Pursuing Profitable Growth Strategies: A Case Study in Value Creation

Astute companies often use a team of third-party experts as an extension of their management team to expand the bandwidth needed to drive success.

Image courtesy of Thapana Onphalai / iStock / Getty Images Plus

It seems logical that all companies would place a high priority on fully evaluating and implementing the ideal profitable growth strategies for their business, but this is not always the case. Why? The answer often lies in limited resources, such as the internal team’s available bandwidth.

Time is money, and your people are a great asset. Astute companies often use a team of third-party experts as an extension of their management team to expand the bandwidth needed to drive success.

Helping our clients focus on profitable growth ensures that optimal opportunities are identified and pursued in a strategic and manageable way. Profitable growth strategies are achievable, measurable, and aligned with each company’s capabilities and overall goals.

Exploring Your Options

Let’s look at an example. One company wanted to develop a growth strategy but was unsure where to focus its efforts. The company produced a diverse product portfolio that included a unique high-margin additive technology platform, along with unrelated niche formulated product offerings.

The first step for the consulting team was to undertake a thorough discovery process to understand the current business’ core competencies. Guided by deep experience in the specialty chemicals sector, the team went through a multi-stage process, including an assessment of the company’s intellectual property (IP) and polymer science capabilities as related to expansion opportunities, as well as an examination of adjacencies to drive higher returns for business units.

Once this information was gathered, the team identified and ranked all opportunities across the portfolio. Various strategies were then developed, taking into consideration issues ranging from sensitivities and key risks to an M&A thesis.

Ultimately, following this deep dive into growth opportunities, the team advised that the divestment of the additive platform would yield an extremely high profit for the parent company if the right buyer could be identified and an appropriate deal structure established. Company leadership approved this strategy, and the team got started, using the work that had been performed to date to create a basis for the growth opportunities presented in the confidential information memorandum (CIM).

In addition, the team studied the list of buyers that had been identified by the company’s investment bank. Based on the consultants’ deep industry knowledge and relationships, the list was enhanced with strategic buyers that aligned with the additive platform that was being divested. The team further developed buyer profiles using its extensive industry connections, technology expertise, and specialty chemicals business acumen.

A customized Pugh Matrix methodology was then used to rank and prioritize buyer candidates for best fit to the seller’s profile and needs. The Pugh Matrix is a criteria-based decision matrix that helps determine which of several potential solutions or alternatives should be selected. The technique gets its name from Stuart Pugh and has become a standard part of Six Sigma methodology. Typically used after the development of the voice of the customer and the creation of a quality function design (QFD), the Pugh Matrix allows for the organization of various criteria (or features) of a solution in a structured way for easy comparison.

Like the company in our example, a thorough end-to-end analysis may find that the best course for your company would be to divest. However, depending on your specific business, different growth strategies could include expanding your manufacturing capacity, embarking on focused technology development to reach new markets, or even making an acquisition of your own.

Taking Action

Fully detailing all options for strategic growth is beyond the scope of this column, but we often see some overlap in terms of next steps. For example, in support of a sell-side M&A strategy, clear benefits result when sellers drive significant added value with operational improvements prior to the sale. Similar operational improvements could also help other companies achieve profitable growth by increasing capacity and/or creating an environment where their R&D team(s) have the ability and resources to develop products that expand their market reach.

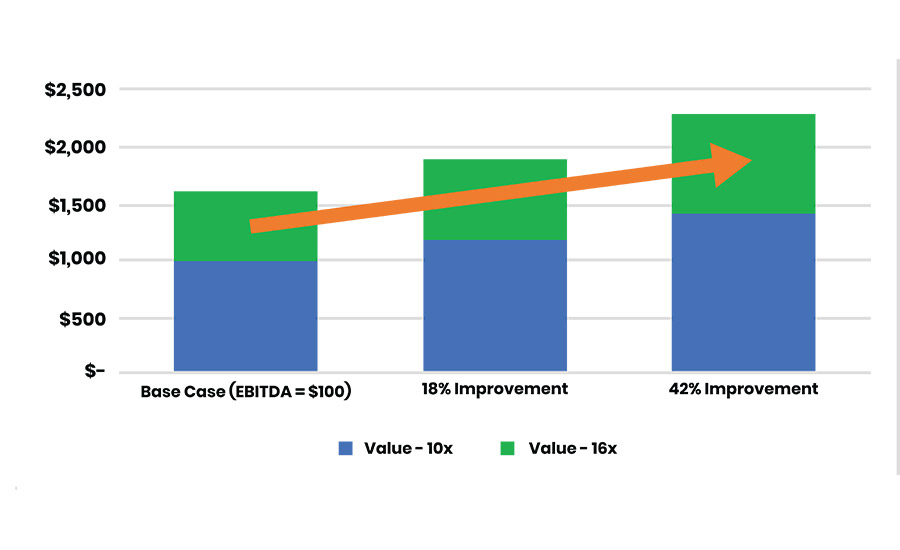

In practice, sellers we have worked with have been able to boost EBITDA from 18-42%, achieving up to double the net proceeds (Figure 1). While the process to identify and capitalize on these potential EBITDA improvements can be lengthy, some of the enhancements may be completed more quickly and lend credibility to the seller’s pipeline.

Planning for Success

Though not a simple or quick process, making the additional effort to identify, refine, and implement your company’s ideal profitable growth strategy is sure to pay off. Augmenting the bandwidth of your company’s internal team with a third party can provide the additional resources and expertise to accelerate the timeframe and help achieve an optimal outcome.

In the case of our example, the consulting team identified the ideal strategic buyer, and the sale of the additive platform ultimately exceeded a 20X EBITDA multiple (all-cash and well above the industry average). As a result, the company was able to pursue organic and inorganic opportunities to grow the remaining business.

For more information, contact the author at jvaughnbiege@chemquest.com or visit https://chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!