Suppliers, customers and channel players in China’s silicone sealant industry agree that the best products come from foreign brands. They also agree that customers are demanding higher and higher quality sealant products. Unfortunately for foreign suppliers, their technological advantage is diminishing as China’s domestic products continue to improve.

China’s urban landscape has changed beyond all recognition over the last few decades, with tall glass-walled office buildings sprouting up to fill the business districts of the country’s major cities. One of the many effects of this unprecedented construction boom has been the creation of a huge market for silicone sealants, which are used both to seal the gaps between the individual glass units that make up the curtain walls of newly constructed skyscrapers and to attach these glass units to the buildings’ structures.

Early in China’s development, these sealants were largely imported from abroad. However, the market today is dominated by domestic firms; recent research by China-based market research and advisory firm GCiS shows that products from foreign companies make up only 14% of the market by revenue. Interviews with suppliers, distributors and customers show that observers from all angles—including foreign suppliers themselves—expect domestic brands’ share of the market to expand further as their technology continues to improve.

This change in the market mirrors a trend seen in many disparate industries across China, as local companies become less content to sell cheap, low-end products and seek to increase their share of more profitable, high-end market segments. These goals are also supported by the Chinese government, with successive five-year plans calling for local companies to improve their product quality and market positioning in various different sectors, including sealants (although the government only plays a minor role in the sealant industry).

The Price for High Quality

The overwhelming consensus among suppliers, distributors and users of silicone sealants in China is that foreign suppliers produce high-quality sealants. In fact, suppliers unanimously report that the main advantage of foreign companies is their product quality. Dow Corning and Momentive hold a particular advantage, with one distributor describing the former as “the first choice for high-end customers.”

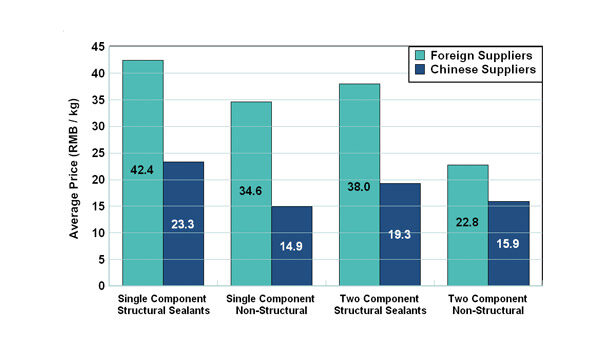

This advantage is counterbalanced by two large disadvantages, however. The largest of these is price: the leading foreign suppliers charge more than twice the price of their major Chinese competitors, with even higher price differentials for some product types (see Figure 1). This obviously has a huge effect on their sales potential; suppliers said that this “makes the scope of use very narrow” and that “most users don’t consider them,” while an interviewee at a major curtain wall engineering firm said that the prices of domestic products were “easier for customers to accept.” The second major disadvantage is that long lead times on orders of imported products also reduce the competitiveness of foreign products.

Of course, it would be a mistake to see all foreign companies as one monolithic block. Some suppliers’ prices are much closer to those of domestic suppliers. While some of these companies may be seen as providing reliable products, however, they might not have the same reputation for top product quality as the leading foreign brands—nor can they compete on price with most Chinese suppliers.

Limited Use Scope

This combination of high quality and high prices means that foreign companies’ products are more popular for some purposes than others. To quote another curtain wall engineering company, “If quality requirements are high, especially for the curtain walls of super high-rise building projects, we generally choose foreign brands—but price is also a major factor.” The company purchased most of its sealant from domestic companies.

Many of the areas where foreign brands are at their most competitive aren’t related to construction at all. Silicone is also used to make specialized industrial sealants for uses such as electronic components, automobile manufacturing and the emerging solar panel market. Many of these industrial uses need high-quality products that most Chinese brands can’t supply, making them fertile ground for foreign players.

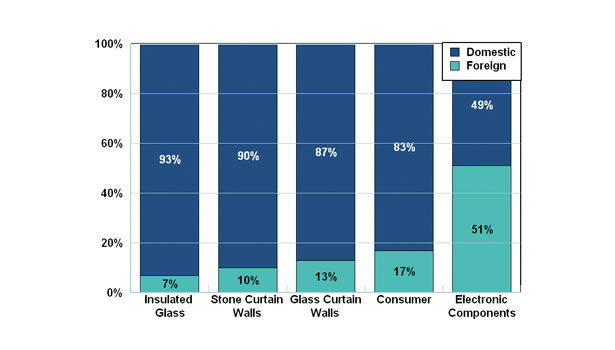

Foreign companies actually hold a slight majority of the market for silicone sealants used in electronic components, with several times the revenue share they hold in the overall market. Japanese chemical giant Shin-Etsu is particularly strong in this market segment, concentrating on sealants for electronic components while not making any silicone structural sealants for construction applications.

Chinese Suppliers

China’s silicone sealant market is deeply fragmented with over 100 suppliers, none of whom hold more than around 4% of total revenues; most control a market share of only a fraction of a percent. Overall, it is fair to say that a large proportion of local companies—especially smaller firms— are low-end suppliers.

Fierce competition means tough pressure on prices, and many domestic companies dilute the silicone oil in their products with cheaper mineral oil. This can save a substantial proportion of total costs, with one supplier crediting this method with reducing the price of a tube of sealant from around RMB 12 (approximately $1.94) to below RMB 10 (~ $1.62). Sealant that contains too much mineral oil will be of significantly lower quality, and many suppliers believe this practice to be the biggest problem facing their industry today.

However, just as foreign companies follow different strategies in the Chinese market, huge variation exists among domestic suppliers. In general, larger companies tend to have higher quality products. State-owned Guangzhou Baiyun Chemical Industry has the largest market share by revenue and is also described as the highest quality domestic supplier by customers and competitors alike.

Most customers are happy to trust the major domestic companies, with some saying they see little difference between the quality of large domestic and international suppliers. Others don’t go quite so far, but still describe the major Chinese suppliers’ products as acceptable for most purposes. In many market segments, domestic brands’ market share is even larger than the 86% they hold of the overall market—Chinese companies take over 93% of revenues from insulated glass manufacturing, for example (see Figure 2).

Pressure From Below

Unfortunately for foreign suppliers, being acceptable for most purposes is not enough for their Chinese competitors. They see their current positioning as a problem, and major suppliers are investing in both product development and building a stronger brand to combat this. According to one such company, their current strategy is to “unceasingly invest in research to upgrade our technology,” while another mentioned their increasing focus on high-end products.

All market players predict a continuing increase in domestic companies’ product quality and market share. One foreign company said that “with the improving technology of Chinese suppliers, foreign companies’ advantages are becoming less obvious,” while a local company said that “domestic product quality and technology are continually improving.”

Although foreign companies currently hold an advantage in the market for industrial silicone sealants, this segment is also under threat. Several major domestic suppliers are seeing rapid growth in this area, and some are focusing their research efforts on this market, which tends to be less price sensitive than the construction sector.

A Rising Market

Growth in China’s silicone sealant market is currently strong, with the overall market expected to grow at around 10% over the next few years. Most of this growth is driven by the construction sector, as a large majority of silicone sealants are either used directly in construction or in other applications that depend on it. It is particularly influenced by commercial construction, which has been less affected by the slowdown in China’s real estate market compared to residential construction. In 2012, the total floor area of newly started office building construction rose by 12%, and that of shopping centers was up 6% compared to the equivalent figures from 2011.

Demand for quality is also rising, meaning that the market for the high-quality products sold by foreign companies is also increasing. Despite having lower growth rates than their major Chinese competitors, all the major foreign companies in this market are still seeing rising sales.

Foreign companies have also taken steps to deal with the increasing competitiveness of local suppliers in the high end. Several have increased their domestic production capacity in recent years and, in most cases, imports only account for a minority of their total sales, allowing them to reduce both costs and delivery times. The success of these steps will be critical if they are to defend their market share in the face of increasingly strong domestic Chinese competitors.