Current government austerity policies in the U.S. and Europe appear to be lowering GDP through reduced government spending and increased taxes. At the same time, central banks in developed countries around the world continue efforts to boost economic growth with unprecedented accommodative monetary policies.

Despite entering a fifth year of such extraordinary measures, real GDP growth in the U.S. and the EU has struggled to reach escape velocity. U.S. GDP grew 2.5% in 2012, and the consensus forecast is for less than 2% in 2013. Since the recession of 2008-09, global GDP has remained fairly stable (around 3.5%) as other emerging regions have made up for slowing growth rates in developed countries. North America and Europe have declined from making up 62% of global GDP in 2005 to 57% today.

Adhesives Implications

In 2012, adhesive and sealant use in the U.S. grew in all major sectors: packaging, transportation, construction, consumer, tape, and product assembly. The two leading sectors— transportation and construction—continue to recover from large declines in 2008 and 2009. Volume growth continues to lag total revenue as formulators have succeeded at raising prices to offset higher raw material costs.

For 2013, ChemQuest expects volume to increase slightly, around 1%, with higher volume gains in sealants due to their high use in comparison to adhesives in the transportation and construction sectors. Revenue is expected to grow in the 6% range due to price increases from formulators.

Construction

After a number of years of declining sales, new and existing home sales appear to be on a sustainable rebound. Existing home sales were 9.7% higher in 2012 than 2011 (up by 4.65 million units). New home sales were 19.9% higher in 2012 than 2011 (367,000 new homes). In addition, remodeling has also picked up with year-over-year growth rates approaching 20%.

Both new and existing home sales are expected to increase in 2013. Existing home sales are expected to increase 7.5% to over 5 million units, while new home sales are expected to be around 500,000, up 36%. Partially offsetting the robust residential market is the continued decrease in public construction projects.

Transportation

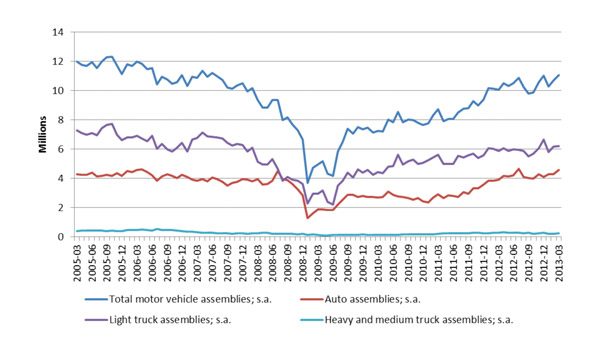

Auto and light truck sales in the U.S. were 13% higher in 2012 at 14.5 million units (up from 12.8 million in 2011) and are expected to surpass 15 million in 2013. Heavy-duty trucks and trailers continue to grow at double digit rates. Assembly of both light and heavy units in the U.S. is running about 10 million annually. Despite Boeing’s problems with its 787, aerospace demand continues to be strong, with increased reliance on structural adhesives and increased composite use.

Final Thoughts

So far, the Fed has been fairly successful at supporting asset prices without inflation. However, the Fed’s effect on unemployment has been uneven, with only a moderate increase in jobs. Job growth in tandem with household wealth is essential to the confidence needed to drive major purchases such as homes, cars, and other durable goods. In all likelihood, fiscal policymakers will need to address the long-term issues facing the economy before GDP growth will return to their pre-recessionary rates.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.