2023 Distributor Roundtable

Leaders in the distribution of raw materials and chemicals provide updates on the state of the industry and what they expect for the adhesives and sealants industry going forward.

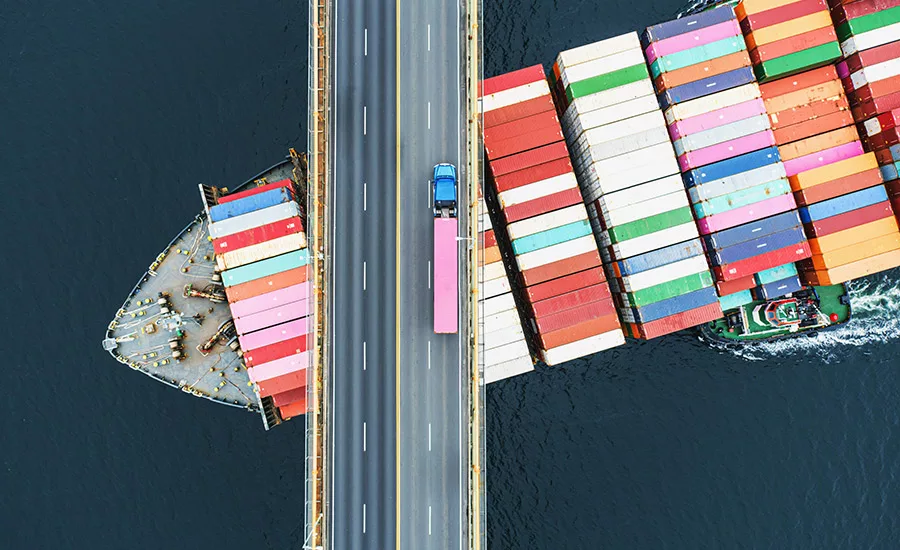

GoldenMike, Creatas Video+ / Getty Images Plus

How would you characterize the current state of the supply chain and what factors are presenting challenges for chemical distributors and their customers? What are the regulatory considerations or compliance requirements chemical distributors and their customers are currently facing and how are they addressing those requirement? Leaders from Palmer Holland, Univar Solutions, and the National Association of Chemical Distributors (NACD) answer these and other questions in this year’s distributor roundtable discussion.

ASI: How would you characterize the current state of the supply chain?

Sam Brooks, Marketing Director – CASE, Palmer Holland: The pandemic broke our global supply chains, sending our industry into chaos. After almost three years of extreme circumstances, we have seen the supply chain stabilize. Excess capacity, minimized shipping cost fluctuations, reduced ocean freight timelines, easing of worker shortages, and clearing of backlogs are key indicators of improvement. Our supply and value chain experts are constantly working to monitor any potential future bottlenecks or turbulence that may come our way. They work hand-in-hand with our existing logistics and warehousing partners to further provide the spring in the supply chain our customers have come to expect.

Sam Brooks, Marketing Director – CASE, Palmer Holland: The pandemic broke our global supply chains, sending our industry into chaos. After almost three years of extreme circumstances, we have seen the supply chain stabilize. Excess capacity, minimized shipping cost fluctuations, reduced ocean freight timelines, easing of worker shortages, and clearing of backlogs are key indicators of improvement. Our supply and value chain experts are constantly working to monitor any potential future bottlenecks or turbulence that may come our way. They work hand-in-hand with our existing logistics and warehousing partners to further provide the spring in the supply chain our customers have come to expect.

Eric Byer, President and Chief Executive Officer at the National Association of Chemical Distributors (NACD): In one word: turbulent. Businesses across the nation have navigated one challenge after another when it comes to the supply chain and the hits just keep on coming.

The National Association of Chemical Distributors (NACD) represents companies who process, formulate, blend, re-package, warehouse, transport, and market chemical products for over 750,000 industrial customers across the United States. NACD’s chemical distributor members need reliable, efficient supply chains to get the adhesives and sealants industry the materials needed to develop crucial products your industry provides to markets like aerospace, health care, marine, automotive, building and construction, and so many more.

Chris Fitzgerald, Global Vice President, Coatings, Adhesives, Sealants & Elastomers and Rubber & Plastic Additives for Univar Solutions: Our supply chain is ever evolving and overall is in a good place right now, though the past 24 months have been challenging across almost every industry and especially hard on supply chains. That said, forecasting is everything. The more transparent our customers are with us on their expected needs, the better we can plan ahead with our suppliers. There seems to be a returning trend of just-in-time (JIT) inventory through much of the value chain, despite the issues experienced with JIT after so many products went on force majeure or allocation after COVID and Winter Storm Uri. This may be tied to the soaring interest rates and the fact many companies rely on lines of credit now hitting their bottom line so negatively. This is why we have to intelligently provide a buffer to the potential stresses which that type of activity presents. Our expertise in chemical logistics and managing complexity are core to what we do and exactly why our customers trust us to do so.

ASI: What factors are causing transportation- and logistics-related challenges for raw materials and chemicals?

Brooks: While transportation and logistics conditions are improving, other areas are of concern. Current excess inventory across the value chain has created challenges in accurately forecasting demand. As customers work through their inventory, they also evaluate their inventory strategies. We have seen a bit of a shift back to Just-In-Time (JIT) inventory, even after the pandemic exposed vulnerabilities in this strategy. While not insurmountable, this creates complexity in forecasting and potential logistics roadblocks. Our industry-leading third-party logistics partners across the continent allow us to provide our principals and customers with the flexibility to shift demand from one mode to another to overcome the transportation- and logistics-related challenges.

Byer: Just as maritime trade was reaching some semblance of “business as usual,” long-simmering labor issues arose to dominate the list of supply chain challenges. The freight rail labor negotiations and the devastating train derailment in East Palestine, Ohio, directed the public eye to underlying issues within the freight rail industry – particularly the adoption of precision scheduled railroading, which led to a significantly reduced workforce and serious deterioration in service.

Byer: Just as maritime trade was reaching some semblance of “business as usual,” long-simmering labor issues arose to dominate the list of supply chain challenges. The freight rail labor negotiations and the devastating train derailment in East Palestine, Ohio, directed the public eye to underlying issues within the freight rail industry – particularly the adoption of precision scheduled railroading, which led to a significantly reduced workforce and serious deterioration in service.

West coast port labor contract negotiations also created severe disruptions and delays across several ports. As the adhesives and sealants industry knows, the repercussions of delays and backups at the largest ports in the nation create strain and uncertainty that is felt far beyond the actual shutdowns.

Soon thereafter, labor negotiations in Canada broke down, resulting in significant delays in the movement of critical chemicals that go into food processing, cleaning products, water purification, personal care, and various other industries. These goods flow through the west coast ports of Canada and down into the United States.

These disruptions leave millions, if not tens of millions, of inventory stranded, causing additional weeks of ground transit time in addition to the extra time spent in the port. This places significant pressure on an already fragile system and increases the prices of essential chemical goods that are used in nearly every U.S. industry.

Fitzgerald: Over the last year we’ve faced multiple dynamic and disruptive transportation-related issues, from rail strikes and port backups to factory shutdowns and general labor shortages. These types of incidents have extended the trajectory of problems we saw crop up during the COVID-19 pandemic and Winter Storm Uri. However, even though these issues may have an impact on our large inbound or import products, they typically don’t affect our ability to provide exceptional final-mile service given our fleet of owned tractors, trailers, and drivers.

As we continue to see the chemical and ingredients industry navigate its way through ongoing turbulence, we work jointly with our customers to ensure we define an optimal supply chain and identify logistics solutions for the raw materials we supply them with. We know that our robust logistics infrastructure, including transportation and warehousing, and forecasting translate to uninterrupted product availability and reliability for our customers. So, even though the industry may continue to experience problems linked to these challenges, with a team of immensely adaptable, highly skilled, and resilient supply chain and CASE professionals, we’re prepared for whatever comes our way. Our approach to external stressors and weathering supply chain challenges means our customers receive the service and products they need, when and where they need them, to drive their success.

ASI: How do you stay up-to-date with the latest advancements and trends within the industries that you serve?

Brooks: We stay up to date through common methods, such as attending trade events, gathering the voice of the customer, collaborating with our principals, and participating on various industry committees, trade journals, and current events.

Our Business Analysts, Business Managers, Technical Managers, and Market Leaders continuously collaborate to understand market trends from multiple perspectives to form a comprehensive view of the landscape. We analyze and apply this information to develop data-driven insights into the current state of our market segments and create future outlooks and growth opportunities for our principals and customers.

Fitzgerald: We have an amazing network of support, tools, and resources throughout our organization that we access to keep us up to speed and at the forefront of the latest trends and advances. First, the regulatory landscape factors critically into our industries, and our ability to keep up with its constant evolution is essential. Our Government Affairs and Marketing professionals maintain an ongoing pulse around global regulatory changes and demands from the broader market and we also collaborate with our customers in this rapidly changing space.

Fitzgerald: We have an amazing network of support, tools, and resources throughout our organization that we access to keep us up to speed and at the forefront of the latest trends and advances. First, the regulatory landscape factors critically into our industries, and our ability to keep up with its constant evolution is essential. Our Government Affairs and Marketing professionals maintain an ongoing pulse around global regulatory changes and demands from the broader market and we also collaborate with our customers in this rapidly changing space.

Second, our supplier partners are constantly bringing us new products and ideas which shape the growing landscape. These aren’t just commercially ready products — many are developmental products, and they trust our evaluation and insight to determine feasibility.

Building on that are our technical resources and our CASE formulation labs at our global Solutions Centers. These labs are second to none and highlight how we’re more than just a distributor, with consistent year-round utilization for supplier and customer evaluations and projects, along with our own research, investigations, and product development. Constant collaboration within our own global ecosystem of innovation helps us deliver technical solutions that address the latest trends, regulatory requirements, and sustainability challenges.

Last, and arguably most important, are our customers. Our technical sellers and in-field application development specialists are out there every day pressure testing the products we offer to understand their efficacy, respond to needs with novel and innovative solutions, gain insight regarding technology gaps and send the feedback back up the chain appropriately.

ASI: How do you establish and maintain good relationships with your customers?

Brooks: At Palmer Holland, we focus on creating connections, which starts by identifying our customers’ ever-evolving needs. As an employee-owned, independent distributor, we are uniquely positioned to act in their best interest. While our Account Managers are industry experts and consultants for our customers, the relationship doesn’t stop there.

Our Logistics Team connects with their Logistics Team to ensure on-time delivery. Our compliance experts are actively engaged in solving complex regulatory issues. Our Customer Experience Team works directly with buyers and production planners to keep their business running smoothly. We deploy more touchpoints than just the Account Manager to provide unmatchable service with tailored sales and service solutions to meet customers’ current and future needs.

Fitzgerald: I believe that best practice in the industries we touch comes down to putting the customer at the center of everything we do, using frequent communication, and engaging in regular dialogue around what matters to them, such as on-time delivery, unique product offerings, sustainability, and competitive pricing. Given the issues the chemical industry has seen over the past few years, there’s the added nuance of acting as creative consultant to our customers, helping them stay ahead of changing dynamics in available products, offsetting formulation needs, and proactively addressing concerns around delays, pricing fluctuation and more. We’ve evolved from a traditional distributor to value-added solutions provider, and we feel honored to advocate for both our supplier partners and our customers in times like these, when we help the entire value chain navigate troubled waters.

ASI: Are there regulatory considerations or compliance requirements you are currently facing, and if so, how are you managing those?

Brooks: The supply chain instability we experienced over the last three years causes a greater emphasis on global trade compliance as manufacturers shift refining and production sites. The need to source a broad portfolio of raw materials requires different considerations, such as import-export laws, licensing requirements, tariff considerations, and the impact of free trade agreements.

Our dedicated Regulatory and Compliance Team continuously monitors the regulatory environment. Some areas of consideration within adhesives and sealants are VOC reduction, substances of concern (PFAS and toluene diisocyanate (TDI) and related compounds), global trade compliance, packaging EPR (extended producer responsibility) laws, environmental considerations, and sustainability.

Sustainability is a very hot topic right now in our industry, but it is also one that comes with a lot of confusion and a lack of visibility on future direction. Our team monitors global regulatory and sustainability trends to evaluate how they may impact our North American markets. We work very closely with our suppliers to ensure we can offer chemistries for reformulation to keep our customers in compliance. Not only is our team monitoring this environment, but they also actively work with Account Managers and customers to educate and address their unique needs.

Byer: The chemical industry at large is constantly facing new and revised regulations. NACD’s regulatory affairs team is closely watching and providing feedback on new rules being proposed and promulgated across numerous agencies. Since 2021, NACD has called on the U.S. Internal Revenue Service to address the industry’s compliance concerns and ease the burden of the reinstated Superfund tax through penalty relief and guidance. Earlier this year, the agency provided additional clarity, but further guidance is needed to ensure chemical distributors and other impacted businesses are able to meet their responsibilities under the reinstated law.

Proposed astronomical fee hikes in the administration of the Toxic Substances Control Act are expected to result in an overall cost increase of nearly $30 million for chemicals sold through distributors, much more than many small U.S. businesses will be able to bear. NACD has encouraged the U.S. Environmental Protection Agency to provide a detailed explanation of the rationale behind the newly proposed fees. Additionally, we have urged them to prioritize fiscal predictability and strengthen protections for small business through fee caps and other initiatives.

The U.S. economy relies on the continued success of American small businesses, like chemical distributors, and chemical distributors rely on our government to adopt policies that support the recovery and growth of America’s businesses.

Fitzgerald: As is typically seen in the broader chemical markets, Europe has regulations in place for things like APEO-free and a move toward low/zero VOC, whereas North America predominantly is experiencing trends toward improvement in these areas, prior to regulation being in place. For example, many of the notable big box stores went APEO-free years ago without a formal push from federal regulations. It’s with that spirit that Univar Solutions endeavors to be a leader in the overall demand for sustainable solutions. We recently launched a sustainable line card of offerings, guides to help customers develop and market sustainable products, and presented at numerous conferences and events on the subject. Without proactive involvement from us, our suppliers, and our customers, the regulations which eventually come down will be neither sensible nor sustainable. We pride ourselves as being a leader in this space.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!