Additives

Excluding binder applications, the U.S. adhesives and sealants industry consumed some 8 billion dry pounds of materials in 2004. Additives, comprising just 6% of this weight, are essential to the success of many products. They can improve the cost, performance, stability and/or application characteristics of a formulation. Additive consumption for adhesives and sealants was 470 million pounds in 2004, worth $420 million. Adhesives took up some three-quarters of the additive volume and sealants one-quarter. Many additive types are well established in larger volume adhesive and sealant applications, giving additives a forecasted 2-3% yearly rate of growth through 2009.

ADDITIVE END-USE MARKETS

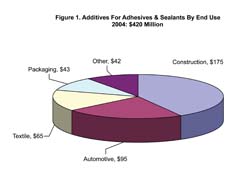

Four adhesive and sealant end-use markets account for 95% of the additive volume and 90% of the dollar value. As highlighted in Figure 1, construction applications for adhesive and sealant products took 42% of additive dollars in 2004. Larger adhesive applications using additives in construction include gypsum joint cements, flooring mastics, wall covering adhesives and film adhesives for architectural safety glass. Latex-based and silicone sealants are the leading outlets for additives in construction sealants. DIY consumers or contractors purchase these sealants for a variety of applications. Additive volume for construction applications has grown modestly the last several years, owing to the strong housing market.In contrast to the growing volume of additives in construction applications, the automotive segment has seen little growth in recent years. Automotive applications consumed 23% of additive volume in 2004. The leading automotive adhesive outlet for additives is found in film adhesives for safety glass. Plastisol body sealants and car body putties are the largest automotive sealant applications for additives. Textile adhesive formulations used 15% of additive dollars. Carpet-backing adhesives took the bulk of the additives in textile applications. Froth aids, thickeners and biocides are the leading additives found in textile adhesives.

Packaging adhesives consumed 10% of additive dollars. Emulsion-based and hot-melt adhesives for applications such as case- and carton-sealing are the largest users of additives in packaging. Plasticizers, biocides and foam-control materials are the major additives for water-based packaging adhesives. Antioxidants are the leading additive for hot-melt packaging adhesives. Plasticizers are also used in specialized hot melts. Other adhesive and sealant end uses took 10% of additive dollars in 2004. Woodworking, consumer, disposables, electronic, aerospace, etc., adhesives and sealants use a variety of additives for product optimization.

Additive Types

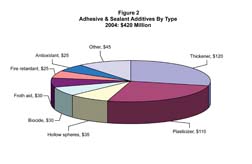

A dozen major additives are consumed in adhesives and sealants. However, numerous types and grades are offered for each, giving the formulator a wide latitude in product optimization. New variations are continuously introduced by additive suppliers. Additives vary from commodity phthalates to specialized, low-volume silane adhesion promoters and light stabilizers. Figure 2 shows the dollar value of additives by type in 2004. Thickeners (rheology modifiers) and plasticizers are the largest dollar value additives, combining to represent 55% of additive dollars. Cellulosic thickeners are the leading type for adhesives, while fumed silicas predominate in sealants. Synthetic thickeners, attapulgite clay and castor oil derivatives are other thickener types. Thickeners can also modify other properties, such as sag resistance, water holding and settling.

Plasticizers range from commodity-type phthalates to more specialized benzoates, esters, polymerics, sulfonamides, etc. Larger plasticizer outlets include sealant plastisols, automotive film adhesives and water-based packaging adhesives. Plasticizers are typically used at a higher percentage than the other additives, making them the leading additive type in poundage. About 150 MM pounds of plasticizers were consumed in adhesives and sealants in 2004, with adhesives taking 55% of the total.

Froth aides are formulated products added to carpet-backing adhesives. Their major purpose is to increase adhesive foaming, which permits lower adhesive coat weights. They also provide greater adhesive penetration into the carpet materials. Froth aids are blends of surfactants and dispersants. Fire retardant consumption was nearly 130 MM pounds, worth $25 MM, in 2004. Most of the volume is low-priced aluminum trihydrate used in carpet adhesives. Other fire retardants used include phosphates, zinc borate, chlorinated paraffins, etc. Adhesive antioxidants were valued at $25 MM in 2004. A variety of products is offered, and usage depends on adhesive formulation ingredients and temperature exposure conditions. Hindered monophenols and bisphenols, polyphenols, and alkylated diphenylamines are the primary antioxidants for adhesives. Secondary antioxidants are used in combination with primary antioxidants in hot-melt adhesives and include thioesters and phosphites.

Other additive types used in adhesives and sealants include wetting agents, organofunctional silane adhesion promoters, defoamers, light stabilizers and dispersants. Wetting agents are surfactants used in water-based formulations to improve substrate wetting, pigment or filler wetting, surface flow and leveling, and/or film coalescence. A variety of surfactants are used, including alkyl phenol ethoxylates, sulfosuccinates, sodium lauryl sulfate and acetylenic diol based products. Silanes are used to improve the adhesion between an inorganic substrate (metal, glass, etc.) and a polymeric-based product. The organic portion is chosen for reactivity with the polymer and the inorganic portion is chosen for reaction with the inorganic surface. Silanes can also improve several other properties of an adhesive or sealant.

Outlook

Additives continue to be improved, offering the formulator a wide selection of products to optimize performance and cost parameters. Successful additive suppliers work with formulators to understand the interaction of their materials with other ingredients, as well as the end-use requirements of the adhesive or sealant product. The commercialization of new adhesives and sealants depends on the development of additive technology.Minesh S. Kusumgar is a director at Kusumgar, Nerlfi & Growney Inc., a firm specializing in market research for the adhesives, sealants, and coatings industries. This article is based on their multiclient study, Additives, 2003-2008. For more information, phone (973) 439-0030 or e-mail nerlfikng@cs.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!