Acquisition Makes Bayer World’s Leading Supplier of Polyurethane Raw Materials

|

|

|

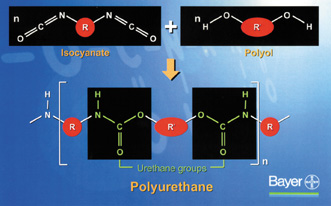

Polyurethanes: Great Variety from Two Components

The basic polyaddition reaction of isocyanate and polyol to form urethane groups was discovered at Bayer’s research laboratories. |

Polyurethanes have a “historic dimension” at Bayer. The basic polyaddition reaction and its products — polyurethanes — were discovered in 1937 by Otto Bayer and his colleagues at Bayer's research laboratories. This marked the beginning of an amazing success story for these materials, and one that is continuing today. By the way, Otto Bayer is not a relative of the company's founder, Friedrich Bayer.

Production of polyurethanes requires two components — diphenylmethane diisocyanate (MDI) or toluene diisocyanate (TDI), in which Bayer was already the world leader, and polyol.

For decades, Bayer's traditional strength has been in the field of isocyanate chemistry. In this segment, the company has for a long time been the world's leading player, with production facilities and service centers in all the major economic centers around the globe. Alongside this, Bayer has devoted considerable attention in the past to building up a significant polyols business — especially in Europe — to enable the company to offer its customers the complete range of polyurethane raw materials from a single supplier. This polyurethane-systems concept has proved extremely successful.

To be able to offer the two main components of polyurethanes — namely isocyanates and polyols — as a complete system throughout the world, Bayer was lacking the polyol capacities on a global level.

By acquiring Lyondell’s polyol manufacturing operations, Bayer has become a single-source polyurethanes supplier, with more than one-quarter share of the world market. "We have also gained access to innovative, patent-protected technology and manufacturing processes, which we shall now transfer to our existing facilities," says Dr. Hans-Joachim Kaiser, general manager of Bayer's Polyurethanes Business Group, adding: "The anticipated synergies will considerably exceed the integration costs as soon as 2002, so the profitability of our business group will be further improved."

Parts of the acquisition are the Lyondell polyols manufacturing plants in Institute and South Charleston, W.Va., and Channelview, Texas; European facilities in Rieme, Belgium, and Fos-sur-Mer, France; and companies in Indonesia, Taiwan and Singapore. Bayer has now closed a strategic gap.

The new production facilities currently have a capacity of some 700,000 metric tons of polyols a year. This means that Bayer can now call on a virtually balanced capacity of these two key components — isocyanates and polyols — at a high level. Additionally, Bayer has acquired research centers in Newtown Square, Pa.; South Charleston; Villers St. Paul, France; and Singapore.

|

|

|

Polyurethane World Consumption by Region

Asia-Pacific, Europe and the NAFTA countries are the biggest polyurethane markets. Nearly 90 percent of all polyurethanes are consumed there. |

Equity Interest in Propylene Oxide

The agreement with Lyondell covers not only the polyether assets, but also the supply of propylene oxide — a basic raw material of polyols — on a producer basis. The US$2.45-billion investment represents a long-term strengthening of the group's core polyurethanes business, as Bayer and Lyondell are also committed to future cooperation in the technology field and in the construction of new manufacturing facilities for propylene oxide. Of the 11 new sites, Bayer will operate seven of them exclusively, including the four technical centers on three continents. The propylene oxide facilities and, in particular, the American polyol sites, will continue to be operated by Lyondell or their partners.Propylene oxide forms the basis of a large number of polyether polyols. Virtually three million metric tons, approximately two-thirds of world demand for propylene oxide, were used in the production of polyether polyols in 1999. The remainder was processed primarily into propylene glycols, glycol ethers and other specialty chemicals.

Almost three-quarters of polyether polyols are processed into flexible polyurethane foam, while the remaining quarter is used for producing rigid polyurethane foam and specialties, such as coatings, adhesives, sealants and elastomers (CASE), and fibers.

Together with Lyondell, Bayer also intends to build a new propylene oxide/styrene facility in Europe. The project, called PO-11, will be built at the Maasvlakte site in Rotterdam, the Netherlands. The plant is expected to start up in early 2003. The new facility should enable Bayer to keep pace with the continuing growth of the polyurethane market regions of the world — Asia-Pacific, Europe and the NAFTA countries. Nearly 90 percent of all polyurethanes are consumed in these locations.

The United States, with its stable economic conditions, is of major importance for Bayer’s business and actually constitutes a cornerstone for it. This is also reflected in Bayer’s polyol acquisition: more than half of Bayer’s newly acquired capacities come from sites in the United States.

|

|

|

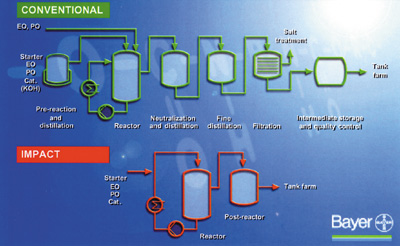

Comparison of the Conventional Polyether Polyol and IMPACT Processes

When the two processes are compared, the diagram for an IMPACT plant looks considerably simpler than the one for classic polyol synthesis with a KOH catalyst. |

IMPACT Technology is Key

When it comes to producing secondary, long-chain polyether polyols, Bayer gained access to an extremely high-performance process — namely the patented IMPACT technology that came with the Lyondell acquisition. This process is already being successfully employed at two locations in Belgium and the United States.The principle behind an IMPACT plant for the synthesis of polyether polyols is a simple one: special, modified zinc-cyanocobaltate catalysts form the centerpiece of the process. The high catalytic activity of the bimetal catalyst also has positive consequences from the perspective of plant safety.

Fewer by-products develop in the IMPACT process than in conventional synthesis processes. Monol formation, in particular, i.e., the conversion of a reactive OH terminal group into an allyl group that does not react with isocyanates, is greatly suppressed. This is one of the reasons for the high quality of IMPACT polyols.

By retrofitting existing polyol facilities to run the IMPACT process, considerable capacity increases can be achieved for long-chain polyether polyols with a comparatively low level of investment.

IMPACT technology makes Bayer the world's only supplier who can produce polyols continuously rather than in the conventional batch process. What's more, the products Bayer’s customers make with polyols produced through IMPACT technology are better. They can make polyurethane-foam car seats with less material without giving up any physical properties. Adhesives and sealants made from Bayer’s polyols have better tensile, tear and elongation properties. Bayer polyols also can replace more-expensive materials used to make products like spandex. And Bayer recently developed a polyols-based product that can replace latex in medical-examination gloves — an especially important development for doctors and patients who are allergic to latex.

In close cooperation with its Polyurethanes Technical Center in Pittsburgh and now also in South Charleston and Newtown Square, Bayer is providing its customers with technical expertise in all areas of polyurethane technology. The IMPACT technology constitutes a key driving force for Bayer’s considerably expanded polyol business, and the company intends to exploit the possibilities offered by this technology to further develop existing applications and to move into completely new market domains. These latter initiatives, also known as step-outs, are being pursued by high-performance teams of experts who are opening up new territory with original ideas and unconventional approaches to solution-finding.

In order to keep pace with the growth of the world polyurethanes market, Bayer will be significantly raising the capacity of its raw materials over the next few years. As far as the polyols segment is concerned, the innovative IMPACT technology provides an important key. This technology for producing long-chain polyether polyols will enable existing production facilities to produce about twice as much polyol as they do at present.

What Else Does the Future Hold?

On the isocyanate side, Bayer has significant new capacities for MDI and TDI in Baytown, Texas, and plans to build world-scale facilities for MDI and TDI in the Shanghai region of the People's Republic of China.Dr. Kaiser notes that plant sizes are increasing all the time. “Whereas a few years ago, isocyanate facilities with a capacity of 50,000 metric tons/year were regarded a respectable size, the planned capacities nowadays for world-scale facilities are somewhere between 100,000 and 150,000 metric tons. Such capacities represent something like 10 percent of world demand — volumes that can hardly be sold in one single country anywhere on the globe.”

Bayer has therefore decided to group together its polyurethane activities into five regions — Europe, NAFTA, Far East, Japan and Latin America. Consequently, global logistics are becoming more important for the company and its partners in the polyurethanes sector. Logistics have become an essential interface between production and marketing.

Bayer’s Polyurethane Business Group has realigned its business units to fit specific applications organized as Automotive, Comfort, Insulation and Specialties:

- Automotive stands for interior and exterior applications in vehicles, for safety and comfort in seats, for sound insulation, and for binders used in connection with material recycling.

- Comfort is what Bayer formerly called Flexible Foam and covers everything connected with seats, beds and comfort in general. Long-chain polyethers and TDI are the formula for success here.

- Insulation covers low- and high-temperature insulation as well as the bonding of wood or other materials. This is where short-chain polyethers, polyesters and MDI come into their own.

- Specialties covers a wide variety of special applications that utilize to full potential the polyurethane success formula. The variety is virtually unlimited. Many of these applications are relatively small from the market-volume point of view but are highly profitable. This justifies Bayer’s high research expenses in this segment.

The Polyurethanes Business Group increased its global sales last year by almost five percent to 2,175 billion euros. The Lyondell acquisition will increase sales to three billion euros. The number of employees will increase by 750 to 5,550, most of them working in more than two-dozen manufacturing sites in all parts of the world. In the United States, the additional sales this year from the acquisition are anticipated to help push Bayer Corporation’s annual sales above the $10 billion (U.S.) mark for the first time.

For more information on polyurethane raw materials, including polyols and isocyanates for polyurethane applications, contact the Polyurethanes Div., Bayer Corp., 100 Bayer Road, Pittsburgh, PA 15205-9741; phone 800-622-6004; fax 412-777-4978; Web site www.bayerpolyurethanes.com/customer. Send e-mail via this Web site.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!