With the advent of shale gas, the U.S. petrochemical industry has witnessed a significant shift in feedstock from naphtha to natural gas (ethane). The shift is greatly supported by higher margins, higher yield of ethylene and lower cost of production enjoyed by the ethane-based ethylene producers, as compared to the naphtha-based producers.

As a result, a significant drop in the yield of other byproducts is evident in the case of ethane cracking, which is now becoming a major concern for adhesives producers and buyers since most of the raw materials are petroleum based. This leads to industry-wide supply uncertainty across the globe, because the majority of industrial chemicals are byproducts of naphtha cracking.

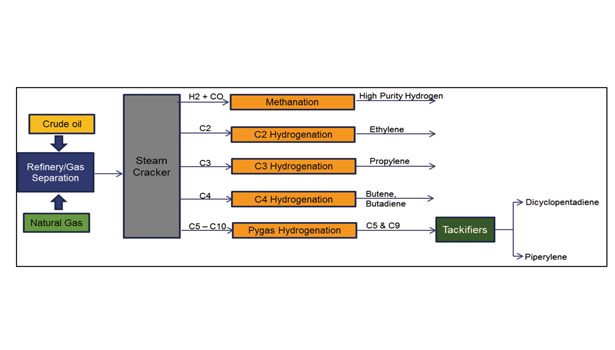

The raw materials for hygiene adhesives could be classified into two subsets: base polymers and tackifiers. Tackifiers can be further sub-divided into petroleum-based/hydrocarbon tackifiers and bio-based tackifiers. The worldwide adoption rate for each type of tackifier depends on factors such as product availability and quality standards.

Recent trends reveal that adhesive buyers have had constraints in sourcing petroleum-based tackifiers due to the advent of shale gas. In 2012, North America accounted for about 30% of global production of petroleum-based tackifier resins. This share is expected to further reduce by 2015 as a result of the increasing shift toward lighter feed cracking. To understand the impact of shale gas on tackifiers in the U.S., it is essential to have knowledge about its sub-categories and value chain.

Hydrocarbon Tackifier Resins

Hydrocarbon resins are made from petroleum-based feedstock such as aliphatic (C5), aromatic (C9), DCPD (dicyclopentadiene), or mixtures of these. There are three basic categories of hydrocarbon tackifier resin, some with several sub-categories including C5/C9 aliphatic/aromatic resins, C5 aliphatic resins, C9 aromatic resins, and hydrogenated C9 aromatic resins.

Pyrolysis gasoline (pygas) obtained from cracking naphtha or ethane is a rich source of C5 hydrocarbons (see Figure 1). Pygas obtained from naphtha contains around 28% of pygas, whereas one obtained from ethane contains only 2% of pygas. The major C5 components that are currently extracted include isoprene, dicyclopentadiene (DCPD) and piperylene.

DCPD can be produced in different purities via multiple production routes that are available for optimizing the kind of purity required for DCPD, while piperylene can also be extracted in different concentrates, depending on the extraction process adopted. Cracking lighter feedstocks reduces the overall pygas yield, resulting in decreased yield of isoprene from the cracker. The yields of DCPD and piperylene are similarly impacted by both feedstock type and cracker operating severity.

Raw Materials Impact

The use of lighter crack feeds like ethane is detrimental for pygas, one of the sources for benzene and crude C4s, which form the basic raw materials for styrene and butadiene. Yield of pygas and crude C4s decreases by around 92% and 57%, respectively, in the case of ethane cracking compared to naphtha.

Piperylene concentrate is obtained from isoprene, which is further processed to use as tackifiers in adhesives. To understand the impact of shale gas on piperylene, it is important to derive the impact of shale gas on isoprene.

Isoprene

Isoprene forms the base feedstock for styrene-isoprene-styrene (SIS) that is used as a base polymer in manufacturing hygiene adhesives. It constitutes approximately 45-50% by weight in SIS composition for adhesive application. Isoprene also forms the base for piperylene concentrate.

Russia dominates the global market in terms of isoprene capacity, production and consumption. The three major producers of isoprene in Russia include Nizhnekamskneftekhim, Synthez-Kauchuk and Togliattikauchuk. Nizhnekamskneftekhim is the largest isoprene producer in the world, with annual capacity of around 176,000 metric tons.

Goodyear (U.S.) is the next-largest world producer of isoprene. North America accounts for almost 19% of the global isoprene consumption, followed by China and Japan, which together consume around 16% of global isoprene production.

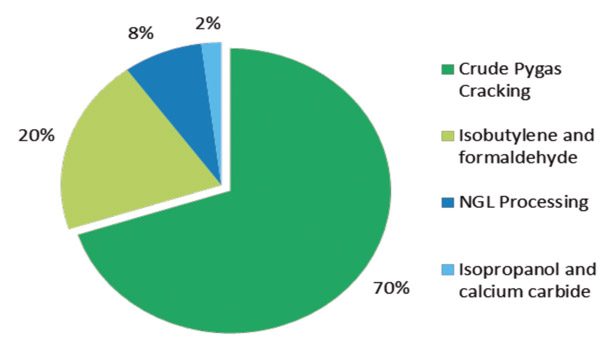

The end-use industry is highly concerned about the expected isoprene shortage in the tire/rubber industry, since isoprene forms a major constituent in tire manufacturing. As a result, top tire manufacturers are focusing on other routes of isoprene production that are either on-purpose routes or bio-based routes independent of petroleum as the basic source. On-purpose routes, such as the new one-stage process licensed by EuroChim and Kuraray, are expected to be of critical importance to balance the isoprene demand in the U.S. market (including the hygiene industry). Figure 2 details isoprene production by source.

The styrene block copolymer (SBC) segment is the next largest consumer of isoprene, out of which SIS producers take up the largest share. As previously mentioned, SIS is predominantly used in the adhesive industry as a base polymer, but styrene-butadiene-styrene (SBS) is proven to be a better base polymer in comparison, and the shift toward SBS is being observed in the US. However, developing economies like Asia, Turkey and Iran are exhibiting greater demand for SIS in the adhesives segment. The SIS market is less volatile than SBS, but the shale gas impact would affect both of these block polymers.

Pygas forms the major source of isoprene production. The U.S. contributes around 20% of the global isoprene capacity. With the shift toward lighter feedstock (e.g., ethane), pygas yield is expected to reduce significantly resulting in a shortage of isoprene supply by 2017 in the U.S. market, which is a net exporter of isoprene currently.

However, sufficient capacity is available across the globe to meet the growing demand, making the U.S. a net importer in the coming years. New capacities are coming up in the market that are of a bio-based route. Goodyear and DuPont have agreed to set up a technology by 2014 that will produce a sufficient amount of isoprene.

Dicyclopentadiene (DCPD)

About 33% of the global DCPD production goes into the production of hydrocarbon resins. The key end-use sectors impacting DCPD demand include the tire and automotive industries, as well as the adhesives and construction sector. It is estimated that the supply of DCPD in China will be larger than the demand in the next few years. Ninety-three percent of DCPD now is used to produce unsaturated polyester. The production of DCPD hydrogenated petroleum resins with high added value will be the focus for the development and use of DCPD in China.

Recommended Plan of Action

The adhesive industry is left with limited options in terms of material availability owing to its smaller size relative to other industries. Hence, a shift toward bio-based tackifier resins (e.g., rosin resins such as gum rosin) seems to be a viable option for the adhesive industry.

Rosin Resins

Rosin resins, which are produced from turpentine and pine trees, impart excellent aggressive adhesion to almost all polymer types, including natural rubber, EVA, SBR, SIS, SBS and acrylics. Hydrogenated rosin resins have improved thermal stability and lighter color due to the hydrogenation of the rosin acid raw material. If the base elastomer being used is low in polarity, such as low vinyl acetate content EVA, polyethylene, or amorphous polyolefin, a hydrogenated rosin ester will be more compatible.

Gum Rosin Market

Gum rosin production is dominated by China, which accounts for about 70% of global production. Gum rosin production is expected to increase at 3.5% annually, driven by availability of labor in the future. Industry experts believe that gum rosin-based resins could be a viable substitute to hydrocarbon resin in the case of a shortage in the latter’s market.

Certain industry myths say gum rosin-based tackifiers are ineffective due to the odor they produce in diapers; however, studies have proven that the odor does not impact the overall quality of the diaper in the hygiene industry. Buyers remain unaware this fact and continue to purchase the hydrogenated form of tackifier resins that produce odorless diapers. With regard to supply, price and stability, the hydrogenated gum rosin seems to be the next best option after white water tackifiers.

Price Comparisons

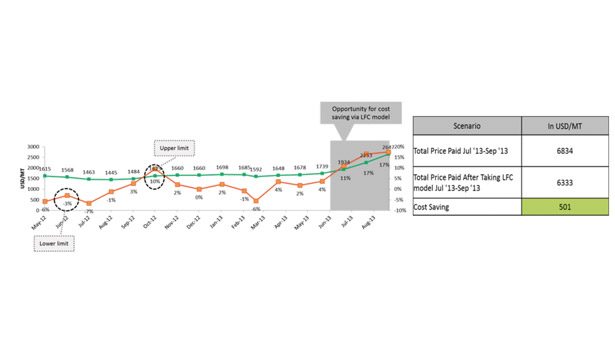

Gum rosin prices have maintained a lower limit on a relative scale with hydrocarbon resin prices throughout the period of comparison from 2012-2013, as depicted in Figure 3. Even though the volatility in the gum rosin prices could continue in the coming months, its prices are not expected to reach the hydrocarbon resin prices due to low production cost. Moreover, volatility in the hydrocarbon resin market is expected to increase in the future as a result of the shale gas impact, whereas volatility in the gum rosin market would not be that significant.

However, not everything is stable within the gum rosin market. Industry professionals are aware that gum rosin prices shot up after production issues sprouting from labor constraints, as well as the replacement of pine trees by eucalyptus trees. Gum rosin production declined by 25% in 2012 due to reduced demand, which resulted in a 35% drop in gum rosin prices. As a result of low demand coupled with low prices in 2012, producers reduced the amount of crude gum tapped, which drastically decreased production.

With the global economy’s anticipated revival, demand for adhesives and printing inks is expected to grow at 4-5% and 3-3.5% per year, respectively, until 2015. This growth is likely to increase the demand for gum rosin. Supply, on the other hand, is expected to move hand-in-hand with the demand given the improvement in China’s labor issues.

Even though this market has experienced supply constraints in the past, the near future is expected to be an attractive one for adhesive customers on a relative scale with hydrocarbon resin market dynamics. The prices of gum rosin have never been dearer compared to hydrocarbon resin prices. Moreover, given the bio-based nature of the gum rosin tackifier, maintaining a long-term relationship with the gum rosin producers will provide an added edge to the adhesive/diaper producers in the hygiene market.

Minimizing Supply Risk

Despite the prevailing raw material market fluctuations in the gum rosin industry, adhesive customers can opt for procurement strategies that will enable them to absorb the dire consequences of feedstock volatility in terms of supply and prices. These strategies will enable the buyer and supplier to enter into a strategic alliance that will be beneficial for both in the long run.

Forward contracts are over-the-counter contracts between the buyer and the supplier where the volume, price, and time of purchase is pre-decided and agreed upon. In this type of contract, the adhesive manufacturer should have profound understanding of the tackifier market. Based on this market understanding, the buyer expects that the prices of tackifiers would either increase or decrease in the near future. Upon negotiating with the supplier, the buyer fixes the purchase price and volume by entering into the forward-type contract with the supplier.

A forward contract requires a buyer to have up-to-date information about the market dynamics of the commodity. In this case, gum rosin prices were observed to rise by almost 10% in October 2012, which gives a warning of a price increase in the coming months. Upon further understanding of the supply market and demand dynamics during this period and the coming months, a buyer might realize that the pine tree extraction is on a decreasing trend due to a shift toward eucalyptus trees alongside labor issues in China, the major producing region. A closer watch on the raw material (pine oleoresin) supply availability gives an outlook of how the prices of gum rosin could change.

In order to leverage this understanding, a buyer could opt for a forward contract for the third quarter of 2013 in June, when prices alarmingly rose to $1,739/MT (see Figure 4). If the buyer is able to negotiate with the supplier and agrees upon the terms of a fixed price point derived by considering the average of historical prices to pay for a fixed volume and time period each month, a cost saving of approximately $500 could be achieved, given the volatility in the real time market in the coming months.

Limited fluctuation contracts (LFC) contain clauses wherein if the price of the base commodity (e.g., gum rosin or hydrocarbon resin) changes drastically upward or downward, negotiations are initiated so that both parties benefit, as shown in Figure 5. In this contract, a ceiling and a base price is fixed after considering the market scenario. If the price of the commodity goes beyond the ceiling price or below the base price, the buyer ends up paying the ceiling price (in the former case) or the base price (in the latter scenario). In other scenarios, where the prices lie between the ceiling and the base prices, the buyer pays the market price of the commodity.

In Figure 5’s scenario, after considering the price fluctuations in the gum rosin prices, if the buyer and seller enter a LFC and fix the upper limit and the lower limit for the price movement to 10% and 3%, respectively, savings of around $500 could be realized during the third quarter of 2013 (see Figure 6). Operating under LFC is considered to be relatively safer than entering into a forward contract. With an LFC, risk is hedged for both the buyer and supplier by placing a cap on both the price rise and fall.

Conclusion

The markets for hydrocarbon resins will see supply and price issues in the future. There is no black and white way of tackling this problem. Buyers may shift toward the less-risky option of gum rosin, which is less expensive than hydrocarbon resins. This market also experiences other issues, such as labor shortage, which cannot be ruled out.

The long-term plan for overcoming such shortcomings is to have an understanding of the raw material market, industry happenings, and pricing trends. Such an understanding will ultimately assist the buyer in entering into an optimum sourcing contract where the supply as well as prices could be hedged. The two procurement models, forward contract and limited fluctuation contract, give an actionable plan to strategize effective sourcing. Implementing the plan that is best-suited for a particular business could lead to effective shielding of buyers from supply shortages and unprecedented price hikes.

In addition, the purchase volume allotted for each type of tackifier, either hydrocarbon or rosin-based, could be in a suitable ratio predefined by the procurement manager in collaboration with the technical support team in order to have a smooth transition from petroleum-based to bio-based tackifier resin for hygiene adhesives. Industry experts believe that significant technology shifts will not be necessary for the transition for a hygiene adhesive producer. Moreover, given the uncertainty and volatility existing in both these markets, it is advisable to opt for both these sources of tackifiers and not completely depend on one.

For more information, visit www.beroe-inc.com.