Commercial Construction Slows in Second Quarter

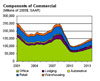

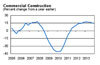

What does this mean for nonresidential investment? For capital equipment, the news is positive, as businesses are flush with cash and opting to address replacement needs neglected during the recession. For nonresidential structures, the story is quite different, and the outlook remains poor, particularly in the commercial segment. According to IHS Global Insight's June U.S. Construction Briefing, real spending on commercial construction put-in-place fell 41.1% year-over-year during the first quarter of 2010, and the segment will continue its downward trend through the first half of 2011. In addition to dimmer outlooks for key economic indicators, spending on commercial construction is facing severe headwinds from rising vacancy rates, lack of demand for commercial leases, and illiquidity in the credit market.

Accounting for about 36% of total commercial construction spending in 2010, office is the largest piece of the commercial segment. Unfortunately, the outlook for office construction remains quite grim. Office vacancy rates climbed to 17.4% nationally in 2010Q2, as 1.8 million square feet of occupied office space across the nation was lost. The abundance of vacant space will be a great detriment to the office market, and as such, IHS Global Insight expects office construction to suffer a more protracted downturn compared to other commercial segments. Year-over-year, declines in real put-in-place spending on office construction will last through 2011 and into early 2012.

Another major component of commercial construction, retail, is expected to fare better than office construction. Nonetheless, similar to the office segment, retail construction will also be hampered by the continued accumulation of vacant retail space in the second quarter, when the retail vacancy rate rose to 17.4%. Positive outlooks for housing, consumer spending, employment, and business spending earlier this year had bolstered confidence that retail construction would resume growth before other commercial segments. However, new June data has brought down growth expectations for many of the retail sector's key supports. The aforementioned employment report will dampen consumer confidence, which will in turn yield decelerated consumer spending. As spending tapers, businesses will be cautious of new investments in either physical or human capital.

For more information, contact IHS Consulting, phone (781) 301-9157; fax (781) 301-9409; or visit www.ihsglobalinsight.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!