CONVERTING/PACKAGING END USER: Fresh Opportunities for the Packaging Industry

Current fresh produce sales have been estimated at more than $12 billion annually. This segment of the produce market has increased more than 10% each year from its start, and the United Fresh Produce Association projects that it will continue this fast-paced growth during the next decades. Although this market represents significant growth potential for the packaging industry, it also presents a host of challenges.

Rising Demand for Fresh Produce

Four major factors have influenced increasing fruit and vegetable consumption in the United States. Let’s examine how each of these trends will continue to support future growth in the fresh produce market.1. Growing Health Awareness

A rising awareness and appreciation on how diet and health are linked has led to further growth in fresh-produce markets. According to the USDA, annual fresh fruit and vegetable consumption in the United States increased by 49 pounds per person between 1986 and 1999 as Americans became more health conscious.

2. An Aging Population

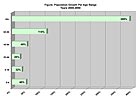

As people age, they consistently increase their expenditures on fresh produce. The Food Institute reports that people in the 55-64-year age group consume 39% more fresh fruit and 34% more fresh vegetables than the national average. United States Census forecasts show that the age groups of 45-64 and 65-84 years old will see the largest growth from 2000-2050 (see Figure).

3. Smaller Households

Another critical factor affecting fresh-produce consumption patterns has been the changing family structure in America. Smaller families are on the rise, and research shows weekly per-capita expenditures at 87% higher for smaller households than for households with five or more members. In addition, per-capita spending continues to rise as two-family incomes allow consumers to spend more money on fresh fruits and vegetables.

4. Expanding Ethnic Populations

The growth of ethnic populations in the United States is another contributing factor to fresh-produce demand. Research has shown that Asian and Hispanic families are more likely to eat a variety of vegetables daily. In addition to increasing overall demand, ethnic consumers generate greater demand for variety and year-round availability.

The Role of Packaging

Packaging is what allows all this fresh produce get to the market quickly and securely. Growth in demand for produce packaging will obviously continue to mirror the increase in sales of fresh produce. So what does packaging do for fresh produce?Packaging serves three distinct purposes: to contain, protect and identify the produce.

Contain

Primary and secondary packaging should contain the produce in manageable units for handling and distribution. Primary packaging involves enclosing produce in materials like film wraps and bags to create a single consumer unit. This can mean an individual cauliflower stalk wrapped in film, or smaller items, like strawberries, to be grouped and enclosed in clam shells. These individual units are then packed into larger secondary packaging, such as bliss boxes, trays and pallets.

Protect

Safety and quality issues are concerns for everyone in the fresh-produce supply chain. Providing tamper-free security and maximizing shelf life is the main job of primary packaging. Produce containers should protect the produce from infestation, help slow the loss of water from the produce, keep out heat with absorbent materials, and reduce over-ripening with specialty liners that maintain a favorable mix of oxygen and carbon dioxide. Secondary packaging should further protect produce from damage during transportation and provide ventilation to promote airflow and allow for fumigation, if necessary.

Identify

Packaging identification is important in both primary and secondary packaging. Providing information to retailers and consumers can be as simple as a labeling the package with country of origin, volume, and type of fresh produce. The Food and Drug Administration requires the use of regulatory marks to identify when food additives are used on fresh produce, such as wax coatings added during processing.

Packaging can also help market the produce and provide a way for the items to stand out in the produce department. Point-of-sale packaging can include photos of the produce, recipes, nutritional information and full-color graphic designs.

Challenges and Opportunities

Now that we know why packaging is needed, let’s take a look at some of the trends affecting fresh-produce packaging. Challenging hurdles, such as consumer and retailer preferences, necessitate innovative solutions.Consumer Preferences

Primary package design and visual appeal will continue to influence produce purchase decisions. According to High Visibility Packaging, a study from the Freedonia Group Inc., clam shell demand will continue to rise due to its upscale appearance and thick, rigid construction. Consumers tend to prefer transparent films and clam-shell packaging that allows them to see what they are purchasing. Marketing messages on packages will attempt to differentiate produce with claims of safer processing, nutritional enhancements, pesticide-free and/or locally grown crops.

The demand for convenient items will continue to flourish, especially with more women than ever before in the workforce. Healthy, easy-to-prepare produce items, such as pre-washed, ready-to-eat packs, frozen microwaveable vegetable pouches and heat-and-eat full meals, are likely to become bestsellers at retailers.

Safety

Quality control must become mandatory at every level of the supply chain to minimize foodborne outbreaks. In addition to recovering from $100+ million losses due to recent outbreaks, the industry needs to restore consumer confidence in produce quality to stop further leakage. Future produce-safety legislation may require marking produce for traceability to track a product’s flow through the production process or supply chain. Adding Country of Origin Labeling (COOL) barcodes and/or RFID tracking to packaging could help quickly identify the produce source and potentially prevent industry-wide losses in the event of an outbreak.

Although non-binding, the Food and Drug Administration’s recently released Guide to Minimize Microbial Food Safety Hazards of Fresh-cut Fruits and Vegetables offers the industry control measures and guidelines to reduce microbiological hazards. Local initiatives sponsored by state governments and industry organizations, like the Produce Marketing Association, should also contribute to quality-control improvements.

Quality

Advances in modified atmosphere packaging (MAP) films, breathable packaging, freshness sensors and anti-fog treatments to reduce perspiration will continue to impact the types of packaging used for fresh produce. Nanoparticle studies at the universities of Bonn and Leuven in Germany could soon be used to improve food-packaging materials, making them less expensive and more environmentally friendly. Adding nanoscopic platelets to plastics may modify their gas and water permeability, which could help extend the shelf life of perishable goods.

Packaging Variety

With more than 1,500 different sizes and styles of produce packages, opportunities abound for creating standardized packaging that meets the needs of the entire supply chain - from growers to consumers. The variety of package sizes and material combinations is a result of the market responding to unofficial-yet-demanding standards from many different segments of the produce industry. Processors want larger packages to minimize unpacking time and reduce the disposal cost of used containers. Retail produce managers tend to prefer smaller, individual packages with graphics to entice consumers. Transportation companies favor standard sizes for better palletizing and handling.

Green Packaging and Mass Retailers

Whether consumers or retailers are pushing the demand, packaging sustainability is a foreseeable growth trend. Since many of the largest fresh-produce buyers are correspondingly those most concerned about environmental issues, it is reasonable to assume that almost all produce packaging will soon become recyclable and biodegradable. Retailer scorecards will continue to demand the use of less packaging and greener materials.

Corrugated boxes will remain the leading secondary produce packaging because of their low cost and light weight. In addition, corrugate provides a cushioning effect for protection, high stacking strength, graphic marketing capabilities and recyclability advantages. Use of reusable plastic containers (RPCs) will gain significant presence in fresh-produce shipping and display as a result of extensive usage by large retailers such as Wal-Mart.

Equipment and material suppliers must work together to service the needs of this high-growth market. Flexible, cost-effective solutions are needed to meet the complex needs found across the industry.

Growers that rely heavily on migrant laborers face language barriers and low skill levels when training their workforce. Consequently, equipment and packaging should remain basic and easy to use. In addition, processing areas range from small, unsheltered sheds found directly in the fields to full-scale offsite plants. Although agricultural packing environments are unique on a case-by-case basis, common needs across the industry are easily identifiable (see Table).

Nordson zeroed in on several of these features as must-haves while developing a new line of adhesive dispensing systems for the agricultural industry. “Our ClassicTM adhesive systems were engineered based on the needs of fresh produce industry growers, packers and materials suppliers,” said Rick Pallante, Nordson Global Market manager, Packaging and Product Assembly. “For example, the larger tank size is specifically designed to handle the amounts of adhesive needed to create and seal bliss boxes.”

Automation

Growing concern over recent immigration legislation and migrant labor supply fluctuations has farmers investigating other options to efficiently process their crops. One viable alternative is fully automated packing sheds, which require little to no human labor. Robotic harvesting systems that that use electronic eyes and image-processing algorithms could pick and pack the fresh produce. The large upfront investment for these automated systems would need to be weighed against efficiency gains and the alternative of losing high-value crops due to low labor supplies.

An Industry Ripe with Change

Foreseeable trends suggest a climate of steady growth in the produce industry for decades to come. Like all agriculture, the fresh-produce market grows increasingly complex. Demand for packaging innovation - driven in large part by increased consumer sophistication - will continue to create new challenges and opportunities in this growing sector.For more information on Nordson’s agricultural systems, visit www.nordson.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!