These and other detailed global trends are presented in The 3rd Edition of the Global Adhesive and Sealant Study, an Executive Market Trend Analysis, published by the partnership of Chem Research GmbH, Frankfurt, Germany, and DPNA International Inc., Troutman, NC.

The Far East region continues to show the greatest growth and has the most vibrant country markets. China has surpassed all other countries in per annum growth, which overall is estimated at 7% for the next three years. Included in this analysis are technical industrial formulated adhesive and sealant products. Excluded are the large commodity segments such as plywood and fiberboard binders and corrugation adhesives.

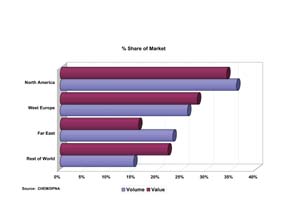

The largest regional markets are North America, Western Europe and the Far East. These three regions account for 85% of the global demand volume and 78% of the total global value. Figure 1 shows this comparison.

Market Driving Forces

There are five major driving forces affecting the world market:1. Market globalization

2. The strengthening of new trading blocs

3. Importance of environmental responsibility

4. Industrial consolidation

5. Technological evolution

Market globalization has a different level of affect on the market for each region. The more mature market, represented by the industrialized economies, is experiencing the effects of market globalization as labor-intensive industries move to lower-cost labor countries. End uses where this has been most apparent are footwear, textile manufacturing, general assembly (e.g. electronics, small machinery) and woodworking.

New trading blocs, including the expansion of the European Union, NAFTA to the Americas Free Trade Agreement (AFTA), and the greater role of the WTO in world trade, are increasing the reach of products at competitive prices throughout the world. It is now more difficult to price product following the old "price to the market" concept.

Environmental awareness and responsibility have reached about every country and resulted in the development of adhesive and sealant products that are "environmentally friendly."

Industrial consolidation has primarily affected the industrialized countries, where there has been consolidation of adhesive and sealant formulators, customers, and raw material suppliers. Although this industry is characterized as being fragmented, three large global players account for 60% of the total merchant demand.

Technological evolution can be described as the adhesive and sealant market passing through three identified stages-emerging, breakthrough and mature. The industrialized countries are in the mature stage whereas the emerging countries vary between emerging and breakthrough. Since the marketplace has become more global, many of the developing countries are "leapfrogging" across the traditional evolutionary cycle. To become competitive, several are opting for the latest technology.

Other Factors

Several external factors and events are affecting the market on a regional basis, while others are more global. In general, the market will grow cautiously in the next 2-3 years until some of these events play out. The following list highlights the major factors.- The aftermath of 9/11

- Concern over continued terrorist attacks

- The threat of another SARS outbreak

- Rising oil prices

- Strengthening of the Euro and Yen

- Detaching the Chinese Yuan currency value from the US dollar

- The effect of e-commerce

- Release of raw material prices

- Continued high employment in Japan, the United States and Western Europe

- Emergence of China as the number two consumer

Technology Trends

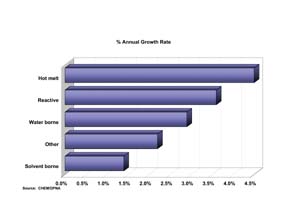

The general movement away from traditional systems is clear as the demand for environmentally friendly and higher performance technologies increases. This is evident when considering global growth is highest for hot melts, reactive high solids and water borne types. Figure 2 presents a comparison of growth rates by adhesive technology.Geographic (Country) Markets

The Far East represents the highest growth region. Four countries are highlighted as representing opportunities for significant growth >4% - China, South Korea, Taiwan and Vietnam. A smaller regional market, Eastern Europe, has three major markets showing demand growth above 4% - Poland, Hungary and Russia. Growth in most other countries is sporadic due to the small size of the total demand. The effect of one large new order, or the loss of another, can swing the growth rate from plus to minus.One interesting country included in the Middle East region is India, the second largest population center after China. India has begun to encourage investment in its industrial base and has the potential to develop into a significant market for adhesive and sealant products.

In terms of market size, the major industrialized adhesive and sealant producers and consumers remain the United States, Japan, Germany, Italy, United Kingdom and France. The development of new products and technologies will flow from these countries for at least the next 3-5 years.

Raw Material Demand (Resin) Trends

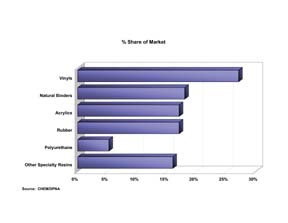

The global demand for formulating resins shows some adjustments as a result of shifting technologies. Highlights include promising increases in the growth of specialty raw materials for formulating water borne, hot melt and reactive systems. Related formulating binder resins showing strong growth include acrylics, styrene block copolymers, polyurethanes (both thermoplastic and thermoset), and silicone-pure and hybrid polymers.A comparison of market demand share for the top five global raw material resin binders, plus other "specialty" resins, is shown in Figure 3.

End-Use Markets

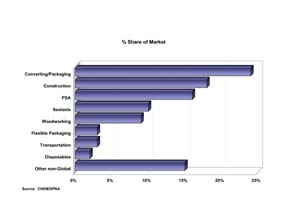

A total of 12 major adhesive market segments, plus sealants, are representative of the market. Eight of the twelve end uses qualify as being truly global, where the demand is for the latest state-of-the-art products. The top five uses for adhesives are: converting and packaging; construction; pressure-sensitive adhesives (PSAs) for tapes, labels, and miscellaneous products; sealants; and woodworking applications. The relative share of the global end use segments and the remaining non-global markets are compared in Figure 4.Supply Patterns

Certain end use segments are characterized by significant foreign trade activity. These are supplied worldwide by multinational merchant adhesive and sealant formulators. The top five end uses supported by exports are converting and packaging, construction, PSA applications, sealants, and woodworking. Most of the export products are manufactured in the industrialized regions and shipped to the emerging country markets. Adhesives and sealants can be exported in different forms ranging from a semi-finished to a fully formulated product.Vertical integration is another characteristic of the adhesive industry. Captive versus merchant supply of adhesive and sealant products varies by market segment. For example, the converting and packaging segment is 40% captive and 60% merchant-supplied, whereas the PSA market represents about 80% captive and 20% merchant-supplied. On the other hand, the consumer adhesive market segment represents a 100% merchant-supplied market. Altogether, about 30% of the adhesives demand is met by captive production.

The top 10 multinational adhesive and sealant companies supply nearly 50% of the merchant market. They represent companies with sales ranging from US $400 million (Forbo-Swift) to a high of US $2.6 billion (Henkel). The remaining formulators below this range are categorized as medium (US $100-390 million) to many smaller companies that may have sales less than US $1 million. It becomes apparent that the supply of formulated products is quite fragmented and populated with many small and niche players.

Conclusion

The global market for adhesives and sealants is growing at about the rate of GDP, with significant variations between the regions. Historically, the industry was dominated by a few industrialized countries. Now, a significant portion of new demand is being generated by emerging countries such as China. The next major growth country could be India.Market fragmentation continues as new adhesive demand is generated from a supply and demand standpoint. The demand growth is also supported by the emergence of new market applications that result from changing substrates and evolving assembly processes. On the supply side, despite ongoing industry consolidation and M&A activities at the level of the multinational companies, new small- and medium-sized companies are beginning to serve targeted market niches and/or specialize in a specific state-of-the-art technology.

For more information on purchasing The Third Edition of the Global Adhesive and Sealant Study: 2003-2006, contact David P. Nick, DPNA International Inc., 126 Allendale Circle, Troutman, NC 28166; phone (704) 528-3985; fax (704) 528-3986; or e-mail david.nick@dpna-international.com ; or Monique von Dungen, CHEM Research GmbH, Hamburger Allee 26-28, Frankfurt, Germany D-60486; phone +49-69-970-8413; fax +49-69-970-84141; or e-mail vondungen@chem-research.com .