ELECTRICAL/ELECTRONIC ENDUSER: Cost of Lead-Free Solder Materials

A

research report by the IPC Solder Products Value Council.

European implementation of the Waste Electrical and Electronic Equipment (WEEE) and Restriction of Hazardous Substances (RoHS) directives, coupled with the adoption of lead-free soldering by Japan’s electronics industry, has created unavoidable costs for the global electronics industry.

Following are examples of costs associated with the implementation of lead-free soldering. One-time costs include:

The constituent metals’ value is based solely on market prices and does not include brokerage or financing charges that solder product manufacturers must pay. These additional charges vary from producer to producer, depending on their purchasing agreements.

As illustrated, using the market prices alone, there is a 263% increase in base metal cost between the most popular lead-free alloy, SAC305 (96.5Sn3Ag0.5Cu), compared to the standard tin/lead (Sn 63% Pb 37%) alloy.

It should be noted that the market prices for these metals do fluctuate in accordance with published markets. In recent months, the price of all metals has risen dramatically. This is especially true for the price of silver, which has almost doubled in value over a short period of time. The cost of silver in the popular lead-free alloys currently accounts for the largest share of the total raw metals cost and directly makes the differential in cost even larger, compared to Sn63/Pb37.

The RoHS requirement is very stringent; the allowable lead content is 200 parts per million. Many material sources do not meet the specification and, as a result, the price of higher-purity raw material sources is greater. IPC-J-STD-006 is tightening the requirements on minor constituents in alloys, which is also changing the purity of raw materials used in the formulation of lead-free solder.

Traditionally, solder products have been sold by units of weight. Consumption of these products, due to the various processes in electronics assembly, is based on volume. A volume of solder paste deposited on a PCB will remain the same for tin lead as it will for lead free solder.

A certain volume of solder, for example, is required to form the fillet on a quad flat pack (QFP) device or to fill the barrel of a hole in the printed circuit board (PCB). When transitioning to lead-free soldering, this volume remains the same, but the mass of each solder joint will be significantly different. Also, the volume of a solder bath filled with lead-free material will require approximately 14.1% less material by weight when compared to tin lead material. The industry will be helped by a reduction in consumption of materials, and the cost may also be reduced. However, other factors must still be considered in this analysis.

The manufacturing process for solder products is also driven by volume. While the analysis of an alloy formulation is dictated by weight, the actual process of making solder into a usable product is determined by volume. Manufacturing and energy costs will all increase due to higher melting temperatures. Furthermore, it is necessary for the manufacturer, for example, to produce more solder powder and flux medium to obtain the equivalent batch weight of solder paste product.

Most key compositions of lead-free alloys that have performed well in manufacturing and with good reliability have North American and Japanese patents. Since these patents cover the use of lead-free alloys based on tin, silver, copper, bismuth and antimony, the solder manufacturers have little or no option but to pay the patent royalties on behalf of the original equipment manufacturer or the electronics manufacturing services company.

The solder product manufacturer - depending on the country using the product, the customer’s marketplace and the alloy used - must pay royalties of 4-8% of the final selling price of the product. It is almost impossible for the patent holder to regulate and recoup these royalties from the solder joint manufacturer for electronic and electrical equipment.

Energy costs will also increase. Higher energy costs are due to the difference in liquid temperatures of lead-free alloys and the higher blending pot temperatures required to formulate alloys. Producers are also investing in casting or extruding lead-free alloys into differing shapes. These new shapes provide a visual difference for the user that can eliminate the accidental substitution of a lead-free solder with a tin/lead solder in the wave soldering process. To avoid lead contamination, some manufacturers have invested in dedicated melting pots and equipment designed solely for lead-free production.

In all applications where the user must use an existing lead-containing solder pot or wave bath, remember that the corresponding weight of the lead-free alloy required to fill the pot is 14.1% less. Additional costs to consider with lead-free solder products are the monitoring and control of lead contamination in the manufacturing processes.

Also be aware that a consumption reduction will be realized by the user, as solder joints made from cored wire are volume-limited, and that each spool of wire at any particular diameter will have an extra 14.1% length of wire per unit weight.

These costs even apply to the chemical flux medium element, since it is formulated by weight and is finally mixed with the metal powders on a weight basis. It will, however, produce a final product greater in volume than its tin lead counterpart. For example, in a 500-g jar of lead-free solder paste, there is 14.1% more solder paste by volume compared to a tin/lead solder paste.

Flux mediums suitable for tin/lead processes are ineffective in the harsher environments of lead-free soldering. This fact has necessitated the use of more thermally stable resins and activator packages, which are typically more expensive than those used in tin/lead-formulated pastes.

Quality assurance also plays a major role in the manufacturing of solder pastes, and has a much higher cost element to the final paste product compared to other solder products.

Of the three solder product groups analyzed in this article, it is fair to say that alloy costs will have the least impact on the final product cost for lead-free solder pastes. Conversely, additional manufacturing costs have the greatest impact on the cost of the lead-free solder paste.

As the cost of lead-free metals and the manufacturing of solder products increases, required working capital for manufacturers increases as well. Solder manufacturers may have to borrow more money to finance their business.

Considerable research and development programs were conducted and funded by solder manufacturers to develop lead-free solder products. These programs were supported by tin-lead manufacturing and sales. Further R&D into new solder products will need to be funded by lead-free margins.

Users need a better understanding of the integral parts involved in supplying lead-free solders, and not by a direct comparison of lead-free to lead-containing alloys. Many factors must be considered, including consumption reduction and a per-board cost increase. An increase of paste prices, for example, does not mean that the cost per board increases by the same percentage. In fact, depending upon the quantity of paste used per board, the impact should be extremely minimal. It is estimated that lead-free solder paste will increase the cost of an average computer product by 0.05%.

The dramatic costs of implementing the WEEE and RoHS directives come from sources other than solder products.

As a member-driven organization and leading source for industry standards, training, market research and public policy advocacy, IPC supports programs to meet the needs of a $40-billion U.S. industry that employs more than 350,000 people. The association also provides its members with countless opportunities to network through its international tradeshows, educational programs, technical conferences and online seminars.

For more information, visit www.ipc.org.

Photo

courtesy of Wacker Silicones.

European implementation of the Waste Electrical and Electronic Equipment (WEEE) and Restriction of Hazardous Substances (RoHS) directives, coupled with the adoption of lead-free soldering by Japan’s electronics industry, has created unavoidable costs for the global electronics industry.

Following are examples of costs associated with the implementation of lead-free soldering. One-time costs include:

- Investment in new equipment

- Changing bill of materials

- WEEE and RoHS licensing and compliances charges

- Scrapping old lead-containing stock and inventory

- Revised packaging requirements

- Possible product redesign

- End-of-life recycling costs

- Cost of product traceability

- Increased energy consumption

- Raw materials costs

Cost of Metals

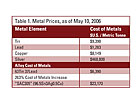

One of the first examples of the higher cost of lead-free soldering is the higher cost of metals used in the lead-free solder alloy. Table 1 lists the market price of tin/lead and the most commonly used lead-free solder - a tin-, silver-, and copper-based alloy.The constituent metals’ value is based solely on market prices and does not include brokerage or financing charges that solder product manufacturers must pay. These additional charges vary from producer to producer, depending on their purchasing agreements.

As illustrated, using the market prices alone, there is a 263% increase in base metal cost between the most popular lead-free alloy, SAC305 (96.5Sn3Ag0.5Cu), compared to the standard tin/lead (Sn 63% Pb 37%) alloy.

It should be noted that the market prices for these metals do fluctuate in accordance with published markets. In recent months, the price of all metals has risen dramatically. This is especially true for the price of silver, which has almost doubled in value over a short period of time. The cost of silver in the popular lead-free alloys currently accounts for the largest share of the total raw metals cost and directly makes the differential in cost even larger, compared to Sn63/Pb37.

The RoHS requirement is very stringent; the allowable lead content is 200 parts per million. Many material sources do not meet the specification and, as a result, the price of higher-purity raw material sources is greater. IPC-J-STD-006 is tightening the requirements on minor constituents in alloys, which is also changing the purity of raw materials used in the formulation of lead-free solder.

Alloy Density

In all available lead-free alloys, tin replaces lead, which, along with the other minor elements of lead-free alloys, has the effect of swapping a very dense metal (lead) with others of much lower density. Using the two most popular alloys, the resultant effect in density change is tabulated in Table 1.

Density/Volume

The figure shows that the SAC305 alloy’s density is 87.62% of the tin lead alloy (Sn63% Pb37). This equates to an equal weight of SAC305 solder but a volume increase of 14.13% over the tin lead equivalent.Traditionally, solder products have been sold by units of weight. Consumption of these products, due to the various processes in electronics assembly, is based on volume. A volume of solder paste deposited on a PCB will remain the same for tin lead as it will for lead free solder.

A certain volume of solder, for example, is required to form the fillet on a quad flat pack (QFP) device or to fill the barrel of a hole in the printed circuit board (PCB). When transitioning to lead-free soldering, this volume remains the same, but the mass of each solder joint will be significantly different. Also, the volume of a solder bath filled with lead-free material will require approximately 14.1% less material by weight when compared to tin lead material. The industry will be helped by a reduction in consumption of materials, and the cost may also be reduced. However, other factors must still be considered in this analysis.

The manufacturing process for solder products is also driven by volume. While the analysis of an alloy formulation is dictated by weight, the actual process of making solder into a usable product is determined by volume. Manufacturing and energy costs will all increase due to higher melting temperatures. Furthermore, it is necessary for the manufacturer, for example, to produce more solder powder and flux medium to obtain the equivalent batch weight of solder paste product.

Most key compositions of lead-free alloys that have performed well in manufacturing and with good reliability have North American and Japanese patents. Since these patents cover the use of lead-free alloys based on tin, silver, copper, bismuth and antimony, the solder manufacturers have little or no option but to pay the patent royalties on behalf of the original equipment manufacturer or the electronics manufacturing services company.

The solder product manufacturer - depending on the country using the product, the customer’s marketplace and the alloy used - must pay royalties of 4-8% of the final selling price of the product. It is almost impossible for the patent holder to regulate and recoup these royalties from the solder joint manufacturer for electronic and electrical equipment.

Solder Bar and Ingot

Solder product in its most basic form consists of melting the constituent parts of the alloy recipe and “running it” to moulds to form the desired bar or ingot shape required by the customer. The density difference between lead-free and lead-containing alloys directly impacts the number of additional bars or ingots cast or extruded in relation to an equivalent batch weight of tin lead solders.Energy costs will also increase. Higher energy costs are due to the difference in liquid temperatures of lead-free alloys and the higher blending pot temperatures required to formulate alloys. Producers are also investing in casting or extruding lead-free alloys into differing shapes. These new shapes provide a visual difference for the user that can eliminate the accidental substitution of a lead-free solder with a tin/lead solder in the wave soldering process. To avoid lead contamination, some manufacturers have invested in dedicated melting pots and equipment designed solely for lead-free production.

In all applications where the user must use an existing lead-containing solder pot or wave bath, remember that the corresponding weight of the lead-free alloy required to fill the pot is 14.1% less. Additional costs to consider with lead-free solder products are the monitoring and control of lead contamination in the manufacturing processes.

Cored Solder Wires

Cored solder wires have a far more complex manufacturing process and involve:- The formulation of flux for the core

- Billet casting of the alloy

- Extrusion of the cored wire product at large diameter

- Drawing the wire to the customer’s desired diameter

- Spooling of the wire onto reels or bobbins

- The cost of manufacturing increases because of the increased wire length necessary for the final product to be sold by weight.

Also be aware that a consumption reduction will be realized by the user, as solder joints made from cored wire are volume-limited, and that each spool of wire at any particular diameter will have an extra 14.1% length of wire per unit weight.

Solder Pastes

Solder pastes, in their formulation and precision manufacturing techniques, are probably one of the most complex solder products. Generally, the processes consist of:- Powder manufacture, which involves some form of particle-making system combined with sieving operations to achieve the desired or required particle size

- Flux medium blending

- Paste blending

- Packaging

These costs even apply to the chemical flux medium element, since it is formulated by weight and is finally mixed with the metal powders on a weight basis. It will, however, produce a final product greater in volume than its tin lead counterpart. For example, in a 500-g jar of lead-free solder paste, there is 14.1% more solder paste by volume compared to a tin/lead solder paste.

Flux mediums suitable for tin/lead processes are ineffective in the harsher environments of lead-free soldering. This fact has necessitated the use of more thermally stable resins and activator packages, which are typically more expensive than those used in tin/lead-formulated pastes.

Quality assurance also plays a major role in the manufacturing of solder pastes, and has a much higher cost element to the final paste product compared to other solder products.

Of the three solder product groups analyzed in this article, it is fair to say that alloy costs will have the least impact on the final product cost for lead-free solder pastes. Conversely, additional manufacturing costs have the greatest impact on the cost of the lead-free solder paste.

RoHS Compliance

The European Directives are the main drivers for replacing lead in the solder alloys and, hence, electronic products. The directives, too, have added new costs in the manufacture of lead-free solder products. The additional costs include:- Additional certification and compliance notifications

- Labeling

- Product identity

- Quality assurance in terms of lead contamination in manufacturing and lead impurity in finished solder products

Conclusions

It is extremely difficult to derive a direct comparison between the costs of a tin-lead solder product and the same lead-free product. There are many costs associated with the production of lead-free solder, including manufacturing, patent and administrative costs. Therefore, changes will likely occur in the factors considered and the methods used by manufacturers in pricing and selling their lead-free products.As the cost of lead-free metals and the manufacturing of solder products increases, required working capital for manufacturers increases as well. Solder manufacturers may have to borrow more money to finance their business.

Considerable research and development programs were conducted and funded by solder manufacturers to develop lead-free solder products. These programs were supported by tin-lead manufacturing and sales. Further R&D into new solder products will need to be funded by lead-free margins.

Users need a better understanding of the integral parts involved in supplying lead-free solders, and not by a direct comparison of lead-free to lead-containing alloys. Many factors must be considered, including consumption reduction and a per-board cost increase. An increase of paste prices, for example, does not mean that the cost per board increases by the same percentage. In fact, depending upon the quantity of paste used per board, the impact should be extremely minimal. It is estimated that lead-free solder paste will increase the cost of an average computer product by 0.05%.

The dramatic costs of implementing the WEEE and RoHS directives come from sources other than solder products.

It is expected that tin-lead solder use will fall dramatically with the growing implementation of lead-free soldering. Prices will likely rise dramatically for what may be considered “marginal products” using tin-lead solder, thus diminishing any perceived advantage of reduced lead-based solder costs for those who have an exemption to the directives.

About IPC

Since 1957, IPC - Association Connecting Electronics Industries® has been guiding the electronic interconnection industry through its dramatic changes. A global trade association dedicated to the competitive excellence and financial success of its more than 2,300 member companies, IPC is the only electronic interconnect organization that brings together all industry players, including designers, board manufacturers, assembly companies, suppliers and OEMs.As a member-driven organization and leading source for industry standards, training, market research and public policy advocacy, IPC supports programs to meet the needs of a $40-billion U.S. industry that employs more than 350,000 people. The association also provides its members with countless opportunities to network through its international tradeshows, educational programs, technical conferences and online seminars.

For more information, visit www.ipc.org.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!