Higher oil prices have resulted in the emergence of new applications that previously did not use adhesives and sealants, such as wind turbine assembly.

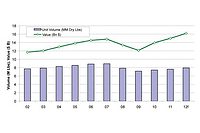

Figure 1 (top). Adhesives and Sealants Growth Trends 1996-2007

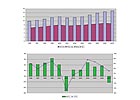

Figure 2 (bottom). Year-Over-Year Growth Trends

Figure 2 (bottom). Year-Over-Year Growth Trends

As illustrated in Figures 1-2, the industry reached $14.5 billion in revenue in 2006 and 8.9 million dry lbs., reflecting year-over-year growth of 3.7% in volume and 5.5% in revenue, respectively. However, 2007 has been more challenging. The economy is sluggish, with consumer spending down, the housing sector in retreat and the U.S. automakers dipping below 50% market share. As a result, we are forecasting modest revenue growth - 3% - due to price actions passing through raw-material increases. However, we are forecasting a 2% decline in volume, with a prospect for further decline if the construction market forecasts continue to worsen.

Following are the top 10 challenges manufacturers said they will face in 2008 and through the remainder of the decade:

- Rising raw-material costs - how high will oil go and how soon will it get there?

- The ability to continue to raise prices.

- The condition of the U.S. economy.

- Product innovation - finding higher margin markets and/or dealing with the changing face of regulatory requirements, such as health, safety, and environmental issues.

- The availability of key raw materials. The rate at which emerging economies, such as China, continue to gobble global demand. China is absorbing 25% of global commodities output.

- Maneuvering changes in competitive landscape due to continued consolidation. At press time, ICI had announced an agreement to sell its business to Akzo Nobel, which subsequently will sell National Starch to Henkel.

- Perceived commoditization in the eyes of the customers.

- Dealing with offshore markets - deciding whether to partner with foreign suppliers and manufacturers and/or follow the customer to emerging markets.

- Changes needed to the sales approach.

- Focusing on core business by reducing product lines and/or services.

We are already beginning to see four positive results as a result of high oil pricing:

- Engineers are designing for better fuel efficiency: more composites, down-gauging and downsizing to improve fuel efficiency. This trend heavily favors greater use of adhesives and sealants at the expense of industrial fasteners and welding, as demonstrated by Boeing’s Dreamliner and Airbus’s A-380.

- Emergence of new applications that previously did not use adhesives and sealants, such as wind turbine assembly.

- Acceleration of adhesive and sealant penetration into energy-saving applications such as insulated glass and window films.

- Margin discipline among manufacturers is driving toward a much-deserved higher value.

ChemQuest forecasts manufacturers’ margins in the range of 30-40% on a gross profit basis, as illustrated in the Table.

Manufacturers have done a good job of recouping lost margins, but on average still lag about 3-6 months and need to recoup an additional six points of margin. In a soft economy led by housing declines and lower automotive sales, this is very difficult and may in fact obstruct needed pricing actions.

Adhesive and sealant manufacturers will continue to meet these never-ending challenges by improving internal efficiencies, finding product niches, developing new markets and competing in a changing paradigm, but in the end it comes down to maintaining their margins. Without a healthy bottom line to support these influencing factors, top-line growth will be a challenge.

For more information, phone (513) 469-7555 or visit www.chemquest.com.