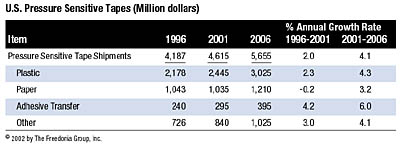

Advances will be driven by material enhancements that will continue to enable tapes to widen their scope of use by supplanting alternative joining and bonding systems in industrial assembly, packaging and other applications. Value gains will also be supported by a shift in the product mix toward higher-performance, value-added technical tapes for industrial applications. Further expansion for tapes will be restrained by maturity in significant applications. These and other trends are presented in Pressure Sensitive Tapes, a study from The Freedonia Group Inc., a Cleveland-based industrial market research firm.

Strongest Prospects

Among tape types, the strongest prospects exist for various technical and specialty tapes, including double-coated, adhesive-transfer and certain plastic-film-backed products. Double-coated tapes, which have supplanted single-coated tapes and other bonding methods in many applications, are used disproportionately in growth industries such as electronics and telecommunications. Performance advantages and new-product development will also support above-average growth for adhesive-transfer tapes, particularly in products where a tape backing cannot remain and greater conformability is required.

Tapes fabricated from higher-end plastic films such as polyester, PTFE, nylon and polyimide will continue to supplant cloth, rubber and paper tapes as well as commodity film-backed tapes based on their durability and high-temperature resistance along with usage in fast-growing niche applications, such as electronics and industrial assembly.