A Look Ahead

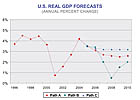

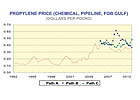

Probe's forecasts are driven by three energy-economic scenarios. Path A, "Soft Landing," has a probability of 40% and assumes that oil prices settle back to more sustainable levels and approach their long-term trend on an inflation-corrected basis, which is basically flat at around $35 per barrel in year 2005 dollars. U.S. real GDP grows 2.5-3% per year.

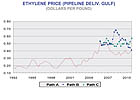

Ethylene is the most capital-intensive chemical and is heavily affected by the industry capital cycle. There hasn't been enough capacity, so that cycle has been working very much in favor of producers. As ethylene capacity builds now exceed demand growth, producer pricing power is starting to be replaced by purchaser buying power. The outcome depends partially on the economy, but we are betting that profits will remain good through 2006. After that, all bets are off.

Probe's forecasts take into account the negative impact of Hurricane Katrina, especially on naphtha-based ethylene. Prices are especially high during the oil price spike in Path B.

Butadiene supply is mostly byproduct. Unlike propylene, butadiene demand is growing slower than byproduct supply. Butadiene is used primarily to produce elastomers, such as styrene butadiene rubber, styrene butadiene latex and polybutadiene rubber. Lesser amounts are used in chemical processes, such as the production of nylon.

The growing surplus of byproduct butadiene has forced a concerted effort, particularly by European producers, to sop up supply and keep prices off the floor - the floor being butadiene's co-cracking value (its value as an ethylene feedstock). Butadiene prices dropped down to co-cracking value in 2002. The ultimate floor for butadiene will be higher than co-cracking value, because it is a versatile molecule. It can be used to make styrene and nylon, among other things.

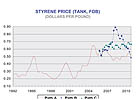

Benzene is valuable these days, which is something new. Large amounts of benzene were rejected from the gasoline pool because of toxicity, and the supply of paraxylene byproduct was expected to flood the market. Thus, refiners cut production and even dismantled some of their catalytic reformer units. Now, because of the phase-out of MTBE (benzene's replacement in gasoline), benzene is in short supply, and its price has been very high. The producers of derivatives, such as styrene, cyclohexane and cumene, have been forced to pay the price or go without, so margins realized on those chemicals have suffered. The benzene shortage has just about run its course.

Styrene is used to make thermoplastics like polystyrene, ABS and SAN, and it is also used to manufacture elastomers, thermoset resins, and syndiotactic polystyrene - a new metallocene-based polymer. Styrene prices and margins are volatile. The styrene market has many buyers and sellers, and traders and speculators influence it. The latter thrive because styrene is easily stored and shipped, and the market is of a manageable size.

Probe's forecasts show styrene margins weakening. At this time, styrene spot prices are falling into the low 40c range, which could mean even more weakening than we show in our forecasts.

Frederick M. Peterson, Ph.D., is president of Probe Economics Inc., Millwood, NY. For more information, visit http://www.probeeconomics.com .

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!