Strategic Solutions

Sustainable Raw Materials: How to Plan for Market Success

A business plan based on a clear understanding of decision drivers

Comprehensive initiatives designed to preserve and improve the environment are included in virtually all manufacturers’ corporate communications. According to the Sheldon Group, 25% of major brand owners have implemented scorecards to rate suppliers and products on environmental impact, and 30-40% more are being developed. These initiatives have spurred public- and private-sector research to develop natural and sustainable building blocks that are either direct substitutes for existing petrochemicals (such as ethylene) or are new molecules. Out of this effort have emerged new companies and corporate divisions that hope to capitalize on the opportunity through environmentally and economically viable business models.

To achieve commercial success, each needs a viable business plan based on a clear understanding of decision drivers throughout the value chain from brand owners to raw material suppliers. The “build it (or develop it) and they will come” strategy has proven to be a recipe for failure. Unbiased market due diligence to gain a thorough understanding of major customers’ selection criteria for material technology, market drivers and resulting trends, strength of competitive suppliers, products and technologies, and, especially, barriers and pitfalls that could derail successful plan execution is key to building solid business strategy.

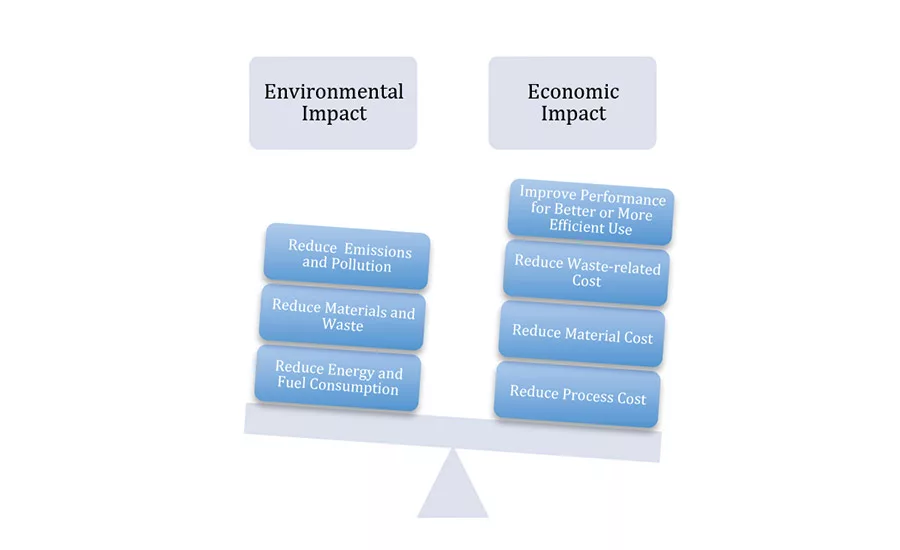

To achieve measurable progress toward environmental impact reduction, end-use stakeholders throughout the industrial value chain are tackling those areas with the highest measureable impact, including consumption (and cost) of energy, waste generation, pollution, and VOC and GHG emissions. So how do sustainable adhesive raw materials fit into this scenario?

First, it is important to note that there are many definitions of “sustainable.” This is especially important for materials such as adhesives, which make up a relatively small portion of a finished product composition, but serve a critical function. Formulating adhesives with renewable ingredients/natural building blocks certainly improves sustainability, as does adding recyclability properties. For brand owners, however, significant improvement in environmental impact is more easily achievable through the use of natural plastics, such as PLA; thinner substrates for reduced material disposal; incorporating lighter weight components using composites, aluminum, or thinner steel into vehicles to achieve lower fuel consumption; or sealing air leaks in buildings for lower energy consumption.

Equally important for most companies is reducing cost. After all, cost is the supreme decision driver for material choice throughout the value chain from the end consumer all the way back to feedstock suppliers. Although this may change in the future, through government mandates or, to a lesser extent, pressure from Millennials, sustainable raw material composition is a “nice to have” rather than a “must have.”

Given that adhesives in product assembly replace other forms of bonding, while comprising 1% or less of end products by volume, performance frequently trumps cost and natural composition in adhesive choice. Adhesives have long included natural raw materials such as rosin and natural resins, though most now contain synthetics due to better performance and supply consistency. Thus, adhesives and sealants exhibit greater sustainability today through performance properties that enable a positive environmental impact in the final product rather than through composition. Such properties include the ability to bond dissimilar materials, enabling manufacture of lighter weight vehicles and equipment; to bond labels that separate cleanly during recycling from recyclable plastic, such as PET; and to reinforce the strength of thinner materials, reducing material consumption weight.

When balancing sustainability with competitive margins, raw material suppliers should thus strive to:

• Analyze the market with eyes open to the major drivers and pitfalls that influence material choices not only by direct customers, but also brand owners, and plan to optimize those drivers.

• Accept that, in the next several years, sustainable raw materials must be essentially equal in total usage costs to petrochemicals in order to justify replacement. This is a relatively high hurdle thanks to persistently low oil and gas prices. Manufacturers of drop-in materials have the best chance and shortest timeline to succeed. By comparison, new chemical producers must demonstrate value in use―from property enhancement or process savings to gain interest.

• Partner with co-suppliers and customers to optimize product development processes and speed commercialization.

• Establish a product value proposition and target niche markets that are less sensitive to cost. It may be necessary to consider further processing to establish more value.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!