Strategic Solutions

State of the U.S. Construction Market

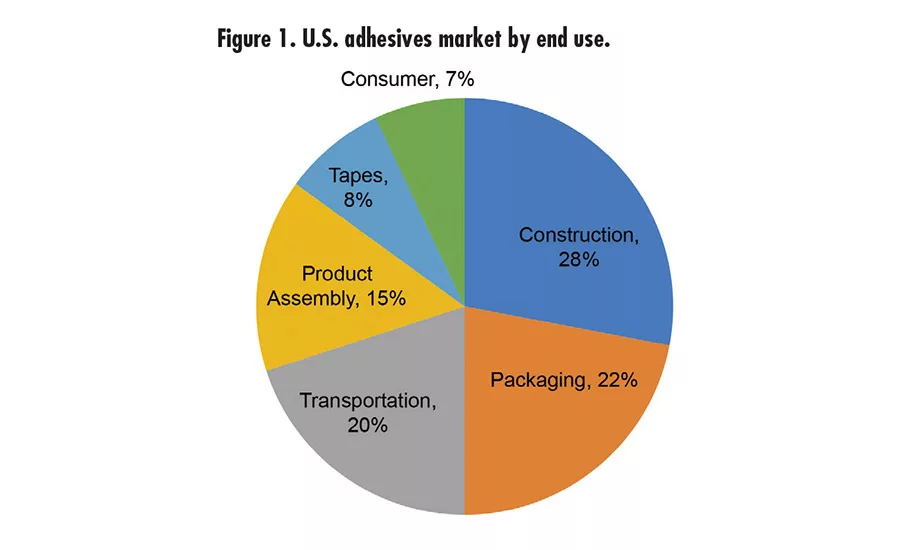

Total construction spending has been growing at a robust 8.1% over the last five years.

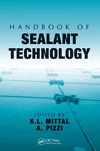

The U.S. adhesives market reached $15.8 billion in 2016; sealants grew to $2.4 billion. Volume growth in each appears to be less than 2% from our interviews of industry participants. Figure 1 shows a breakdown of the U.S. market by end use in terms of value.

Construction-related end uses make up 28% of the market for adhesives and sealants in the U.S., and even more globally—over 40%. In terms of a breakdown between residential and non-residential construction, the split is 60/40, with non-residential representing the larger of the two components. The average growth in total construction spending has been a robust 8.1% over the last five years.

Non-Residential Construction Spending

Non-residential construction spending continued to increase, albeit at a slower pace (4.1%) in 2016, according to the U.S. Census Bureau. Construction markets showing double-digit year-over-year increases include lodging, office, and commercial. Sectors that declined in 2016 were mainly in public spending, including water supply, sewage treatment and public safety. The outlook for the next five years is an average growth rate of ~ 4.5% per year, according to consensus estimates, slightly lower than the 5.5% per year seen over the previous five years.

Residential Spending

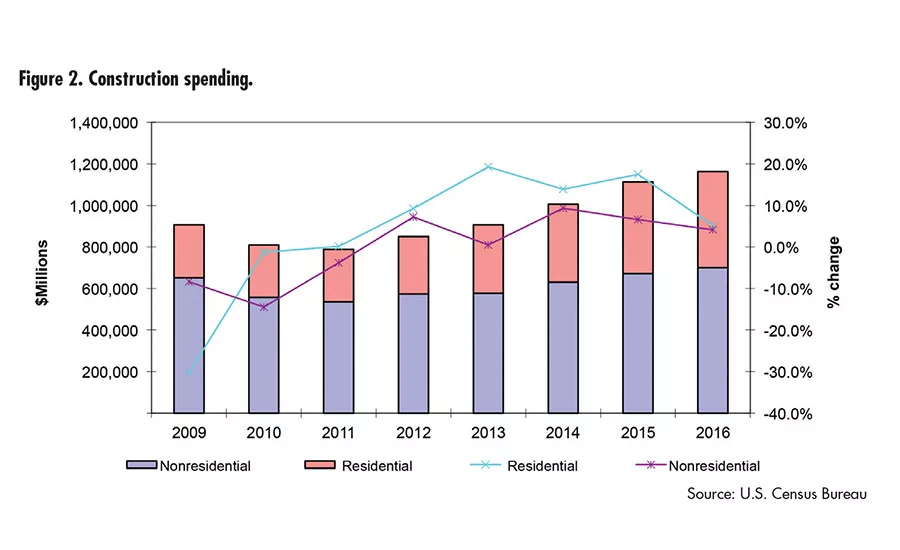

Before the recession of 2007, U.S. residential fixed investment historically accounted for about 5% of GDP; it dropped to a low of 2.6% in 2010. It is currently is averaging 3.5% of GDP over the last three years.

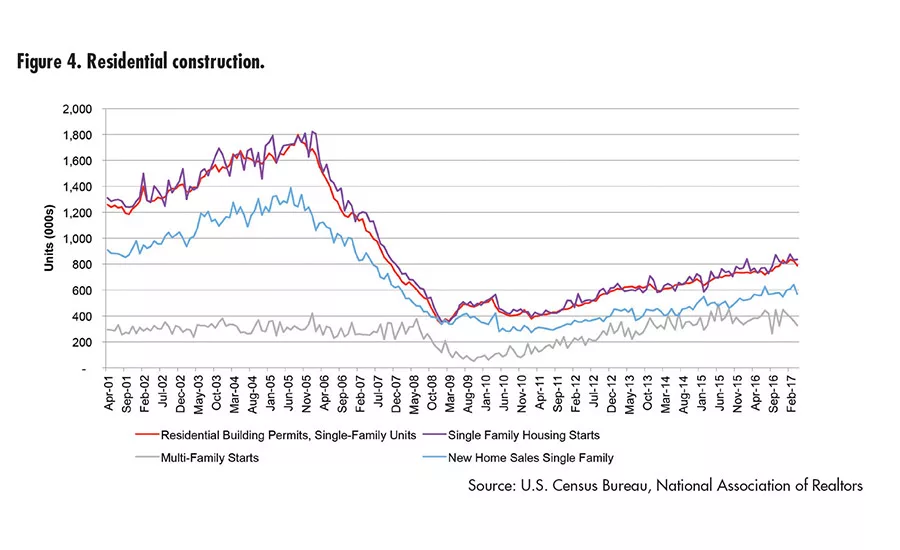

The recovery from the historic downturn in residential construction continues in 2017, but the sector remains at only 75% of its peak in 2006. Both single- and multi-family housing starts have recovered from their lows of 550,000 per year at the end of 2008 to a forecasted 1.35 million for 2017. In 2016, existing home sales were 3.8% higher than 2015, with 5.45 million units sold. New home sales were up even more 12% in 2016 with 561,000 units sold. Employment gains, continuing low interest rates and low inventory of existing homes (especially starter homes) for sale continue to be supportive of the new home market.

Nevertheless, other factors continue to limit growth, including price appreciation (up 5.5% year-over-year as of April 2017), low inventory and more stringent loan criteria. In addition, demographic changes among buyers and their preferences are changing the market.

Home ownership rates have stabilized but are still low, particularly for those under the age of 45, compared to their historical average. Currently, the number of Americans owning their own house is at 63.9%, up from its lowest level since the mid-1960s but well below the peak of 69% in 2005. Those under 45 years old owning homes now are about 7% less than the historical norms, but that has begun to improve as well. The demographic shift toward renting led to an increase in the construction of multi-family units for rent in recent years. Homebuilders have responded to the demand for starter homes by building smaller, new single-family homes to meet a lower price point to compete with renting.

The unemployment rate for the construction industry was at 4.5% in June 2016, slightly lower than the current overall rate of 4.9%. Labor costs for builders are climbing due to many skilled workers leaving during the extended downturn in construction, offsetting lower costs of raw materials.

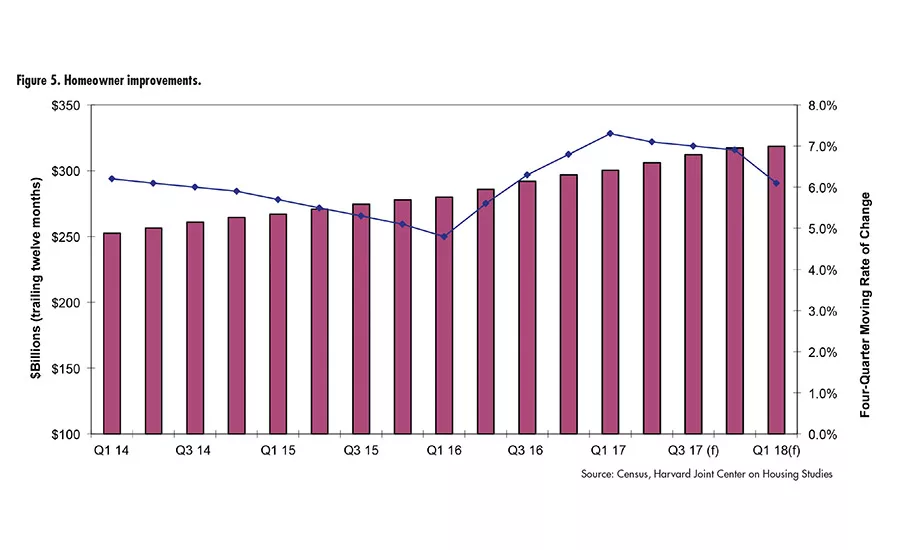

The residential remodeling market continues to flourish. Remodeling includes both improvements and maintenance/repairs. Historically, spending is traditionally split 80/20 in favor of improvements vs. maintenance.

Although remodeling projects use less adhesive than new construction, it is still an area of significant adhesive demand. The long-term trend of homeowners moving away from do-it-yourself (DIY) and hiring others for projects has resumed after reversing a bit during the recession. ASI

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!