2013 can only be characterized as the first year in the recent past where all was quiet on the front lines of the adhesives and sealants industry—especially as compared to the significant volatility the industry has been experiencing since the beginning of the 2008 recession. Recovery in the U.S. continues on solid footing, with the construction sector finally showing solid signs of growth.

Construction Sector Outlook

In 2006, when the boom peaked, 7.7 million people worked in the construction sector. By 2011, the figure had bottomed at about 5.4 million. As of August 2013, nearly 5.8 million people were employed in construction.

For now, the industry is building faster than it is hiring. In February, builders began work on single-family homes at the fastest pace in five years. In March, new home construction broke the one-million mark for the first time since June 2008. Permits for future construction are also near a five-year high.

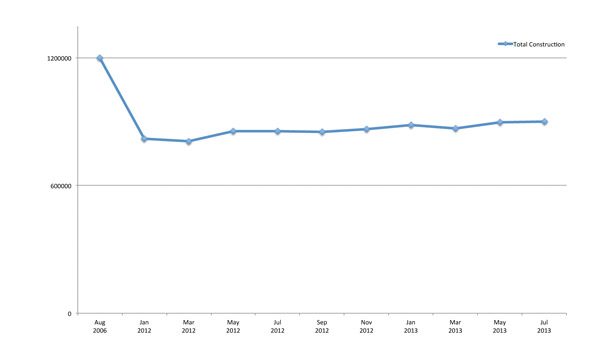

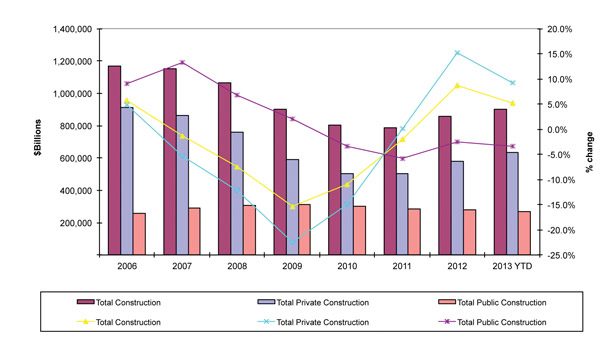

Construction spending is at post-recession highs, but it is still depressed overall. Total construction spending in 2012 increased 9.8% vs. 2011, and the trend continues in 2013. Spending rose to a seasonally adjusted annual rate of $901 billion in July from $896 billion in June. Spending is up 5.2% but is still 25% off its peak of $1.2 trillion in August 2006.

Private construction rose 0.9% month-over-month, while public construction spending fell 0.3%. Public construction has been falling over the past year and is down 3.7%. Year-over-year, private construction is up 9.5%. Residential construction rose 0.5% month-over-month and is up 16.8% year-over-year. Non-residential construction is up 2.8% year-over-year.

U.S. Box Shipments

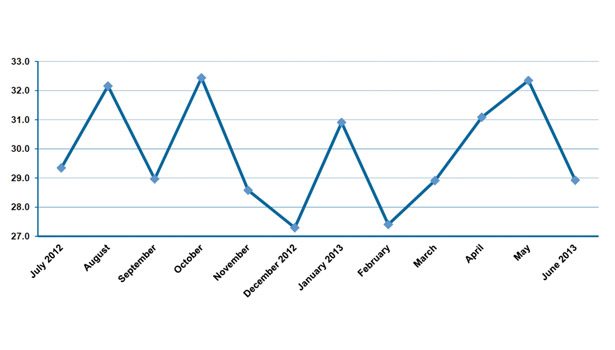

U.S. box shipments are a good economic indicator—not only for the packaging industry, but also for the greater U.S. economy. For the first half of this year, U.S. box shipments remained relatively muted and in line with 2012. Total shipments increased just 0.2% for 2012, down from the 0.5% growth recorded in 2011.

The stagnation in box shipments during the last two years reflects the minimal growth in industrial production of nondurable goods, which are the key driver for corrugated demand. Nondurable goods production only increased 1.7% for the year in 2011 and 0.9% in 2012. The remainder of 2013 is expected to remain relatively flat, since it appears more likely that 2013 will be a repeat of the last two years.

Motor Vehicles

The motor vehicle industry offers another positive force for the adhesives and sealants industry in 2013. Through July, motor vehicle production was 4.8% higher vs. 2012, with automotive assembly reflecting a 6.1% rise. Medium and heavy trucks retracted 11.1%.

Overall Industrial Production

U.S. industrial production through July 2013 was 1.4% higher over the same time period in 2012. While this points to a manufacturing momentum gain, it is somewhat lackluster. Industrial production is a key driver for adhesive and sealant OEM applications for component assemblies.

A closer look at some of the key sectors that drive the adhesives and sealants industry demand reflects sound growth prospects typically ranging from 2-7% year-over-year. Auto, light truck, construction machinery and appliances led the major gains, while furniture retracted by nearly 1%.

In 2012, the adhesives and sealants industry reached $16.2 billion, a 1.9% volume increase corresponding to a 7.4% increase in value vs. 2011. A 2-3% increase in volume and a 6-8% value increase are expected for 2013.

Margin outlook for 2013 is “good.” The cost structure for U.S. adhesive companies is more favorable in 2013 relative to 2012, with major raw materials experiencing relatively stable supply outlook. In fact, raw material costs have been on a downward cycle due to slowing demand from recessions in Europe, as well as slowed growth in China and Brazil.

Long-term, major trends are favorably aligned to help further penetration against other fastening methods, including mechanical fastening:

Sustainability

Adhesives and sealants are enabling technologies that drive innovation to influence several aspects of sustainable solutions. For example, adhesives and sealants:

• Offer raw material alternatives based on renewable sources

• Help optimize manufacturing processes to achieve reduced energy, greenhouse gases, water and waste

• Provide the opportunity to reduce distribution channel costs due to reduced mileage and maximized weight efficiencies

• Enable end uses that make efficient use of resources, overall carbon footprint and worker safety

• Reduce waste, enabling recycling, composting and re-use

Aging Population

Aging (with increasing life expectancy) bodes well for the industry where an increasing use of minimally invasive procedures, medical devices, electronics and joint implants capitalizes on adhesive and sealant innovations.

Fuel Efficiency

Lightweighting, down-gauging and downsizing using various dissimilar materials—including composites, plastics, and lightweight metal alloys—provide significant opportunities, as adhesives are among the most cost-efficient methods to effectively fasten such complex dissimilar structures.

Electronic Explosion

The proliferation of electronic devices, including smartphones, tablets, computers, monitoring devices, etc., has made these devices staples of everyday life. Adhesives and sealants are great enablers of electronic assemblies, allowing for pristine aesthetics, thermal management, and optical clarity.

Civil Infrastructure Repair

Using adhesives and sealants as a structural repair material for concrete is more cost effective, and project cycle time is shorter (highways and bridges can be reopened faster as repair time is condensed).

High Hopes

In conclusion, U.S. manufacturers are hopeful for the recovery in the U.S., yet they continue to be challenged with dimmer prospects globally. The industry’s balance sheet is significantly improved, leading to much better prospects for investment in continued innovation and fueling the prospects for a return to heated mergers and acquisitions in 2014. Finally, macro and micro trends offer continued enthusiasm for the long-term health and viability of the entire industry.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.