The participating members of the IPC Solder Products Value Council1are compelled to clearly articulate the current situation regarding the global supply and demand of two crucial metallic elements to the Electronics Industry. The cost of tin and silver have reached 19-year highs and it is important for our industry to understand the implications of this kind of cost increase on the supply of solder alloys.

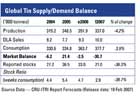

Figure 1.

Source Data - CRU-ITRI Report Forecasts (Release date: 19 Feb 2007)

Source Data - CRU-ITRI Report Forecasts (Release date: 19 Feb 2007)

Cost Impact of Current Tin Supply

The International Tin Research Institute2(ITRI) has published a report forecasting a potential shortfall in tin availability in 2007. ITRI is projecting that global demand for tin will exceed production by 30,700 metric tons. The primary reason behind this shortage is a 30 percent reduction in tin exports from Indonesia.

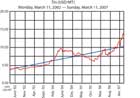

Figure 2.

“A dealer told StarBiz that price movement had been volatile over the past month as Indonesia tightened tin export regulations and clamped down illegal mining operations mostly in the Bangka-Belitung province, which account for almost half of the republic’s refined tin exports," reports Hanim Adnan. “We are looking at daily price movements of US $200 to US $400 per tonne. Early this year, the metal had jumped by U.S. $1,000 per ton on a single-day trading. Market players were now waiting to see whether the metal can touch the U.S. $15,000 per ton mark next week, the dealer said."

The price of tin has always exhibited volatility, but since 2003 the price has remained in a range of $6,000 to $9,000 per metric ton. However, in the last 6 months the price of tin has increased over 40 percent and the price continues to climb. The negative impact of this price volatility on the electronics assembly industry is particularly acute due to the increased consumption of tin by our industry due to the accelerating transition to high tin lead free alloys.

Figure 3.

Figure 4.

Silver Cost Impact

Different market forces have also caused the price of silver to climb dramatically in the past 18 months. Silver was priced in the $7.00 to $8.00/troy ounce range through most of 2005. In late 2005 and early 2006, the price of silver climbed to more than $14.00 per troy ounce. One of the factors for the increase is growth in demand of silver due to the trend toward lead free and prominence of 3 percent to 4 percent silver bearing alloys to the electronics assembly industry.

Figure 5.

The impact of this dramatic increase in the cost of silver is a significant new additional pressure on the soldering materials suppliers. Silver has quickly eclipsed almost all other material costs for suppliers in the last 18 months and now represents the number two raw material cost for the industry, second only to tin.

Figure 6.

Overall Impact on Solder Alloy Industry

In the intense, cost-competitive assembly electronics marketplace, this new cost increase is yet another market driver that our industry is going to have to learn to manage. A key to our industry’s growth will be how we address these dramatic cost increases without driving the assembly electronics supply chain to yet another dangerously low level of profitability. This is imperative as the marketplace continues to demand a pipeline of innovative and enabling technologies to meet the market’s requirements. The PCB laminate industry in the early 2000s is an example of a segment that was turned inside out due to the intensity of a cost-driven downward business cycle.Over this 15 month period, the impact from the cost increase of tin and silver combined in solder paste have increased by $6.58 ($12.28 -$5.70) for tin, and $4.53 ($12.22-$7.69) for silver, for a total of $11.11 of increased cost per kg of solder paste. This represents a cost increase equivalent to between 20 to 30 percent of the global average sales price for solder paste sold into the assembly electronics segment. The chart below demonstrates a 74 percent increase in the alloy cost of Sn/3.0%Ag/0.5%Cu since March 2007.

Conclusion

The soldering materials supply chain, already stretched thin financially due to the constant downward trend of average sales prices and the increased costs of doing business with the explosion of lead free solders, is monitoring this issue very closely. Our industry will be significantly challenged to absorb increased costs of these magnitudes. It is the Council’s recommendation that electronic assemblers stay in close communication with their soldering material suppliers regarding supply and availability during this unprecedented period of volatility in the market price of metals.This article is based on a paper originally published by the IPC as “Global Impact of the Accelerating Cost Increase of Metals on the Assembly Electronics Industry.” For more information, visit www.ipc.org.

Footnotes

- The IPC Solder Products Value Council consists of 22 soldering-materials manufacturers from around the world. The IPC SPVC estimates its membership represents more than 80% of the world’s supply of soldering materials.

- The International Tin Research Institute is the most prominent association globally representing tin-consuming industries. It is based in the United Kingdom.

- The London Metal Exchange is the world’s premier non-ferrous metals market, and is the market representing the majority of the global tin supply.

- $6.375 = $7.5/troy oz of Ag x 0.85 troy oz of Ag/kg of SAC 305 solder paste.

- See “The True Costs of Lead Free” IPC SPVC article.