These and other trends are presented in Construction Chemicals, a new study from The Freedonia Group Inc., a Cleveland-based industrial market research firm.

The market for caulks and adhesives, the second largest product type, is also relatively mature, although a shift toward higher value, better performing, and more environmentally favorable products will help caulks keep pace with overall construction spending growth.

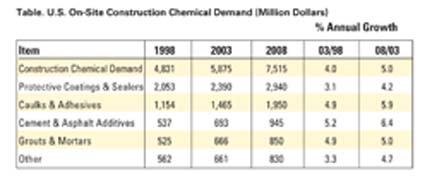

Cement additives and SPF are expected to continue to lead construction chemical gains. These products constitute a growing niche in the construction chemical market, as increasing numbers of contractors and builders avail themselves of the many advantages offered by these developing technologies. Concrete is being used more often in building design, even in residential building, where concrete has traditionally been limited to foundations and driveways. The use of SPF will continue to grow as developments have simplified the application process. Emerging environmental regulations could restrain SPF gains somewhat, however, if they make product pricing uncompetitive.

For more information, contact Corinne Gangloff, The Freedonia Group Inc., 767 Beta Drive, Cleveland, OH 44143-2326; phone (440) 684-9600; fax (440) 646-0484; e-mailpr@freedoniagroup.com; or visit www.freedoniagroup.com.