Globalization: The Tail Gets Longer

Consolidation and globalization have been major buzzwords in the adhesives and sealants industry for many years. The industry is constantly referred to as fragmented and said to be both in need of, and benefiting from, consolidation.

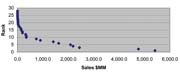

Figure 1 shows the unstated but assumed process for globalization. Globalization will proceed by way of firm consolidation in order to achieve the critical mass to effectively compete in a global marketplace. But what is globalization? Over 1,000 definitions and references in various contexts of the word appear on the Internet. Let's review a few with particular relevance to the industry.

- Increasing economic integration and interdependence of countries.

- Increased flow of goods, services, money and ideas across national borders, and subsequent integration of the global economy.

- Processes leading to the integration of economic, cultural and social systems across geographical boundaries.

- A process of creating a product or service that will be successful in many countries without modification.

Not one of the above definitions implies economic consolidation; in fact, the word most used in these definitions is "integration." While consolidation can be one form of integration, the two processes can operate on independent paths.

Globalization means awareness of others' needs, which may be different than yours or mine. I believe we like it that way, and I don't want to see homogenization become globalization. Therefore, the business challenge is to satisfy an increasingly disparate or fragmented customer requirement. The strategic question then becomes What is the best way to serve this global requirement?

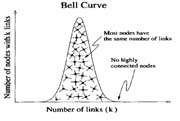

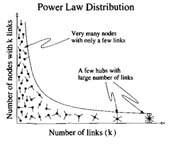

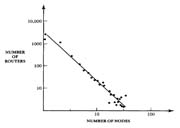

In the world of corporate competition, Barbasi3 has argued that the market is a directed network; companies, firms, corporations, financial institutions, governments and all potential economic players are the nodes. Links quantify various interactions between these institutions, involving purchases and sales, joint research and marketing projects, etc. The map of the Internet is a good visual for a market like ours that is fragmented.

- Services

- Retailing

- Distribution

- Wood and metal fabrication

- Agricultural products

- "Creative" businesses

There is significant discussion devoted to how to compete in this type of environment. Porter's assertion that industries must be viewed as interrelated, and Barbasi's contention that markets are connected networks, are very similar concepts. Yet no one has tackled the implications of a "fragmented" industry competing in a global environment, and there is by no means extensive literature on the subject.

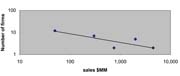

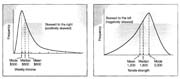

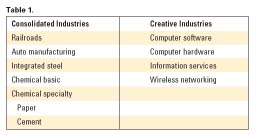

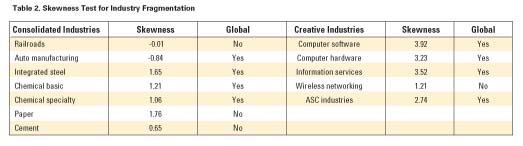

We postulate then that a particular industry must globalize within its most efficient overall structure, which could be "completely consolidated" (0 to negative skew; e.g., automotive producers), a hybrid situation (modest positive skew), or fragmented (high positive skew). In fact, the processes of consolidation and globalization are completely separate.

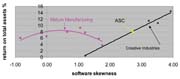

Figure 10 shows a plot of the coefficient of skew vs. return on total capital for the industries considered. It seems that for consolidated industries, the closer they are to a normal distribution in firm size, the higher return they receive When these competing firms fragment too much they quickly lose competitive advantage. The "creative" industries seem to fare much better when there is a significant amount of "fragmentation." This can be credited to the fact that "ideas" can be more easily commercialized in these industries and therefore have immediate impact.

A Peek at the Future - The Music Industry

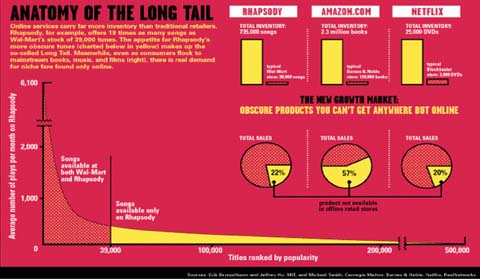

There is no business more "global" than the American entertainment industry. Every one of the many countries in which I have traveled plays, enjoys and, indeed, demands American pop music and movies. This is a huge success story for American creativity, and truly qualifies as one of those creative industries to which Porter8 refers. The music and entertainment industry, however, is undergoing a radical change.11 Chris Anderson writes in "The Long Tail," an article in Wired magazine, that, "For too long, we've been suffering the tyranny of lowest common denominator fare, brain-dead summer blockbusters and manufactured pop. Why? Economics. Many of our assumptions about popular taste are actually artifacts of poor supply-and-demand matching - a market response to inefficient distribution. The main problem is that we live in the physical world and, until recently, most of our entertainment media did, too."11 Figure 11 demonstrates this with only a fraction of the entertainment titles physically available. Hit-driven economics is a creation of an age without enough room to carry everything for everybody. This is the world of scarcity. With online distribution and retail, we are entering the world of abundance, and the differences are profound. The market that lies outside the reach of the physical retailer is big and getting bigger.

Aggregating the Long Tail

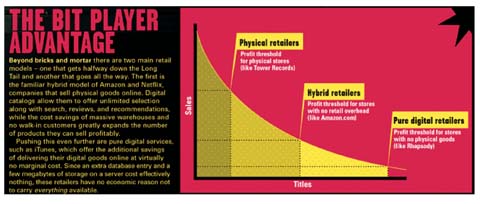

Most successful businesses on the Internet are focused on aggregating the long tail. Niches are where economic success will be in the future, resulting in pulling consumers down the long tail with lower prices. Figure 12 illustrates this as the bit player advantage.11Because it is impossible to e-mail a drum of adhesive to a customer, this analogy can only be taken so far. However, if we look at Figure 12 and change the word titles to formulas, and then consider this on a global basis, I believe the fragmentation brings more value to the customer. There are many companies out there that have excellent technology in this industry, and as we become more comfortable and capable of doing industrial business over the Internet, the ability to extract value from the long tail of the industry will only increase. As small, foreign companies enter the mix, the industry may globalize through additional fragmentation and not consolidation.

Long-tail businesses can treat customers as individuals, offering mass customization as an alternative to mass-market fare. This is especially applicable to the adhesive and sealants industry, where varying customer processes, rapid dislocation of manufacturing sites, and changing end-use requirements demand mass customization.

Conclusion

- Globalization in the adhesive and sealants industry may proceed more effectively through fragmentation rather than consolidation (see Figure 13).

- Fragmentation (for some industries) presents a higher rate of return on capital.

- Fragmentation is a more robust industry structure than consolidation for providing value to the customer on a global basis, given the trend to mass customization.

- Both large and small firms play an important role in creative industry dynamics.

Future Work

The role of mergers and acquisitions in creating value in globalization is currently being examined in order to identify specific strategies for firms along the "power chain" to exploit so that appropriate tactics for growth are identified.

For more information, contact John Lowry, The Chemark Consulting Group, phone (850) 525-0031; fax (910) 692-2523; or e-mail lowry@chemarkconsulting.net.

References

1 Van Dusen Wishard, William. Between Two Ages: The 21st Century and Crisis of Meaning, Xlibris Corp.; 2000.2 Burch/Cheswick Map of the Internet, copyright 1999 Lucent Technologies.

3 Barabasi, Albert-Laszlo. Linked: The New Science of Networks. Perseus Publishing; April 2002.

4 Faloutsos, Michalis; Faloutsos, Petros; Faloutsos, Christos. On Power Law Relationships of the Internet Topology, Comput. Commun. Rev. 29, 251 [1999] 4.

5 Cambel, A.B. Applied Chaos Theory: A Paradigm for Complexity, Academic Press, Inc. Harcourt Brace Jovanovich Publishers; 1993.

6 Buchanan, Mark. Nexus: Small Worlds and the Groundbreaking Science of Networks, W.W. Norton and Co.; 2002.

7 Barnsley, M.F.; Devaney, R.L.; Mandelbrot, B.B.; Peitgen, H.O.; Saupe, D.; Voss, R.F. The Science of Fractal Images, Springer-Verlag; 1988.

8 Porter, Michael. Competitive Strategy: Techniques for Analyzing Industries and Competitors, Simon & Schuster; 1980.

9 Value Line Ratings and Reports, Value Line Publishing Inc.; 2005

10 Lind, D.; Marchal, W.; Mason, R. Statistical Techniques in Business & Economics, 11th Ed; McGraw-Hill Irwin; 2001.

11 Anderson, Chris. "The Long Tail," Wired magazine October 2004, Conde Nast publications; 2005.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!