Market Trends Polyurethane Materials Consumption Holds Steady

These and other results of the market survey were released at Polyurethanes Expo 2003. The Expo drew more than 1,200 people to Orlando to discuss polyurethane technology and issues.

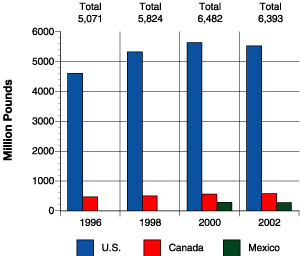

The survey indicates that the North American polyurethanes industry volume for 2002 was 6,393 mil. lbs. In the United States, volume was 5,528 mil. lbs., down from 5,641 mil. lbs. in 2000. Mexico's volume was 282.7 mil. lbs., essentially unchanged from 283 mil. lbs. in 2000.

"The survey revealed that the slight attrition expected in the U.S. was offset by moderate growth in Canada and Mexico," said Joanne Ulnick, a partner at Ducker Research, the marketing firm that conducted the survey. "Overall, the North American polyurethanes industry stood firm over the past two years of economic volatility."

The 6,393 mil. lbs. for North America is approximately double the number of pounds consumed in 1989, when usage was first tracked.

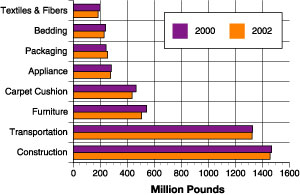

The report also showed that the top five polyurethane end-use applications remained unchanged from two years ago - construction, transportation, furniture, carpet cushion and appliances.

The two largest applications, construction and transportation, showed slight decreases in the amount of polyurethane used in the United States compared to 2000. Construction demand decreased 0.68% (1,469 to 1,459 mil. lbs.) and transportation demand decreased 0.15% (1,328 to 1,326 mil. lbs.) from 2000 to 2002. This followed growth of 6.5% and 10.9%, respectively, from 1998 to 2000.

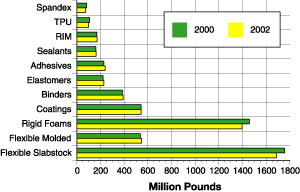

Flexible polyurethane foams accounted for 41% of total polyurethane demand; rigid polyurethane foams represented 25%; coatings represented 9.6%; and adhesives represented 4.3%. These numbers are nearly identical to the numbers reported in 2000.

"Certain applications and product types did experience moderate growth from 2000 to 2002," Mericle said. "For example, flexible molded foam demand increased 3.4% in North America from 2000 to 2002. Also, demand for polyurethane elastomers increased 5.3% in North America during the same time."

The biennial survey addresses the current state of the entire industry, and was the result of more than 900 interviews conducted throughout North America. End-users, formulators and producers all participated in the survey.

Construction

Construction is the major end-use market for rigid polyurethane foam, accounting for 57% of rigid foam demand in the United States. Roofing and wall insulation are the primary uses for spray polyurethane foam and polyisocyanurate board in construction. The survey calculated a 1.3% compounded annual growth rate from 1996 to 2002 for rigid foam in the construction industry.

Construction applications also represent 31% of the demand for polyurethane coatings in the United States. Coatings for wood flooring account for a major portion of demand, as the trend toward hard surfaces continues to gain momentum. Demand for polyurethane coatings in construction applications increased 2% between 2000 and 2002 in the United States.

Transportation

Transportation applications account for 18% of the demand for flexible slabstock foam in the United States. Automotive end-uses include floor cushion, headliners, and HVAC components.The transportation industry uses 86% of all flexible molded foam consumed in the United States. The most prominent automotive application for flexible molded foam is seating systems. The survey calculated a 3.0% compounded annual growth rate for flexible molded foam in transportation since 1996, attributed primarily to increased seat size and volume.

Transportation accounts for 30% of polyurethane coatings demand in the United States. Refinish paint for automotive and truck applications is the major use of polyurethane coatings in this area.

Furniture

Polyurethane demand in 2002 for furniture applications was 505 mil. lbs., representing a slight decrease from the 544 mil. lbs. reported in 2000.Residential furniture represents the largest end use for flexible slabstock foam in furniture applications - 95% of all flexible slabstock foam used in the furnishings industry. Commercial furniture uses 90% of the furniture industry's flexible molded foam demand; however, only 7% of the total U.S. demand for flexible molded foam is used in furniture.

In this area, volume growth closely correlates with furniture unit sales. The survey calculated a 7% decline in volume since 2000.

CASE (Coatings, Adhesives, Sealants and Elastomers)

Solventborne coatings continue to make up the majority of U.S. demand for polyurethane coatings. There was 282.4 mil. lbs., approximately 52% of all U.S. demand for polyurethane coatings, used in solventborne coatings. Other coating types contributing to polyurethane demand include waterborne, urethane alkyds, powder and moisture-cured.Demand for polyurethane elastomers increased in all three countries included in the survey. Approximately 20% of polyurethane elastomers demand in the United States comes from the construction industry, where thermal breaks are a common application. Shoe soles are the primary footwear application for polyurethane elastomers. In footwear, the survey calculated a 4.9% compounded annual growth rate since 1996.

Construction continues to be the largest user of polyurethane adhesives in the United States, responsible for 34% of adhesives volume. Structural applications dominate demand in this area. The amount of polyurethane adhesives used by the construction industry increased 4% since 2000. In packaging, film-to-film laminates are a common application for polyurethane adhesives. The survey calculated a 7% increase in adhesive demand for packaging from 2000 to 2002.

For more information:

The End-Use Survey was sponsored by the Alliance for the Polyurethanes Industry, a business unit of the American Plastics Council, and conducted by Ducker Research. For more information, contact Dick Mericle, Alliance for the Polyurethanes Industry, at 703-741-5652 or visit www.polyurethane.org.Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!