The Impact of E-Business on the Chemical Industry, the Adhesives Industry and You

Change in the business world may be similar to change in your personal life. If you have a home PC with an Internet connection, regularly communicate with friends and family via e-mail from home, or spend at least five hours per week on the Internet, you have already ventured into the information revolution — the Internet revolution — and are changing the way you manage life.

If you accept the fact that the Internet is here to stay and acknowledge the profound impact it will have on the chemical industry, then there are a number of questions you need to ask yourself:

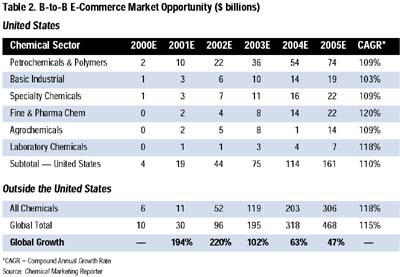

1. How large is the business-to-business (b-to-b) marketplace today in the chemical industry, and how large is it expected to become?

2. In what areas of the b-to-b marketplace should you participate?

3. How do you make e-business part of your overall business strategy?

4. What impact will e-business have on your product line and profitability?

1. Size: Today and Tomorrow

There are many forecasts on how large Web-based commerce will be five years from now. However, these forecasts can be misleading considering the relatively low rates of actual Internet sales conducted today. Revenue growth is also directly related to adoption of e-commerce. And while ‘chemicals’ are frequently characterized as one industry, there are different dynamics occurring in various industry segments. The following are illustrations of real-revenue growth rates, e-commerce adoption rates and growth in different segments. Table 1 shows b-to-b e-commerce adoption rates, both inside and outside the United States, and by industry sub-segment. Today, only a small percentage of the Internet is actually used as a commerce tool within the chemical industry. However, in five years the adoption rate of the Internet as a commerce tool will increase to 24%.

The projections indicate potential sales revenue, an area of interest to everyone who participates in the adhesives and sealants industry. However, what these figures do not show are the cost savings available in b-to-b commerce. Cost savings result from efficiency in customer service, faster service response or more efficient information exchange. The cost savings could be significant, and b-to-b commerce capabilities will be required to remain competitive. Keeping in mind the projections are for a five-year period, and given the historical time it takes to develop business plans or win new business in the adhesives industry, it is evident that in order to participate in the Internet economy, you must react in Internet time.

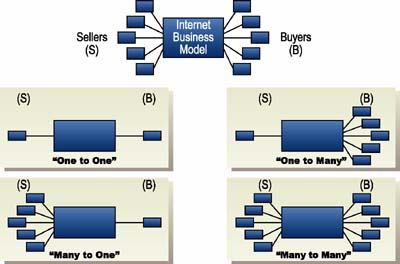

2. Where to Participate

The second question you need to ask yourself is where to participate in b-to-b Internet marketplaces and why? The marketplace has been recently inundated with new channels and, therefore, has become very confusing. Nevertheless, these new Web-based channels are just another forum for bringing buyers and sellers together. Many of the new Internet channels are formed using the switchboard profit model, from which five basic Internet business models can evolve (Figure 1). They are:- Integrated Direct – a one-to-one relationship between the buyer and seller;

- Company.com – where the seller constructs a Web site for many buyers; also referred to as a storefront.

- Micromarkets, Marketplaces or Communities – where many buyers and sellers do commerce on a common site;

- Auctions – where either a buyer or seller puts his or her product or service out to bid;

- Content Aggregators – where a neutral site gathers all the relevant information from a number of sources for one buyer.

The following are examples of how Air Products and Chemicals, Inc., participates in each area:

- Integrated Direct. In the summer of 2000, Air Products launched APDirect™, a secure, 24/7*, collection of self-service commerce applications designed to make ordering products and accessing related information, such as material safety data sheets, certificates of analysis and other customizable reports, as easy and convenient as possible for our customers and channel partners, including sales agents and distributors. Other features include order-shipment status, carrier tracking and sample-ordering capabilities.

- Company.com. In 1996, Air Products was the first industrial-gas company with a Web presence, www.airproducts.com. In its first year, it registered over one million hits. Today it receives over two million hits per month. It has 20,000 pages of content, receives over 750 e-mails per month and was named best chemical-industry Web site by European Chemical News in 1999.

- Micromarket, Marketplace or Community: These terms can be defined as a constantly changing group of people collaborating and sharing ideas on a common interest over the Internet. Air Products is currently active in several communities, including ChemConnect® and Elemica.

-

Auctions: A competitive bidding event for b-to-b or business-to-customer (b-to-c) companies whereby sellers offer products or services to buyers through a Web site with a structured process for price setting and fulfillment. Air Products is currently involved in several types of auctions. Most recently, Air Products entered into a pilot agreement with FreeMarkets, Inc., one of the leading e-commerce companies specializing in buyer-hosted reverse auctions. Air Products’ Energy and Materials Department will be conducting tens of millions of dollars of reverse auctions globally during the next quarter using the FreeMarkets® e-marketplace auction platform. The purpose is to evaluate the success of reverse auctions as a purchasing tool.

A reverse auction typically favors buyers in that the buyer specifies the product or service desired and then sellers compete for the buyer’s business in a downward-price auction. This should result in dramatically reduced costs for the buyer’s organization.

- Content Aggregators: Commonly referred to as e-catalogs, electronic versions of product and service catalogs. Air Products’ customers and b-to-b companies may use e-catalogs as a guide for placing orders for Air Products’ products and services via their own systems.

3. How Your Company Can Participate

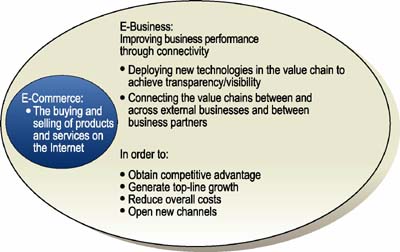

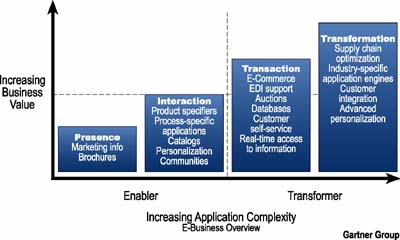

At this point, it is important to clarify some terminology that is used interchangeably in the industry. At Air Products, we view e-commerce — which is solely the buying and selling of products on the Internet — as only one part of the e-business platform. At Air Products, e-business is focused on improving business performance through connectivity by deploying new technologies in the value chain to achieve transparency/visibility and also by connecting the value chains between and across external businesses and between business partners in order to obtain competitive advantage, generate top-line growth, reduce overall costs and open new channels. (See Figure 2.)This broader definition of e-business obviously extends well beyond the buy-sell relationship to include a transformation of the way to do business. It is also important to point out that Air Products’ e-business strategy works from the enterprise global perspective. It executes platforms that work across all of the company’s businesses and across all of its regions.

Now that you have seen the various interactive business models on the Internet, you must ask yourself the third question: How do you participate in e-commerce; how does it become part of your overall strategy?

Any good strategy should start with a vision. Air Products’ e-business vision is to drive change so that the company thrives in the Internet economy. The associated metrics for this vision are:

- 15% of the company’s revenue will shift to the Internet by 2003.

- $100 million in new revenue will be generated on the Web at that time.

- Millions of dollars in cost reductions will be realized.

- The Internet will facilitate 80% of our transactions.

Like many companies, Air Products is in the transactional stage. The company is in the process of developing and evaluating many different Internet business models, with potentially many different partners. It is important to choose the right partners, as they all play a different role in supporting the overall strategy.

4. Effect on Product Line and Profitability

One noted e-business consultant for the chemical industry states, “Although commodity-chemical companies will suffer, the biggest losers in the e-chemicals commerce age could be the companies that are currently in the least transparent and most fragmented markets, notably specialty and intermediate manufacturers.”2 Since adhesives formulators could be among this vulnerable segment, it is very important that these businesses consider where they are now, and where they want to be in the next few years, and start assembling the strategy that will ensure a competitive position. These companies should engage in initiatives that will help streamline work processes and create opportunity for top-line growth and bottom-line savings. E-business has the potential of generating significant savings on the “buy” side in terms of procurement, logistics and internal efficiencies. On the “sell” side, the success of e-commerce can have a significant impact on profits.Summary

The Internet will have a profound impact on the way participants in the chemical industry conduct business. In order to survive and thrive in this new economy, companies in the adhesives industry must:- Expect that growth rates in e-commerce will occur dramatically in the next five years, but that substantial revenue as a percent of overall chemical industry revenue will not become evident until 2003-2004;

- Establish an e-business vision and strategy now, which includes evaluating and choosing Internet partners to tactically implement against the strategy;

- Use the transforming power of e-business to lower costs, extend market reach, and find opportunity to maintain product-line differentiation and prevent eroding profitability.

In 2000-2001, Air Products and VerticalNet will be launching a comprehensive suite of e-business solutions designed to integrate all the components necessary to transact business on the Web. One of these communities is Adhesives and Sealants.comsm (www.adhesivesandsealants.com), which has been developed for adhesives and composite technologists and scientists working in the adhesives and sealants industry, including composite assembly. Through Adhesives and Sealants.com, Air Products provides its audience — which is comprised of a variety of functional experts including chemical and process engineers, chemists and other laboratory personnel, business managers and executives, production personnel, and others involved in adhesive, sealant, caulk and grout manufacture and peripheral services to the adhesive industry — with industry-specific product information and an e-mail mechanism for getting additional information. In addition, the Air Products Pavilion, which is accessible from 32 of VerticalNet’s family of 57 communities, provides broader chemical industry information and a distributor locator so that potential customers can identify the Air Products office closest to them.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!