Strategic Solutions: The Petrochemical Feedstock Market

Ethylene

• The demand for ethylene is driven by demand for its derivative products, 60% of that being polyethylene plastics.• The ethylene market is expected to continue to build strength in 2006.

• Pricing remains strong, in the range of $1,150 per metric ton for North America and somewhat less in Europe and Asia.

• Average usage is expected to be 93% for the coming year. With the high usage rates, ethylene prices are expected to fall only slightly from their recent highs.

• The top 10 producers hold 45-50% of industry capacity worldwide.

• Current surpluses in North America represent less than 5% of total demand and are expected to remain tight, with scheduled outages for the first half of 2006 and little new capacity coming on-line in the short term.

• Most of the future planned ethylene capacity is scheduled for the Middle East and Asia, with minimal expansion in North America through the rest of the decade.

• Middle East ethylene capacity could impact the market starting in the next few years; many plants are currently delayed.

• Overall, sustained economic recovery is critical for demand growth to match capacity additions.

Propylene

• Propylene consumption is dominated by polypropylene (PP), one of the fastest growing derivatives at 5-6%/year.• The North America propylene market continues to be strong.

• Current spot prices for chemical and polymer grade propylene are 41.5¢/lb. and 46¢/lb., respectively.

• The U.S. propylene market is very tight, as producers have mostly implemented price increases for polymer and chemical grade products.

• In Europe, demand continues to be strong. Since a number of crackers have experienced operating problems, supply is tight as well.

• The propylene market in Asia has begun to show signs of softening, with China showing lackluster demand. This softening could be temporary as a number of outages in propylene derivative units in Japan created a temporary loosening of demand as well.

• The outlook for propylene remains solid, with strong fundamentals continuing through 2006 and margins continuing near peak levels.

• For propylene, the U.S.'s dominant position in global trade will be maintained as global steam cracker propylene capacity will fall short of demand by 30 million tons by 2010.

• Middle East ethane-based ethylene production will provide little propylene. With Asia significantly short of propylene, on-purpose production and high prices will be needed to meet the shortfall.

• Propylene prices are expected to continue following ethylene to historically high levels.

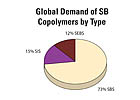

Styrene Block Copolymers

There are three major types of SB copolymers:(1) styrene-butadiene-styrene (SBS)

(2) styrene-isoprene-styrene (SIS) (profiled in this section)

(3) styrene-ethylenebutylene-styrene (SEBS)

• SBS is primarily used in adhesives and sealants, footwear, polymer modification, modified bitumen roofing, and asphalt pavement modifying.

• SEBS copolymers rival polypropylene/EPDM blends on a manufacturing-cost-economics basis, and tend to compete in similar vulcanized rubbers applications.

• Styrene is currently trading near its all-time high at 60¢/lb., although margins for styrene producers are not as favorable due to lower capacity utilization of 80-85%.

• The market for styrene-isoprene-styrene (SIS) is primarily adhesives (specifically pressure-sensitive adhesives).

• There are more than 10 product brands and 30-40 product varieties.

• In the United States, 80-90% of SIS is used in adhesives.

• U.S. SIS production is projected to climb from 103,000 tons in 2005 to 134,000 tons by 2010.

• Only 13 SBS block copolymer producers can produce styrene-isoprene-styrene (SIS) block copolymers.

Conclusion

While up cycles have historically been short lived, lasting about 4-5 quarters, the current one may last longer, given the current global economic environment. The outlook appears favorable for feedstock producers through 2006, and a case can be made for the up cycle extending beyond, given the expected capacity growth.Caution is still advised because of the difficulty in predicting cycles, as unforeseen events affecting ability of the downstream businesses to continue to support high prices and the global economy are key risks. Until now, firms throughout the value chain have been passing costs to customers successfully. However, those firms not in a position of power in the value chain will have their margins squeezed the longer this cycle continues.

For more information, phone (513) 469-7555 or visit www.chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!