Our annual ASI Top 20 details the leading worldwide manufacturers of adhesives and sealants. We targeted sales figures (and other details) for finished adhesives and sealants, as well as related products such as tapes, to develop the ranking.

To those companies that responded to our requests and provided these details, please accept our thanks. We understand that it involves a degree of effort, as well as trust in some cases, to compile and send this information, and we truly appreciate all that you’ve done. Your cooperation will help us continue to improve the quality of the list, ensuring its ongoing use as a global resource on and for the adhesives and sealants industry.

In addition to information supplied by company contacts, we gathered details from annual reports, company websites, press releases, and other sources. In cases where organizations did not respond to our requests or declined to provide adhesives/sealants-focused information, and reasonable estimates could not be made based on publicly available information, some companies did unfortunately have to be left out.

If you would like your company to be considered for the 2021 ASI Top 20, or if you have any questions or suggestions for future rankings, please contact Susan Sutton, editor-in-chief, at (248) 786-1704 or suttons@bnpmedia.com.

Note to reader: Click on a listing to learn more about the company

View All of the 2020 ASI Top 20

Düsseldorf, Germany

CEO: Carsten Knobel

Adhesive Technologies Board Member: Jan-Dirk Auris

Henkel operates with three main business units: Adhesive Technologies, representing 47% of the company’s €20.1 billion (approximately $22.7 billion) in total 2019 sales; Laundry & Home Care, 33%; and Beauty Care, 19%. The company employs over 52,000 people worldwide.

In the Adhesive Technologies segment, sales in 2019 were essentially flat compared to the prior year, reaching almost €9.5 billion (~ $10.6 billion). Within this segment, the Industrial business saw mixed results for the year; Packaging and Consumer Goods Adhesives sales were overall flat, while the Transport and Metal, General Industry, and Electronics business areas all declined to various degrees. Sales for the second Adhesive Technologies’ segment—Adhesives for Consumers, Craftsmen and Building—grew in 2019.

Henkel Adhesive Technologies operated 138 production sites in 2019, down from 141 in 2018. Henkel’s total R&D spend in 2019 was €499 million (~ $563.4 million), with Adhesive Technologies representing 57% of that figure, or about €284.4 million (~ $321.1 million).

The company began to see the effects of the COVID-19 pandemic in early 2020. “In the first quarter 2020, the Adhesive Technologies business unit was impacted primarily by significantly declining demand from the automotive industry,” said a company source. “Sales decreased nominally by -4.3% from 2,309 million euros [~ $2.6 billion] in the prior-year quarter to 2,209 million euros [~ $2.5 billion]. Organically (i.e. adjusted for foreign exchange and acquisitions/divestments), sales decreased by -4.1% driven by volume. Performance in the first quarter was marked by a significant decrease in industrial production in the wake of the COVID-19 pandemic.”

In February 2020, Henkel Adhesives Technologies officially inaugurated its new production facility in Kurkumbh, India, near Pune. With a total investment of about €50 million (~ $54.7 million), the business unit will serve the growing demand of Indian industries for high-performance solutions in adhesives, sealants, and surface treatment products.

The facility admeasures 100,000 sq m and has a built-up area of 51,000 sq m, which reportedly makes it India’s largest adhesive manufacturing site. Henkel expects that the facility will further increase Adhesive Technologies’ capabilities to serve customers across various markets, including flexible packaging, automotive, agriculture and construction equipment, general industry, and metals.

Henkel is among 155 major global companies from 34 sectors that have signed a statement urging governments around the world to align their COVID-19 economic aid and recovery efforts with the latest climate science. The companies, which are all part of the Science Based Targets initiative (SBTi), are calling for policies that will build resilience against future shocks by supporting efforts to hold global temperature rise to within 1.5°C (34.7°F) above pre-industrial levels, in line with reaching net-zero emissions well before 2050.

“Now, we need to invest in innovation, scale up the solutions we already have and work with our partners along the value chain towards climate-neutrality,” said Carsten Knobel, Henkel CEO. “To achieve that, we have set ourselves ambitious, science-based targets.”

The 155 companies have already set (or committed to set) science-based emissions reduction; Henkel’s targets were recently approved by the SBTi. By signing the statement, the companies are reaffirming that their own decisions and actions remain grounded in science, while calling on governments to “prioritize a faster and fairer transition from a grey to a green economy.”

“Governments have a critical role to play by aligning policies and recovery plans with the latest climate science, but they cannot drive a systemic socio-economic transformation alone,” said Lila Karbassi, chief of Programmes at the UN Global Compact and an SBTi board member. “To address the interconnected crises we face, we must work together as an international community to deliver on the Sustainable Development Goals and the Paris Agreement. As the largest ever UN-backed CEO-led climate advocacy effort, these companies are leading the way in driving ambitious science-based action and advocacy to help reduce vulnerability to future shocks and disasters.”

Sources: company contact, annual report, press releases

St. Paul, Minn.

CEO: Mike Roman

3M’s 2019 total sales topped $32.1 billion, essentially flat compared to 2018. The company manufactures adhesives, sealants, tapes, films, and other products in all of its business segments. Industrial products within the Safety and Industrial Business segment include tapes, adhesives, and sealants, while pressure-sensitive tapes and resins serve electrical markets. In the Transportation and Electronics Business segment, 3M’s transportation-related products include films, adhesives, sealants, and various tapes, while electronics solutions include films and tapes. Medical tapes provide solutions in the Health Care Business, and the Consumer Business provides various tapes, glues, and adhesives.

In January 2020, 3M announced a new global operating model and streamlined organizational structure. As a result of these actions, the company initiated a restructuring that will reduce approximately 1,500 positions, spanning all business groups, functions, and geographies. In the new model, 3M’s business groups have full responsibility for all facets of strategy, portfolio optimization, and resource prioritization across their entire global operations.

3M reported total sales of $8.1 billion in the 2020 first quarter, a 2.7% increase compared to the first quarter of 2019. Total sales grew 21% in Health Care and 4.6% in Consumer, with declines of 1% in Safety and Industrial and 5% in Transportation and Electronics.

“In this unprecedented time, I could not be more proud of how our 96,000 people have stepped up to help fight COVID-19, and I thank all 3Mers for their incredible efforts,” said Mike Roman, chairman and CEO. “We are attacking the pandemic from all angles, which includes mobilizing all of our resources and rapidly increasing output of critical supplies to healthcare workers and first responders.

“Given the breadth and diversity of our businesses, the financial impact of COVID-19 is varying across 3M. In the first quarter we saw strong growth in personal safety, as well as in other areas of our portfolio experiencing high demand due to the pandemic. At the same time, we experienced weak demand in several end markets that were more severely impacted by actions taken around the world to slow the pandemic. Looking ahead, 3M is taking action that will help us navigate near-term uncertainty, generate strong cash flow, and lead out of the slowdown by delivering for employees, customers and shareholders.”

The Ethisphere Institute recently recognized 3M for ethics and integrity in business conduct and compliance for the seventh straight year. Recognizing that corporate integrity, character, and transparency impact the public trust of companies, the Ethisphere Institute defines and advances standards of ethical business practices through data-driven insights.

“For more than a century, we have built a foundation of trust and unwavering integrity in all that we do,” said Michael Duran, 3M vice president and chief ethics and compliance officer. “Our success as a company depends on all of us to make the right decisions every day. This recognition is a collective effort by our 96,000 employees around the world. Our ethics and values are what make 3M a great place to work.”

Sources: annual report, company website, press releases

Glendale, Calif.

President, CEO, and Chairman of the Board: Mitch Butier

Avery Dennison employs approximately 30,000 people in more than 50 countries around the world. Total R&D spending dropped 5.7% in 2019 to $92.6 million. (The company declined to provide specific adhesives/sealants-related sales and other details.)

Avery Dennison’s total net sales dipped slightly (1.2%) in 2019 compared to the prior year, to almost $7.1 billion. Label and Graphic Materials, the largest business segment at 66.2% of total sales in 2019, achieved $4.7 billion in sales for the year (essentially flat compared to 2018). Retail Branding and Information Solutions (23.9% of total sales) saw a slight increase for the year, to almost $1.7 billion, while Industrial and Healthcare Materials (9.5% of total sales) declined to $673.9 million from $694.7 million in 2018.

Net sales for Avery Dennison in the 2020 first quarter were essentially flat at about $1.7 billion. “The coronavirus is having a substantial impact on our teams, our markets and customers, our communities, and, of course, our shareholders,” said Mitch Butier, chairman, president and CEO. “The situation has been evolving in unpredictable ways, and the team is doing a tremendous job adapting to the new reality, anticipating and planning for various scenarios…

“While earnings exceeded our expectations in the first quarter, the early stages of this downturn are playing out differently than past recessions. Label and Packaging Materials, our largest business, serves essential categories that are experiencing higher demand during the pandemic. In contrast, RBIS, which primarily serves apparel markets, is seeing a significant decline in demand, reflecting widespread retail store and apparel manufacturing closures.

“As a result, we anticipate a decline in organic growth and earnings for the year, as strong volume in essential label categories is more than offset by declines in categories serving apparel and industrial end markets. We are actively managing this dynamic environment, updating our scenario plans to reflect the unique nature of this global health crisis.”

“The savings from this program have been significant, but the biggest benefit for L’Oréal Australia is being able to meet our zero waste to landfill through the services and expertise of Wasteflex and Avery Dennison,” said David O’Leary, national logistics manager for L’Oréal Australia.

This past April, Avery Dennison officially opened its first intelligent label innovation space in the Asia-Pacific and Sub Saharan Africa region. The new Avery Dennison I.Lab™, located in Pune, India, is an interactive facility that provides customers and partners with hands-on experiences, live demonstrations, and technical support to help converters and partners explore the opportunities surrounding intelligent label solutions and RFID adoption.

“We are thrilled to be the third global I.Lab™ in India,” said Pankaj Bhardwaj, senior director and general manager of Avery Dennison, South Asia. “Through I.Lab, we are well-positioned to advance the creation, delivery and adoption of intelligent label solutions for businesses in various industries.”

Modeled after the first concept lab in Oegstgeest, Netherlands, this new facility will reportedly demonstrate how Avery Dennison’s intelligent labeling solutions can bring items to digital life. By connecting the physical and digital world through item-level digital identities, businesses can benefit from improved inventory management and increased efficiencies throughout the supply chain.

Sources: annual report, company website, press releases

St. Paul, Minn.

CEO: Jim Owens

Effective December 1, 2019, H.B. Fuller completed the realignment of its business from five to three operating segments. According to the company, aligning resources around the three new global business units—Engineering Adhesives; Hygiene, Health and Consumable Adhesives (HHC); and Construction Adhesives—better positions it to quickly identify trends and utilize its adhesives portfolio to deliver new solutions targeted to evolving trends. In addition, the new organizational structure enabled a simplification of business processes, leading to reduced costs.

Net revenue for H.B. Fuller’s 2019 fiscal year (ended November 30, 2019) was almost $2.9 billion, a decrease of 4.7% compared with fiscal 2018, primarily due to the negative impact of foreign currency exchange rates. For its second fiscal quarter this year (ended May 30, 2020), the company saw net revenue decline 11% compared to the 2019 quarter, to $675 million. H.B. Fuller reported strong operational performance for the 2020 quarter, with net income of $32 million, driven by solid organic sales results, benefits from restructuring efficiencies, and lower raw material costs.

Organic revenue for the HHC segment in the second 2020 fiscal quarter increased 7% year over year, with double-digit growth in hygiene, packaging, and health and beauty. Engineering Adhesives and Construction Adhesives organic revenue declined 20% and 15% vs. last year, respectively, in line with the company’s planning assumptions for expected impacts related to the COVID-19 pandemic.

“The economic environment in 2020 will be dominated by effects of the COVID-19 global pandemic,” said a company source. “It is difficult to forecast sales based on these unprecedented circumstances, although it is reasonable to expect global demand in many end markets will decline compared to 2019 due to impact from community lockdowns to fight the pandemic and the expectations for related recessionary economic forces, and this will affect H.B. Fuller total company sales.

“The diversity of H.B. Fuller’s products and customer set are expected to partly mitigate the effects of the coronavirus on our business, and historically have supported resiliency in margins and cash flow during economic downturns. For example, while automotive and construction markets have been suppressed, we have seen an increase in demand for our paper, tissue and towel, packaging and hygiene products.”

H.B. Fuller recently announced the opening of a new business office in Johannesburg, South Africa, as well as a network spanning three warehouses across the country, to support its growth plans in the region. The new H.B. Fuller entity will offer customers local adhesive expertise and a globally connected team with industry knowledge spanning the 28 market segments served by the company.

Sources: company contact, annual report, press releases

Colombes, France

Chairman and CEO: Thierry Le Hénaff

Earlier this year, Arkema announced that it had realigned around four main businesses: Adhesive Solutions, Advanced Materials, Coating Solutions, and Intermediates. Bostik SA, which was included in Arkema’s High Performance Materials segment prior to the reorganization, employs 5,000 people and produces industrial, construction, and consumer adhesives and sealants in 50 countries worldwide.

The new Adhesive Solutions segment achieved sales of almost €2.1 billion (~ $2.3 billion) in 2019, representing 24% of Arkema’s total sales of €8.7 billion (~ $9.8 billion) for the year. Sales in the first quarter of 2020 were essentially flat for the segment, at €515 million (~ $581.9 million). Adhesive Solutions saw increased demand from the packaging sector during the quarter, and the construction industry was strong in both the U.S. and Southeast Asia. Volumes for the quarter decreased 3.2% overall, however, due to reduced demand from the transportation sector and other industries, as well as construction lockdowns in Western Europe at the beginning of the pandemic.

Arkema reports that it intends to continue playing an active part in the consolidation of the adhesives market. In October, Bostik completed its acquisition of Prochimir, a company specializing in high-performance thermobonding adhesive films. Prochimir operates two production facilities, one in Vendée, France, and another in Virginia. The company employs 85 people and reported sales of €30 million (~ $33 million at the time of the initial announcement in July 2019). Prochimir’s solutions are sold around the world; exports account for 75% of sales.

Bostik acquired LIP Bygningsartikler AS, a Danish manufacturer of tile adhesives, waterproofing systems, and floor preparation solutions, in January 2020. With strong geographic and commercial synergies, Arkema expects that the acquisition will enable Bostik to offer customers an extended range of high-value-added solutions while boosting its presence in Nordic countries. LIP employs around 50 people and reported sales of €30 million (~ $33 million).

Sources: company contact, annual report, press releases

Evansville, Ind.

Chairman and CEO: Tom Salmon

Berry Global’s total net sales in its fiscal 2019 (ended September 28, 2019) were about $8.9 billion, a 13% increase compared to the prior fiscal year. The company operates in four business segments: Consumer Packaging-International (36% of fiscal 2019 revenue); Consumer Packaging-North America (24%); Health, Hygiene & Specialties (20%); and Engineered Materials (20%).

Among many other products, the Engineered Materials segment produces a multitude of tapes for the medical, industrial, HVAC, construction, and retail markets, as well as spray adhesives. The segment’s net sales declined by about 4% in fiscal 2019, to $2.5 billion.

In August 2019, Berry sold its Seal for Life business to Arsenal Capital Partners for approximately $330 million. Producing products including polyolefin tapes and corrosion prevention and sealant technology, the business reportedly has annual sales of approximately $120 million.

Berry reported overall net sales of almost $3 billion in its 2020 fiscal second quarter. The 53% increase in net sales compared to the prior year quarter was primarily attributed to acquisition net sales of over $1 billion and a base volume increase of 2%. In the Engineered Materials segment, net sales were $598 million in the 2020 second fiscal quarter, down from $619 million in the 2019 quarter. The net sales decrease in the Engineered Materials segment was primarily attributed to lower selling prices of $39 million due to a pass through on lower resin costs, partially offset by a 2% base volume increase.

Sources: annual reports, company websites, press releases

Medina, Ohio

Chairman and CEO: Frank C. Sullivan

Total sales in RPM’s fiscal 2019 (ended May 31, 2019) reached $5.6 billion, a modest increase compared to 2018’s $5.3 billion. The company employs 15,000 people and invested $71.6 million in R&D last year.

RPM’s fiscal 2020 nine month net sales increased 2.1% to $4.1 billion from almost $4 billion during the first nine months of fiscal 2020. Organic growth was 2%, with acquisitions adding 1.3% and foreign currency translation reducing sales by 1.2%.

In 2019, RPM combined its former tremco illbruck Group, Tremco Group, and other components from the Performance Group to create a new Construction Products Group. Following that action, the company is organized into four segments: Construction Products Group (34% of 2019 sales), Performance Coatings Group (20%), Consumer Group (34%), and Specialty Products Group (12%). The company declined to provide specific adhesives/sealants details; sales for those products (along with many others) are mainly found in the Construction Products Group and the Consumer Group.

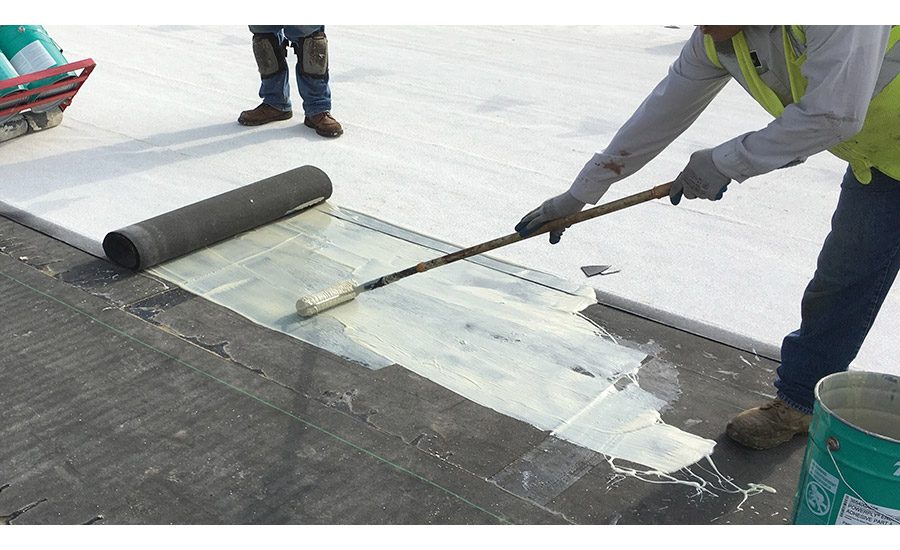

Tremco Roofing’s POWERply® Endure® BIO adhesive received a Certified Biobased Product label from the U.S. Department of Agriculture last year. RPM reports that the adhesive consists of 71% bio-based material with an ultra-low level of volatile organic compounds (VOCs). The reportedly virtually odor-free adhesive is cold process, 100% solids, and fully cured and watertight within 24 hrs of application.

Sources: annual report, company website, company investor presentation, press releases

Baar, Switzerland

CEO: Paul Schuler

Sika does not report results by product segment, but it sells adhesives and sealants (among many other products) into almost all of its target markets and regions. (The company did not respond to requests for specific adhesives/sealants details.) Sika employs over 25,000 people worldwide and invested CHF 200.2 million (~ $211.6 million) in R&D.

Target markets for the group include Waterproofing, Concrete, Roofing, Flooring, Refurbishment, Sealing & Bonding, Industry, and Building Finishing. New for 2019, the Building Finishing customer focus includes tile adhesives and grouts, as well as products for under-tile waterproofing and sound reduction, and others.

Sika’s total sales grew by over 14% in 2019, to CHF 8.1 billion (~ $8.6 billion). The company reported a new sales record of CHF 1.8 billion (~ $1.9 billion) in the 2020 first quarter, an increase of 15.4% in local currencies. A negative currency effect led to sales growth in Swiss francs of 10.3%, with an acquisition effect of 16.7%. Organic growth was thus slightly negative in the first quarter (down 1.3%), reflecting the first repercussions on business of the COVID-19 pandemic.

In September 2019, Sika announced that would acquire Crevo-Hengxin, a Chinese manufacturer of silicone sealants and adhesives used in both industry and construction applications. With this acquisition, Sika reports that it is expanding its Industry and Sealing & Bonding target markets’ presence in China and the Asia-Pacific region while gaining additional silicone technology and a production footprint.

Sika received the Swiss Technology Award last year in the Innovation Leaders category for SikaForce® Powerflex. The new adhesive technology reportedly combines the characteristics of elastic and high-strength structural adhesives in a single product.

“It is a great honor for us to receive the coveted Swiss Technology Award, which demonstrates Sika’s innovative strength once again,” said Frank Höfflin, Sika’s chief technology officer. “Our aim is to offer customers solutions with added value. With our prize-winning SikaForce Powerflex adhesive technology, we not only support faster assembly processes, but also make a major contribution to meeting the challenges of the future—enabling lightweight construction, and thus contributing to environmental friendliness in the transportation field.”

Sources: annual report, company website, investor presentation, press releases

Tokyo, Japan

President and CEO: Makoto Hattori

LINTEC’s sales in its 2020 fiscal year (ended March 31, 2020) declined by 4.1%; nearly half (49.4%) of those sales were overseas. The company cites trade friction between the U.S. and China for the main reason behind reduced sales volumes.

Three main sectors comprise the business: Printing and Industrial Materials Products (adhesives for seals and labels, automotive adhesives, industrial adhesive tapes, films for various end uses, and other products); Electronic and Optical Products (semiconductor- and multilayer ceramic capacitor-related tapes, as well as other products); and Paper and Converted Products. Mactac is part of the Printing and Industrial Materials Products segment (listed separately; see note).

Sales for the Printing and Industrial Materials Products segment were essentially flat in the fiscal 2020 year compared to 2019. The Electronic and Optical Products segment saw sales drop by 9.3%, due to factors such as lower demand from automotive and smartphone production. Sales for semiconductor-related tapes increased for the year, however, and those for optical display-related adhesive products were steady.

*Editor’s note: Since Mactac, LINTEC’s U.S. subsidiary, provided adhesives/sealants-related details and requested that they be withheld, specific sales levels for LINTEC will likewise not be published to avoid any conclusions potentially being drawn. Mactac’s sales were subtracted to determine LINTEC’s ranking.)

Sources: company website, results presentation and summary

Munich, Germany

President and CEO: Rudolf Staudigl, Ph.D.

Four divisions comprise Wacker’s business: Wacker Silicones, Wacker Polymers, Wacker Biosolutions, and Wacker Polysilicon. The group’s total sales were essentially flat for 2019 (down 1%), at €4.9 billion (~ $5.5 billion).

Wacker Silicones’ sales dipped 1.8% in 2019 to almost €2.5 (~ $2.8 billion). The division produces silicone sealants, resins, and elastomers (along with many other products) for customers in end-use sectors such as medical, electronics, and transportation. It employs approximately 5,300 people and invested €65 million (~ $73 million) in R&D in 2019, an increase of almost 7% over 2018. Wacker declined to provide specific adhesive/sealant-related figures, but a company contact did report that the “silicone sealants business including hybrid polymers achieved lower range double digit growth in 2019.”

For the first quarter of 2020, Wacker’s sales total sales declined by 3% compared to the 2019 first quarter, to €1.2 billion (~ $1.3 billion), primarily due to the impact of COVID-19. Wacker Silicones reached sales of €590 million (~ $663 million), 3% less than last year’s first quarter.

“We closed Q1 2020, with generally good figures, as we expected,” said Rudolf Staudigl, CEO. “Despite persistently difficult economic conditions and the additional challenges of the coronavirus pandemic in China, our sales were almost on par with Q1 2019 and EBITDA was substantially higher. In silicones and dispersible polymer powders, we benefited from higher volumes and, in bioengineered products, from a better product mix.”

Sources: company contact, annual report, company website, press release

Glenview, Ill.

Chairman, President and CEO: E. Scott Santi

ITW’s Polymers & Fluids segment produces industrial, construction, and consumer adhesives, among many additional products. Pressure-sensitive adhesives are produced for applications in electronics, medical, transportation, and telecommunications by the company’s Test & Measurement and Electronics segment. (The company did not respond to requests for adhesives/sealants details.)

Of ITW’s total $14.1 billion in 2019 revenues, Test & Measurement and Electronics produced $2.1 billion, while Polymers & Fluids contributed $1.7 billion. Both segments were relatively flat for the year.

ITW reported revenue of $3.2 billion in the 2020 first quarter, a 9.1% decrease compared to the first quarter of 2019. Revenue in the Test & Measurement and Electronics division was $485 million, down from $524 in the 2019 quarter. Polymers and Fluids achieved $393 million in the first quarter of 2020, compared to $416 in 2019).

Sources: annual report, company website, press releases

Wilmington, Del.

CEO: Ed Breen

With 2019 total revenue of $21.5 billion, DuPont has four main business segments: Electronics & Imaging, Transportation & Industrial, Nutrition & Biosciences, and Safety & Construction. Adhesives-related revenues were estimated to exceed $750 million in 2019, according to a company contact.

“The majority of DuPont’s Adhesives portfolio falls within their $5B Transportation & Industrial and $5.2B Safety & Construction division,” the contact said. “Sales of DuPont adhesives were steady in 2019 compared to 2018. The biggest change was in the completion of the merger between Dow and DuPont. In early 2019, DowDuPont split into three separate entities: Dow, DuPont and Corteva. Many adhesives products moved from Dow to DuPont in the split.”

The company expects sales of adhesives to be negatively impacted in 2020 by COVID-19. Pandemic-related reduced demand caused sales in the Transportation & Industrial segment to decrease in the 2020 first quarter. The company cited a reduction in automotive production as the reason for the segment’s dip in volume for the quarter.

“DuPont has weathered many challenges and crises over its two centuries and our team is navigating this period with the benefit of our cumulative expertise,” said Ed Breen, CEO. “While it is still impossible to predict timing, our markets will eventually stabilize and return to growth. In the interim we are prioritizing the safety and health of our employees, safely maintaining our operations, strengthening our balance sheet, and partnering with other industry leaders to combat this pandemic.”

According to the company contact, DuPont’s target for R&D spending is 4% of estimated new sales. “The transportation industry is constantly evolving, especially in the development of advanced mobility platforms for hybrid and electric vehicles,” the contact said. “DuPont is utilizing heritage adhesive solutions as well as formulating novel solutions to support ongoing advancements in the transportation industry.”

Sources: company contact, company website, press release

Mumbai, India

Chairman: Madhukar Parekh

Pidilite operates with two main businesses: Consumer & Bazaar and Business to Business. The largest segment, Consumer & Bazaar, produces adhesives and sealants, as well as craft materials and construction-related chemicals for retail consumers (includes professional end users such as carpenters and painters). The Business to Business segment serves industrial customers with adhesives and synthetic resins, among other products.

Pidilite’s total net sales for its 2020 fiscal year (ended March 31, 2020) were Rs 7,254 cr (~ $1.1 billion), an increase of 3% compared to the prior fiscal year. Specific adhesives/sealants sales figures were not available. However, according to the company’s 2018-2019 annual report (most recent available), adhesives and sealants in the Consumer and Bazaar segment represented 56.4% of the company’s sales, while industrial adhesives were 9.2% of the total.

The company discussed its pandemic-related experiences in a June press release: “While April’20 sales ground to a halt due to closure of most markets, in May and June we have seen the country open up for business gradually with Rural markets restarting quicker vis a vis Urban markets. We observe that markets in the South and East have opened up gradually with North and West being slower to open up. Large cities continue to be constrained, especially those in West, North and Central India. We continue to see challenges around labour availability in our own units—warehouses/factories as well as at users/customers. As normalcy returns slowly across various markets we remain cautious and focused on restoring volumes enabled by investments in brand building, growth categories, capabilities and sales and distribution.”

Sources: company investor update, press release

The Woodlands, Texas

Chairman, President and CEO: Peter R. Huntsman

represented 15% of Huntsman’s overall sales in 2019, which reached almost $6.8 billion (an 11% decrease compared to 2018). Worldwide, the company has around 9,000 employees and operates in over 30 countries. (The company did not respond to requests for specific adhesives/sealants information.)

Huntsman Advanced Materials produces epoxy-, polyurethane-, and methyl methacrylate-based adhesives for aerospace and other industrial sectors, as well as consumer applications. Additional products include resins, hardeners, curing agents, and more. The company cited lower volumes in industrial, power, and automotive markets for the reduced 2019 segment revenues.

Revenues declined 11% in the Advanced Materials segment in the 2020 first quarter, to $241 million. Sales volumes decreased across most markets, particularly commodity, industrial, and aerospace, primarily due to the economic slowdown and customer destocking.

Sources: annual report, company website, press release

Detmold, Germany

Board of Directors: Klaus Kullmann, Ralph Nitschke, and Christian Terfloth, Ph.D.

Jowat is a fourth-generation, family-owned adhesives manufacturer with 23 affiliated companies and sales in 80 countries around the world. The company serves industries ranging from wood, furniture, and construction to automotive and packaging.

Jowat was one of this year’s winners of the Axia Best Managed Companies (BMC) Award for excellently managed companies. The Jowat SE board received the prize in the company’s House of Technology in Detmold, Germany. The Axia BMC Award is an international seal of approval for successful Mittelstand (small- and mid-sized organizations in German-speaking countries) companies awarded by the auditing and consulting firm Deloitte and the WirtschaftsWoche, in cooperation with the Federal Association of German Industry (BDI) in Germany.

“As one of the award winners, Jowat impresses with its first-class corporate management—through its high level of innovation, a long-term strategy and strong governance structure,” said Lutz Meyer, responsible for the German Mittelstand program and partner at Deloitte.

Sources: company contact, company website, press release

Dublin, Ohio

CEO: Guillermo Novo

Parent Company: Ashland Global Holdings, Inc.

Ashland produces adhesives in chemistries including acrylic, urethane, epoxy, and more for industries such as packaging, construction, and transportation. Adhesives-related revenue was stable in 2019 at approximately $350 million.

Near the end of 2019, Ashland announced that it would move from a functionally led organization to one focused on business units. The company reorganized around three primary external reporting segments—Consumer Specialties (including Life Sciences, Personal Care & Household), Industrial Specialties (including Specialty Additives and Performance Adhesives), and Intermediates & Solvents—as well as a Corporate reporting segment. According to Ashland, these changes will enable it to align its business models, resources, and cost structure to the specific needs of each business unit and create greater ownership and accountability for both short- and long-term performance.

Corporate reporting segment. According to Ashland, these changes will enable it to align its business models, resources, and cost structure to the specific needs of each business unit and create greater ownership and accountability for both short- and long-term performance.

Sources: company contact, annual report, press release

Stow, Ohio

CEO: Edward LaForge

Parent Company: LINTEC Corp.*

With 500 employees based in the U.S., Canada, and Mexico, Mactac focuses on pressure-sensitive adhesives and materials. According to Janet Page, senior marketing manager, the company’s adhesive production increased 17% in 2019. She reports that the company expects 2020 adhesive-related sales to increase by over 10%.

In April, Mactac announced that it had received recognition as the first pressure-sensitive adhesive manufacturer to have products listed in the BioPreferred™ program established by the U.S. Department of Agriculture (USDA). The BioPreferred distinction recognizes that Mactac has developed pressure-sensitive adhesives that have been independently tested and certified as USDA bio-based products.

Mactac reports that its BioPreferred adhesives, MacBond XT and MacBond Ultra 555, are designed for industrial applications such as foam bonding, appliances, packaging, insulation bonding, gaskets and rivets, fixture and dispenser mounting, acoustic and decorative panels, interior signage and displays, and mirror mounting.

“Mactac is proud to be a leader in sustainable adhesive and tape manufacturing and we are honored to receive this commendable recognition,” said Page. “Mactac’s customers can purchase our BioPreferred™ products with the peace of mind that they are not only receiving a quality, high-performance product—but also, a product that was manufactured with components that reduce environmental impact.”

*Editor’s note: Details for LINTEC are included separately.

Sources: company contact, company website, press releases

Windach, Germany

Managing Director: Robert Saller

Managing Partners: Sabine Herold, Wolf Herold

DELO’s adhesive products, including light- and dual-coating acrylates and epoxies, are used in industries such as electronics and automotive. The company employs approximately 800 people.

Revenues for DELO’s 2020 fiscal year (ended March 31, 2020) increased by approximately 5% to €163 million (~ $179 million) compared to the prior year. “While this is pretty decent, it’s a bit below our long-time average,” said Matthias Stollberg, head of Corporate Communications. “What is remarkable is that we managed to finish the last quarter of our fiscal year from January until March above expectations despite the massive worldwide production shutdowns. This was mainly due to our Asian customers who were increasingly building up stocks in order to be independent of possible local restrictions.”

According to Stollberg, the company is “cautiously optimistic” about the near-term future. “We have coped well with the COVID-19 crisis so far and are doing everything we can to keep it that way,” he said. “If the global economy continues to recover and no further shutdowns occur, we could even see an increase in sales by the end of this fiscal year. However, it all depends on how big a second global COVID-19 wave will be.”

DELO continued its strong focus on R&D in 2019, investing approximately 15% of its revenues. “We expect that our R&D spending remains at this high level,” said Stollberg. “To increase it even beyond 15% is really difficult if you think that you also need to invest in production, raw materials as well as digitization. But so far, the high invest has paid off: Roughly 30% of our revenues regularly come from products that are younger than three years.”

DELO announced last year that it had broken the world record for achieving the heaviest lift using adhesive. For the attempt, an 18-ton truck was lifted by crane to a height of 1 m with 3 g of adhesive. The entire weight hung for 1 hr on a bonded aluminum cylinder with a radius of 3.5 cm, which corresponds to the diameter of a standard soft drink can. The new record was officially recognized by Guinness World Records.

The company developed the high-temperature-resistant DELO MONOPOX adhesive for the record attempt. The one-component, heat-curing epoxy resins in this product group reportedly provide high strength and are used in the automotive industry and mechanical engineering.

Sources: company contact, company website, press release

City of Industry, Calif.

CEO: Brad Boyle

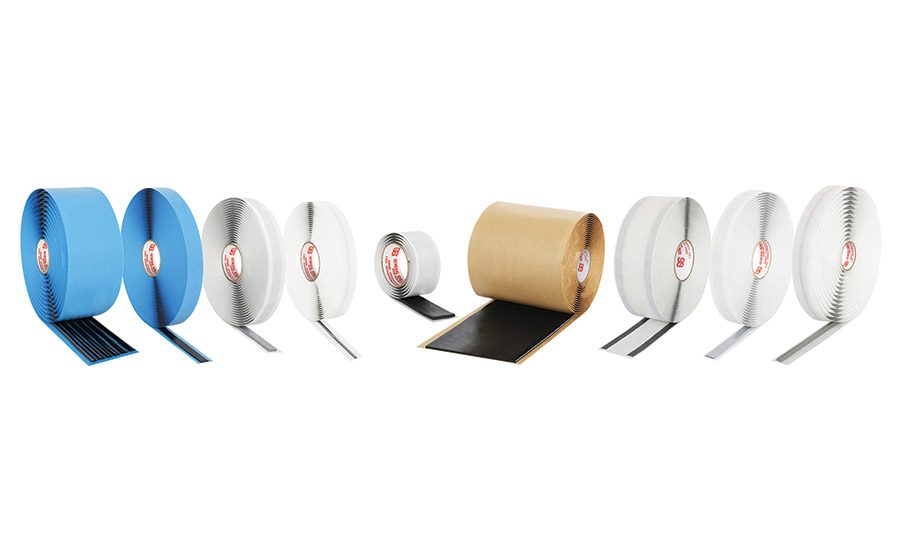

General Sealants produces butyl tapes, polysulfide sealants, and vacuum bag sealant tapes, among other products, for customers in 75 countries worldwide. Markets served include automotive, aerospace, telecommunications, composites, industrial manufacturing, and infrastructure-related applications.

Net sales for General Sealants in 2019 increased by approximately 8% compared to 2018, and the company is optimistic for a rebound in 2020 following a pandemic-related dip. “Q1 sales were relatively strong with a 12% increase in sales compared to Q1 of 2019,” said Patrick Boyle, president and chief operating officer. “COVID-19 has impacted sales negatively thus far in the Q2 and we are projecting a return of strong sales by mid to end of Q3 and into Q4.”

General Sealants increased its R&D spending dramatically (46%) in 2019, a trend that Boyle expects to continue. “R&D expenditures have continued to increase in 2020 as we find there is an increased demand for custom formulated butyl sealants to solve our customers’ unique product applications.”

Source: company contact, company website

Alpharetta, Ga.

CEO: James Cooke

Chemence serves customers in several industry segments, including: Medical, Consumer, Industrial, Graphics, VIS, and Cosmetics. The company’s 248 employees produce products ranging from wound closure and tissue adhesives to structural adhesives and cyanoacrylates.

According to Michael Pomykala, global director, Chemence’s 2019 sales increased by approximately 4% over the prior year. COVID-19 negatively impacted sales targets in the early part of 2020, but Pomykala reports that the company expects to finish the year even with 2019.

Chemence’s increased focus on innovation and product development for target industries such as medical adhesives and consumer electronics assembly is reflected in recent year-over-year spending increases on R&D. The largest portion of the increased R&D budget is for the company’s new global R&D center, which is set to open in August. The 15,000-sq-ft facility will be home to Chemence’s R&D and applications engineering teams, as well as its materials testing and analytical labs.

Sources: company contact, press release

Editor’s note: The ASI Top 20 is based, in part, on publicly available financial information, including annual sales/revenue, along with details supplied by company contacts and other sources. Information was verified whenever possible, but adhesives/sealants-related details have been estimated in some cases. In other cases, details for privately held companies have been withheld on request. Financial figures are generally rounded, and the timing of currency conversions may impact specific figures/results.

Where specific and verifiable information was not provided and reference materials were not readily available, some companies unfortunately had to be left out. If you have questions or would like details regarding how to have your company considered for future ASI Top 20 rankings, contact Susan Sutton, editor-in-chief, at (248) 786-1704 or suttons@bnpmedia.com.