Market Trends

Adhesives Consumption Growing Despite Environmental Restrictions

Curbs on emissions are bringing about changes in the commodity pattern of the U.S. adhesives industry.

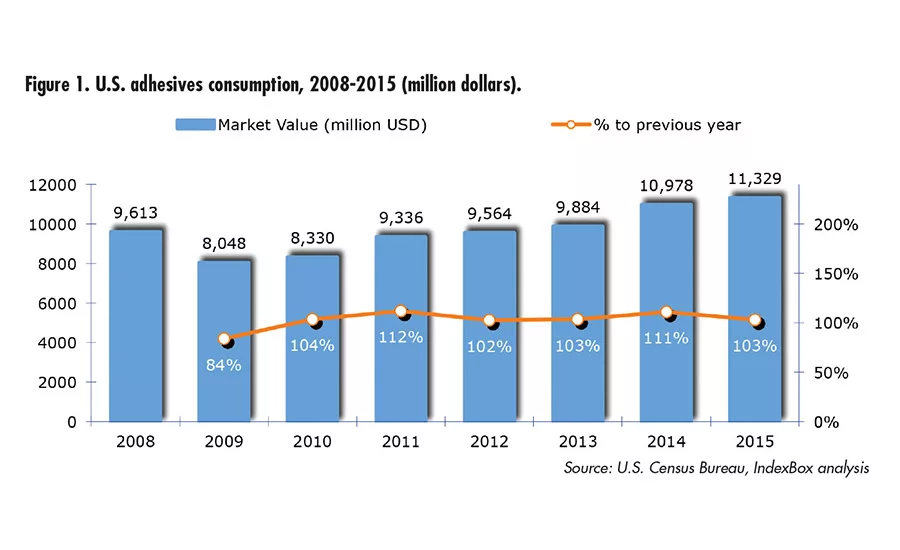

U.S. adhesives consumption continued to grow in 2015, a positive trend that began after the culmination of the global recession seven years ago. Compared to 2014, the market has increased by 3% in value terms to $11.3 billion, and by 18% when compared with 2008. The recovery seen in certain consumer industries— construction and car manufacturing— is the driving factor behind this growth.

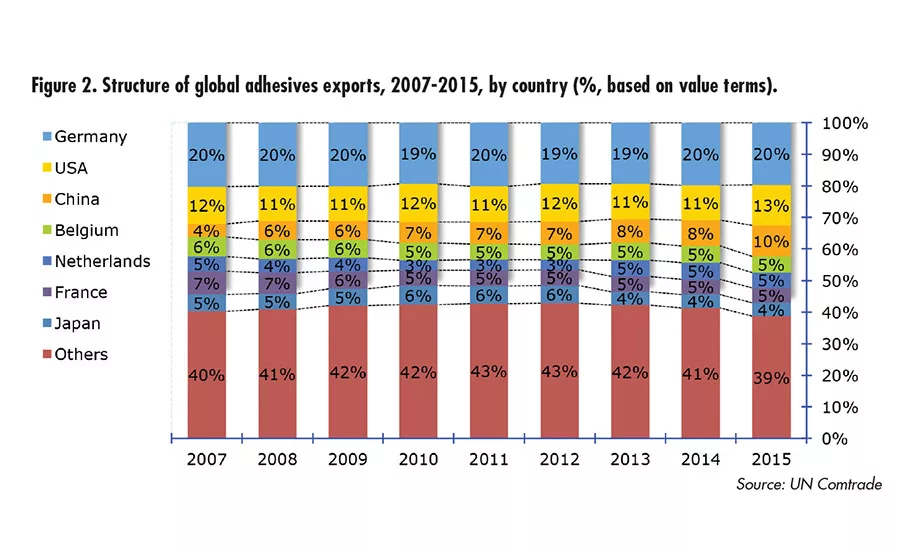

The U.S. adhesives market is loosely dependent on imports from abroad: from 2010-2015, the imports share in terms of consumption did not exceed 12%. The imports structure was dominated by products from Canada (in value terms, Canada accounted for 28% of the adhesives imported into the U.S. in 2015); Germany was in second place (17%), followed by Mexico (10%) and China (8%). Canada and Mexico are also among the largest importers of U.S.-manufactured adhesives, due to their geographical proximity and the supportive trading conditions; in 2015, their share in U.S. exports amounted to 37% and 22%, respectively.

From 2010-2015, the exports share oscillated around 21% of the domestic adhesives output. The U.S. share in terms of global adhesives exports remained stable. This number stood at 12% in 2010 and at 13% in 2015, second in the world after Germany; Germany’s share did not fall below 19% for the same period.

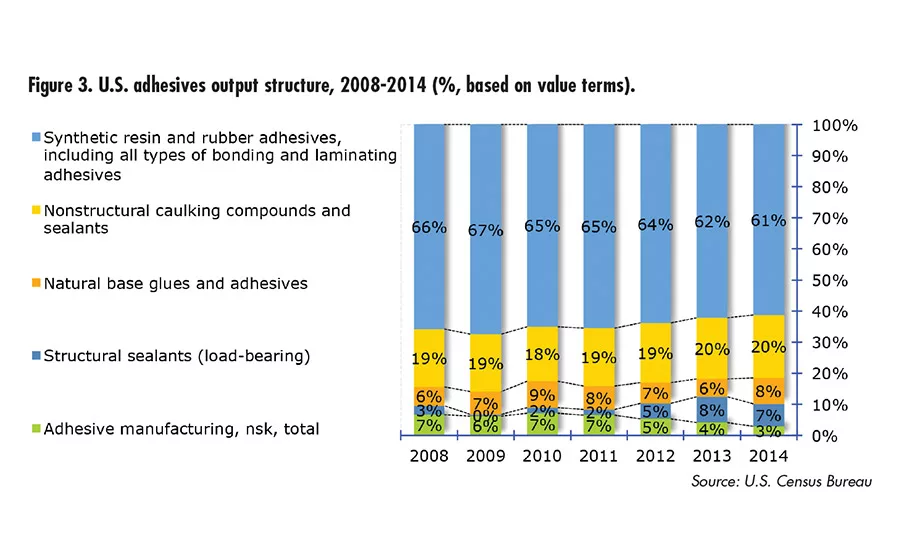

From 2007-2015, U.S. adhesives production rose at an average annual rate of 2.8%, reaching $12.7 billion, based on last year’s results. At the same time, the output commodity pattern showed signs of instability. According to IndexBox estimates, the share of natural-based glues and adhesives in terms of U.S. production increased from 6% to 8% over the period from 2008-2014 (see Figure 3), while the share of synthetic resins and rubber adhesives contracted from 66% to 61% over the same period.

These changes are a result of the actions of regulatory authorities, restricting the use of products that produce toxic waste and exert a negative impact on the environment. In the future, this is set to result in the increased production of bio-adhesives, which use natural raw materials in the production process (e.g., starch and natural rubber), instead of synthetic polymers (e.g., silicones, vinyl, acrylic). The transition from the production of traditional solvent-based adhesives to their water-based alternatives would also be another consequence of this trend.

We believe the adhesives market is set to experience measured growth in the medium term. Enhanced demand from the car manufacturing and construction sectors, combined with increased employment levels and rising household incomes, not to mention the development of innovative technology (which will extend the potential scope of use for adhesives), will be the driving impulses for the sector’s steady expansion. ASI

For more information, visit www.indexbox.co.uk.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!