be confused with product technology), productivity is expected to remain within this range.

LOOKING AHEAD

Going forward, the adhesives industry in the U.S. is expected to continue hiring at a modest pace, in line with end-market demand. Most likely, the overall size of the workforce will remain smaller than pre-recession levels. The adhesives industry is currently adding jobs as it increases capacity, though it seems that most new jobs are being created where the growth is; that is, in emerging markets overseas.

In the U.S., the near-term employment situation in adhesives manufacturing is unclear. Stable productivity means that job losses resulting from improvements in technology are unlikely. But the industry is in a consolidation phase, and mergers and acquisitions are adding pressure to “rationalize” capacity and eliminate redundant plants. A recent example is H.B. Fuller, which announced the closing of six facilities in the wake of its 2011 acquisition of Forbo’s Global Industrial Adhesives business.

On the other hand, some modest job growth is anticipated due to the recovery in key markets for adhesives, including light vehicles and construction. Longer term, some improvement is likely to occur in employment resulting from a general revival in U.S. manufacturing, which will benefit manufacturers of adhesives for all the major end-use markets—particularly for general assembly, transportation (auto OEM, aerospace, and marine), packaging, and other consumer products.

Part of this revival will come from reduced energy costs resulting from the ongoing extraction of domestic shale gas reserves. Other factors, however, may be just as important, and may involve more than just a positive turn in the business cycle. There is some evidence that “off-shoring” as a business model is being supplanted by an “in-shoring” movement. Many U.S. manufacturers are now rediscovering the value of having product designers, manufacturing engineers, assembly-line workers, and marketing and sales personnel work together collaboratively to produce products that are both of higher quality and lower in cost than products outsourced to offshore contractors.

General Electric, a pioneer in this movement, has announced that by 2014, 75% of its appliance manufacturing will occur in the U.S., up from 55% currently. The implications of this sea change in manufacturing for the adhesives industry are beyond the scope of this article, but they do support an optimistic view of the future for adhesive manufacturing.

For more information, visit www.gracematthews.com.