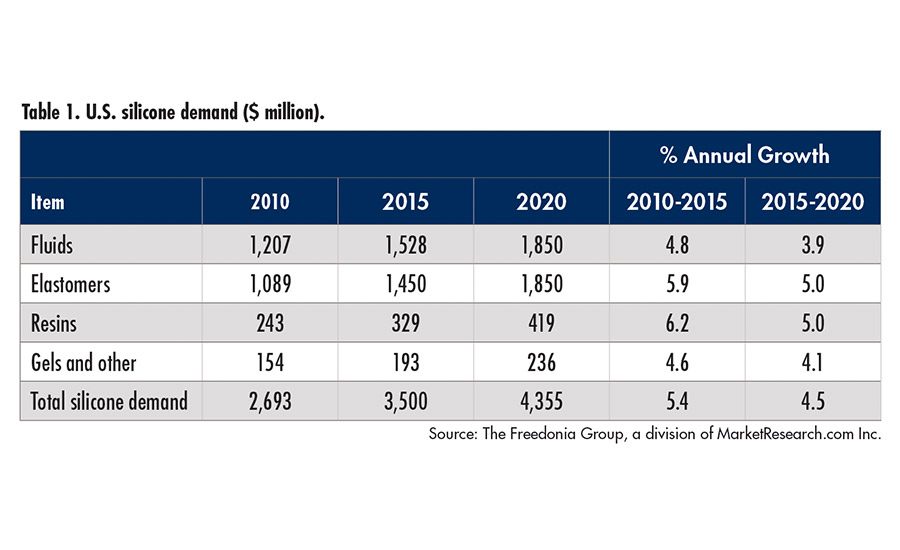

U.S. demand for silicones is forecast to climb 4.5% annually to $4.4 billion in 2020, with volume rising 2.6% per year to 908 million lbs (see Table 1). This will be a moderation in gains from the performance of the 2010-2015 period, which saw exceptional growth as a result of a broad economic recovery from the recession of 2007-2009. These and other trends are presented in “Silicones,” a recent study from The Freedonia Group.

Elastomers and fluids are the two leading silicone product types, together accounting for more than 85% of total market value in 2015. Advances for elastomers going forward will be propelled by fast-growing and expanding opportunities in the medical field, as well as continued strong and widespread use in the construction sector.

“Silicone resins will also achieve healthy gains in the construction industry, where the resins are primarily employed in paints and coatings,” said Larry Catsonis, analyst. Opportunities for silicone gels will stem from their use as protective encapsulants in high growth applications such as solar cells and light emitting diodes (LEDs). Moreover, silicone gels are widely used as the basis for breast and other implant products and will continue to gain share at the expense of their saline-filled counterparts.

The industrial market is the leading outlet for silicones, due largely to the growing quantities of silicone used in motor vehicles. While growth in the motor vehicle market will decelerate substantially, silicones will continue to find opportunities as manufacturers use them in higher quantities per vehicle to improve vehicle safety and fuel efficiency, as well as to meet consumer preferences for quieter cabins.

Among other outlets, the medical market is forecast to achieve the most rapid gains through 2020, expanding at a pace even faster than that of the 2010-2015 period. Growth will be driven by the superior heat resistance and chemical stability of silicones over competitive materials, as well as by the ongoing development of new products that will expand the range of medical applications for silicones. The construction market is also forecast to achieve rapid gains, outpacing those of the 2010-2015 period, as the turnaround in building construction activity continues and silicones find greater use in high-performance adhesives, sealants, and coatings. ASI

For more information, visit www.freedoniagroup.com.