Photo courtesy of Devcon

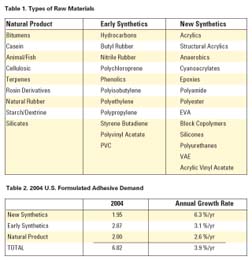

Second, it has consistently outperformed the U.S. GDP over the last 30-40 years. Although the growth has slowed over the past decade, it is still expected to exceed the GDP over the next five years. In 2004, ChemQuest estimated the size of the U.S. formulated adhesives industry to be 6.82 billion dry pounds, with an average annual growth rate of 3.9%/year. This growth rate is at least 0.5% faster than the 3.4%/year rate expected for the U.S. GDP.

Why has the adhesives industry continued to display such vitality? Who should be credited for such an astonishing growth record? In this writer's opinion, the credit is shared equally between the adhesive formulators and the raw-material suppliers.

The adhesive industry has always benefited from its position as a component of the fastening industry. As such, a significant percentage of its enhanced growth has come from its ability to capture market share from other types of fasteners, such as nails, screws, staples and rivets. Still, there are many other examples of growth not related to other fasteners. For example, when one considers the changes that have occurred in signage, ranging from interstate highway signs to fleet marking decals, the growth of pressure-sensitive adhesives in these applications has arguably come at the expense of the coatings industry.

The adhesive industry has benefited from a continuing evolution of new applications for adhesives to attack. Furthermore, there is every reason to believe that new applications will continue to emerge, and adhesive formulators deserve a great deal of credit for their ability to identify these opportunities and develop new adhesives to meet these needs in a timely manner. However, it must also be acknowledged that many of these success stories are heavily dependent on the development of new raw materials with improved properties.

Since 1940, polymers have moved steadily from an embryo to sophisticated polymer architectures. From 1940-1965 (which I have arbitrarily termed the "early synthetic" period), most of the polymers that received significant commercial development attention were primarily homopolymers, or simple copolymers. Included in these early synthetic polymers were polyvinyl alcohol, polyvinyl chloride, polyvinyl acetate, polychloroprene, styrene butadiene, and others (see Table 1).

By contrast, I have termed those polymers that received their major commercial development effort in the adhesives industry after 1965 "new synthetics." Interestingly, the introduction of a new raw material class never replaces an existing class in all of its applications. Instead, it typically replaces some of the existing demand from the incumbent raw materials, but the enhanced properties allow formulators the opportunity to capture new applications where existing adhesives couldn't compete.

For this reason, there is still significant demand for natural product-based adhesives today. In fact, ChemQuest estimates that this group of raw materials accounted for almost 30% of 2004's formulated adhesive demand. However, they are continuing to lose market share and are expected to account for less than 20% of industry growth over the next five years. Suppliers of many of these materials have continued their investment in modifications of their products and more efficient manufacturing processes. This is most notable among suppliers of starches, rosin derivatives and terpenes. Without that investment, the decline would have been far more dramatic. It's also interesting to note that the high price of oil and oil-derived products is giving new life to some of these materials due to formulators finding new ways to use them with synthetics as a way to manage costs.

When the early synthetics are considered as a class, they account for 42% of the 2004 adhesive demand. However, they are also losing market share while accounting for only 33% of the growth. The new synthetics clearly emerge as the growth stars, accounting for almost 50% of the expected growth while representing only 28% of the total 2004 demand.

This simple analysis shows how the newer classes of raw materials are responsible for enhanced industry growth. It is this conclusion that makes the business environment of the past three years so troubling. During these years, most raw-material suppliers found their costs increasing with little opportunity to pass through price increases. As such, costs were reduced wherever possible, including R&D costs and capital investment. Now, because of that reduced investment, shortages are occurring and prices are quite naturally moving up. This will allow suppliers to reinvest in their businesses. While this investment will clearly be made in manufacturing, we should all hope that some of it is also made in R&D. Without that investment, it is difficult to see how the adhesives industry can keep its vitality over the long term.