Strategic Solutions

Plan Now to Profit from Sustainability

Demand for “green" has benefited adhesives and sealants manufacturers and their suppliers.

After years of modest growth in the adoption of green/sustainability programs, major corporations, along with their suppliers and logistics partners, have committed to sustainability and social responsibility goals. Many have formed dedicated sustainability/social responsibility departments, and even more have appointed at least one senior champion to develop and implement strategic sustainability plans. According to Green Biz Group Inc., 89% of Fortune 500 corporations issue a sustainability report each year as part of their annual report.

The Growth of “Green”

Sustainability has been embraced for various reasons. Meeting government regulations is the key reason, but mounting stakeholder pressure has become a significant factor, especially for publicly traded companies. Building brand equity as an environmentally and socially responsible corporation has become especially important to ensure strong future business performance in a changing consumer environment (no pun intended). While being “green” is still considered just “nice to have” for many chemical companies, others have noticeably increased their investment in bio-engineered material development goals to ultimately balance volatility in fossil fuel supply and price as well.

Because U.S.- and Europe-based corporations were early adopters, the growth rate of green certifications in the U.S. and Western Europe has slowed. However, it is accelerating in developing countries like India and China. Last year brought considerable change globally: political upheaval in the European Union with Brexit; a distinctly new U.S. presidential administration with its vow to rollback recent stringent environmental regulations; and terrorist attacks around the world. Such turmoil fuels CEO uncertainty, especially in the construction markets, which slows progress in projects that have longer rates of return on investment while focus shifts to short-term business results.

The demands brought on by the “green movement” have both challenged and benefited adhesives and sealants manufacturers and their suppliers, especially in the packaging, transportation, and construction markets. These sectors have invested heavily to comply with volatile organic compound (VOC) and hazardous materials regulations and standards, while striving to achieve higher application performance to enable the use of lighter-weight dissimilar materials.

While multinational corporations that have established sustainability-focused product development programs will continue to push forward despite easing of customer demand, smaller privately held U.S. companies have noticeably eased off on demands for sustainable materials, according to raw material suppliers. Price and performance remain paramount in buying decisions, while sustainability beyond meeting regulations is still only a bonus.

Sustainability and the Future

Smaller companies are tempted to focus on shorter-term business goals when markets are uncertain, but it is also important to look to future scenarios to ensure profitable future growth as sustainability becomes mainstream. Look beyond today and even tomorrow to envision and understand the needs of markets 10 years from now and where those markets are, and set milestones to fulfill those needs profitably. Evidence indicates that in the future, sustainable products and processes will become the norm, rather than the exception, driven by global consumer demand.

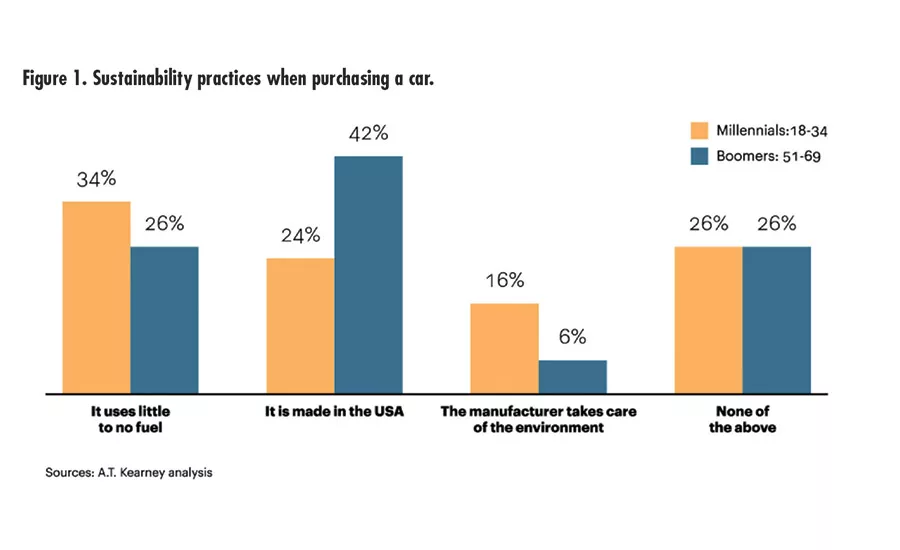

In addition, keep in mind that demographics are changing. Millennials, with their professed commitment to a clean, healthy and sustainable environment, will become the dominant consumer group soon; Generation Z is reportedly even more committed. Even though the majority of people in these generations have yet to earn incomes high enough to be major purchasers of more expensive sustainable products today, they will shape the market for sustainable products and construction soon.

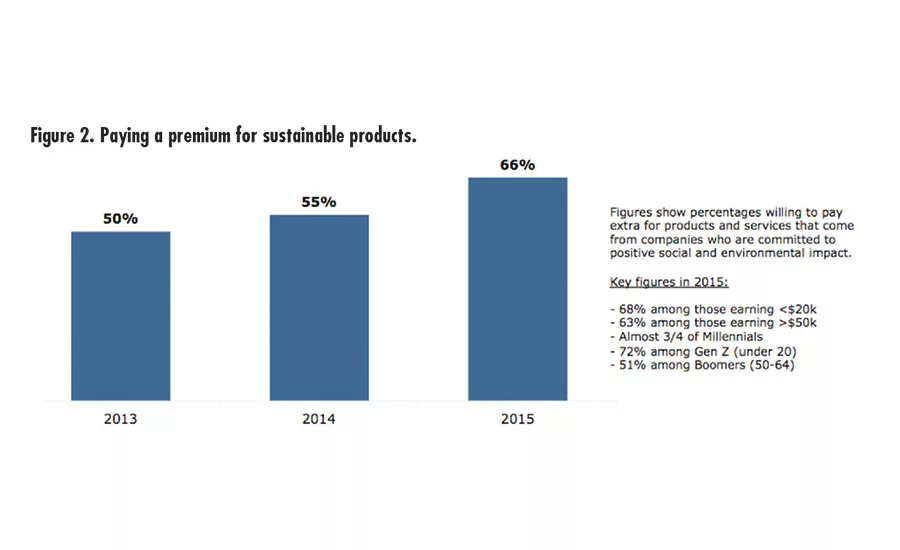

Consider the survey results indicated in Figure 2. Consumer trend analyses show that consumers are becoming more willing to pay extra for products that are environmentally friendly.

How much more they’ll be willing to pay is a big question. In a survey of 1,000 consumers in the U.S. and Europe conducted by McKinsey in 2012, 70-80% of respondents indicated that they would pay a premium of up to 5% for green products that perform equally to alternatives in five markets: electronics, building, automotive, packaging, and furniture. Willingness dropped off rapidly as the premium was raised past 10%.

Although in a 2016 Yardi Matrix survey of 2,631 renters, 69% indicated willingness to pay more to live in a green building, 52% would pay only $100/month more, a $460 deficit from what green buildings demand.

Critically analyze sustainability trends along with market trends, uncover unmet needs, and identify potential pitfalls to develop viable business plans to profit in an increasingly green-aware world. Evaluate your company’s core competencies, your competitors, your customers, your customers’ customers, and beyond to plan where and how to profit from this evolution, even as you tackle today’s issues. ASI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!