Market Trends

Pressure-Sensitive Labels Lead Labeling Market

Worldwide demand for all label types was approximately 64.2 billion sq m in 2018, representing healthy growth of 4.4% over 2017 volumes.

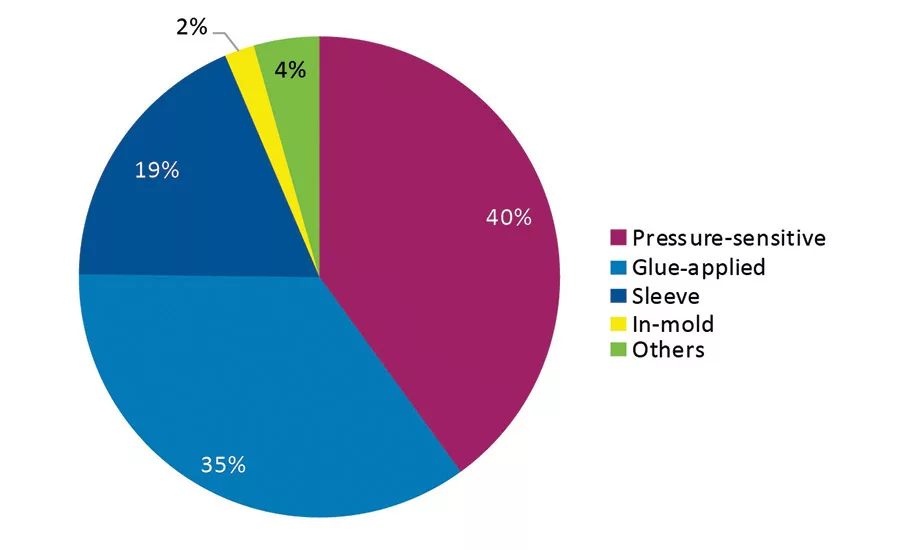

Figure 1. Global label market by technology, 2018.

According to AWA Alexander Watson Associates’ latest research, pressure-sensitive labeling continues to represent a 40% share of the global labeling technologies market, while the established glue-applied technology claims second place (35% market share), and the still-growing sleeve labeling technologies now represent a solid 19% share. AWA’s “2019 Labeling & Product Decoration Annual Review” draws a detailed portrait of a market that, like all aspects of the packaging industry, is changing.

Current Market Status

In 2018, AWA estimates that worldwide demand for all label types was approximately 64.2 billion sq m, representing healthy growth of 4.4% over 2017 volumes, in line with global GDP. The regions driving growth around the world include China, India, Southeast Asia, and the eastern European countries.

The largest regional market continues to be Asia, with a 44% market share. Europe follows with 25%, while North America holds 19% of the market. Additional major markets include South America (8% market share) and Africa and Middle East (4%).

Growth Contributors

VIP labels are a major contributory force, reflecting increased activity in e-commerce and transportation and logistics. This is particularly true for pressure-sensitive labels, which command the majority share of VIP labeling.

Sleeve labels—particularly heat-shrink sleeves—continue to provide the main source of competition to pressure-sensitive and-glue applied labels in the food and beverage market segments, as well as the in-mold labeling formats in household chemicals (see Figure 1).

Competitive Technologies

All the label formats are now competing with direct-to-package print, in terms of flexible packaging in particular, which is growing strongly in both the developed and emerging markets. An additional competitor is direct digital print to plastic, glass, and metal containers, which offers added brand owner feature options in terms of limited editioning and personalization.

The current focus on sustainability is also favoring renewed growth in printed cartonboard packaging. These alternative technologies are all benefiting from growth rates higher than those for traditional labeling.

For more information, visit www.awa-bv.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!